Net profit rises by 32%, financial activities shine

According to the financial report of the first quarter of 2024, port exploitation, maritime services, and transportation activities continued to contribute to the main revenue stream of MVN, generating 1,703 billion VND and 1,084 billion VND, respectively, accounting for a combined total of 77% of revenue. Revenue from these two activities also experienced a respective increase of 17% and 1% compared to the same period last year.

After deductions, MVN‘s net revenue was over 3,596 billion VND, which was 26% more than the same period last year. However, the gross profit margin was reduced by 2.6 percentage points to 20.2%, mainly due to a 1.8 percentage point decrease in the transportation margin, while the port exploitation and maritime services margin increased slightly by 0.8 percentage points. MVN‘s gross profit subsequently increased by 12% to over 726 billion VND.

Financial activities were a highlight, with revenues reaching nearly 169 billion VND, a 47% increase driven by a surge in gains from the sale of investments, exchange rate gains during the period, and revaluation of the ending balance. Meanwhile, expenses dropped by 21% to 75 billion VND, thanks to a reduction in interest expenses. With these positive results, MVN‘s financial income reached 93 billion VND, 4.8 times the same period the previous year.

Another element contributing to the growth was a 95% increase in profit from joint ventures and associates, reaching over 40 billion VND.

Despite some pressure from a 12% rise in business management expenses and a 75% decrease in other profits, MVN still ended the first quarter with pre-tax profits of nearly 577 billion VND, up 19%, fulfilling 21% of the annual plan, and net profits of over 342 billion VND, up 32%.

|

Business results of MVN in the first quarter of 2024

Unit: Billion VND

Source: VietstockFinance

|

Cash and cash equivalents reach record high since listing

As of March 31, 2024, MVN‘s total assets were valued at over 27,818 billion VND, slightly unchanged compared to the beginning of the year. The most significant fluctuation was a 23% increase in cash and cash equivalents to over 3,398 billion VND, marking the highest level since the company’s listing on UPCoM in October 2018.

| MVN‘s cash and cash equivalents have never touched the 3,398 billion VND mark since listing |

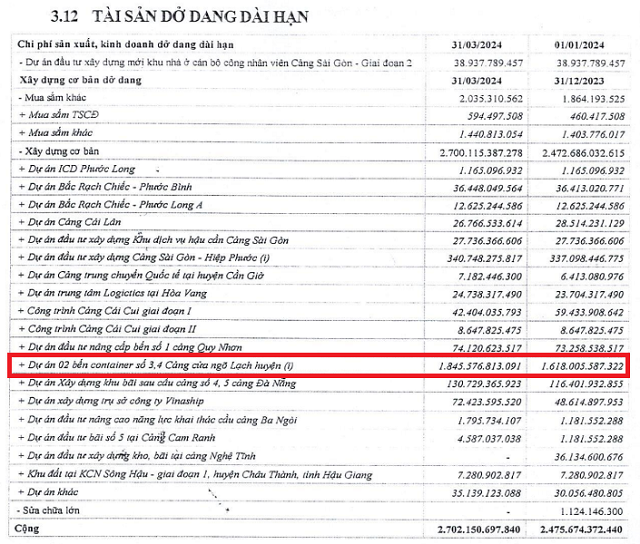

Short-term accounts receivable reached 2,986 billion VND, an increase of 9%. Long-term assets under construction also showed growth, rising by 9% to 2,741 billion VND, primarily due to a 14% increase in the construction value of berths 3 and 4 at Lach Huyen gateway port, reaching nearly 1,846 billion VND as of March 31, 2024.

Source: MVN

|

|

The investment project to construct berths 3 and 4 at Lach Huyen gateway port, in the Dinh Vu – Cat Hai economic zone, Cat Hai district, Hai Phong city, is invested by Hai Phong Port Joint Stock Company (UPCoM: PHP). The total investment value of the project is 6,946 billion VND, with an implementation period from 2020-2025. As of March 31, 2024, the project was in the process of constructing primary construction and installation items. This large-scale project includes two berths for vessels up to 100,000 DWT (nearly 8,000 TEUs) with a total length of 750m and width of 50m; a barge berth and services with a total length of 250m and width of 15m for vessels up to 3,000 DWT (nearly 160 TEUs); shore protection; a system of cargo storage yards, traffic roads, auxiliary structures, and technical infrastructure; and synchronous equipment over an area of 47ha, including the main equipment for operation. |

In contrast, short-term financial investments dropped by 18% to 4,343 billion VND, entirely in the form of savings deposits with terms of 6-12 months at commercial banks.

On the other side of the balance sheet, MVN does not have much debt, with over 3,283 billion VND of loans, which remained relatively unchanged compared to the beginning of the year and accounted for approximately 12% of the capital structure.