Today’s liquidity recovery is a good sign, but the increase is still low. The market is still in recovery with limited cash flow because it is not clear whether this is just a technical bounce and another bottom test or the official start of a new wave of growth…

The two matching sessions were about 16.3k billion this session, only equivalent to the average of the last 3 weeks of April. This level is also only about half of the peak average.

Currently, there is almost no news that can stimulate excitement. Domestic macroeconomic data, business results, information from shareholder meetings… have also waned. The world only has US CPI data in mid-May to estimate the tone of interest rates. May is usually devoid of news, so there is no motivation for strong cash flow. Statistics from 2018 to present show that liquidity in May often slows down significantly compared to the previous and subsequent months. However, that does not mean that May will be bad or there will be no opportunity to make money. It is just that we should clearly identify specific opportunities and ” bite-sized” opportunities, while real waves are difficult to come by.

Currently, many stocks are increasing in price faster than the index, and as long as the index does not meet any significant resistance levels, the room for growth in individual stocks remains. However, this is no longer a good time to buy; instead, we should wait and monitor the portfolio closely. Stocks that have made good profits can gradually close positions, especially for portfolios with a high proportion of stocks.

The pillar group is supporting the indices quite well, especially the VN30, which has a much better uptrend (+5.2%) than the VNI (+3.93%). However, this is not very important, because as long as the indices do not show too much of a decline, the strength in each stock will still remain. Therefore, at this time, there is no common strategy; we must act based on which stocks reach the resistance level and whether there are signals of profit-taking.

With limited cash flow and high concentration, weak stocks that followed the trend are likely to stop and reverse. We still hold the view that the market is not bad, even the sharp decline in April was just a normal correction. However, the market also has periods of excitement and periods of boredom. The current sentiment is one of doubt, so there is little money. To attract more money, there needs to be something that makes a difference. If not, supply and demand will fluctuate in short cycles. After a stimulating session like April 24th, if money is still sluggish, the ability to go far will be limited.

Technically, the indices/stocks have a reference bottom nearly ten sessions ago and a high peak at the end of March, the beginning of April. The market could develop positively toward the old peak or pull back to test the recent short-term bottom. The thing to do is not to guess the probability but to observe the signals and have a specific action plan for each situation.

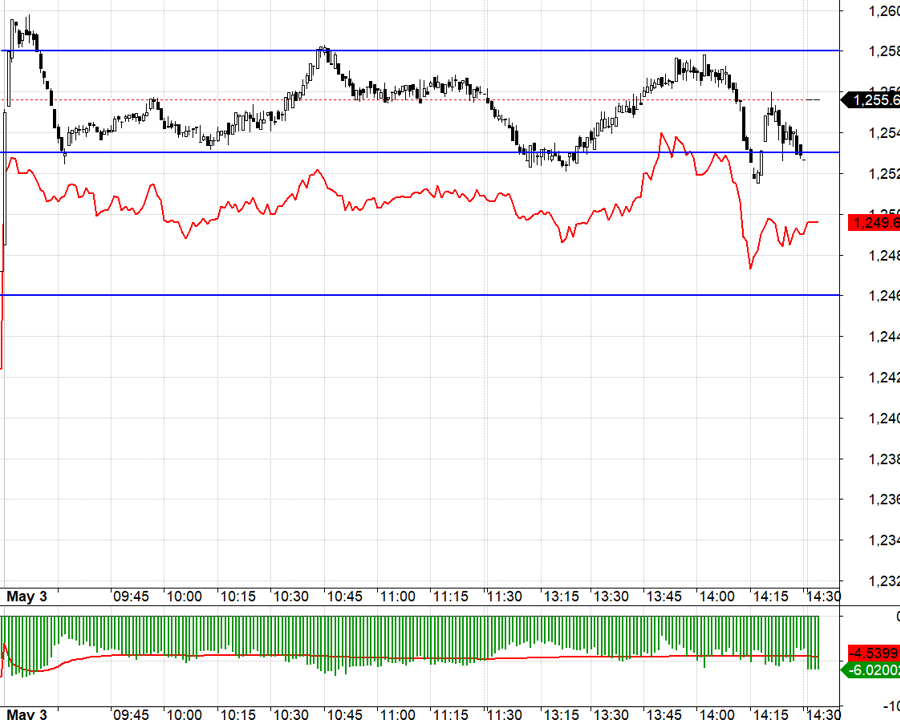

Today’s derivative market is boring, with no trading opportunities. Liquidity fell to its lowest level in 15 sessions. The F1 basis has been discounted for the fifth consecutive session, and during the session, it maintained a very wide discount of about 6 points. The opportunity for VN30 to increase is narrowing, and derivatives will be difficult for the Long side even with a favorable basis. However, Short is not easy unless there is a basis contraction. If it is too difficult, then rest and monitor stock closing.

VN30 closed today at 1255.62, at a mark. The next resistance level will be 1259; 1263; 1269; 1275; 1280. Support 1252; 1246; 1238; 1234; 1225.

“Stock market Blog” is personal and does not represent the opinion of VnEconomy. The views and assessments are those of the individual investor, and VnEconomy respects the author’s views and style. VnEconomy and the author are not responsible for any problems arising from the investment views and opinions posted.