VPBank’S Profitability Declines Due to Falling Interest Rates

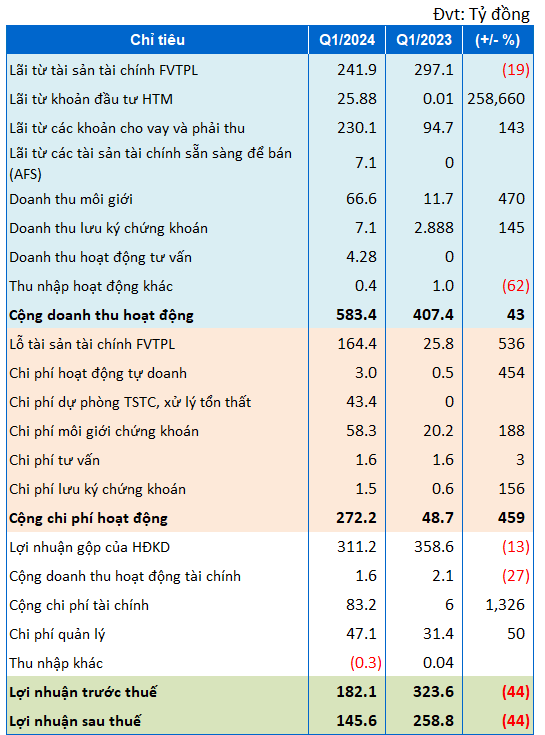

VPBank’s first-quarter 2024 financial results show a 43% year-over-year increase in operating revenue to VND583.4 billion. However, expenses also rose across the board: operating expenses increased by 5.6 times to VND272 billion; financial expenses increased by 14 times to VND83 billion; and administrative expenses increased by 50% to VND47 billion.

As a result of these developments, VPBank’s pre-tax and after-tax profits decreased by 44% year-over-year to VND182 billion and VND145.6 billion, respectively.

For 2024, the company planned to achieve a pre-tax profit of VND1,932 billion. Progress towards this goal is currently at around 10%.

In its explanation of the first-quarter results, VPBank stated that its financial asset income declined significantly compared to the same period last year due to sharp fluctuations in the market caused by falling interest rates.

In terms of revenue structure, interest income from financial assets recognized through fair value profit or loss (FVTPL) and interest on loans and receivables were VND242 billion and VND230 billion, respectively. Interest income from FVTPL assets decreased by 20% year-over-year, while interest on loans and receivables increased by VND143 billion.

Brokerage revenue for the first quarter reached VND66 billion, almost six times higher than the same period last year.

While interest income from FVTPL assets declined, losses on FVTPL assets increased by more than 530% to VND164 billion. As a result, the company’s proprietary trading activities saw a significant decline in profitability compared to the same period last year. This quarter, proprietary trading only generated VND74.5 billion, a decrease of over 72%.

In the first quarter, VPBank also recorded provisions for financial assets and loss management of VND43 billion.

40% of Assets in Bonds

According to the balance sheet, VPBank’s total assets at the end of the first quarter reached over VND23.4 trillion, an increase of 4% compared to the beginning of the year. Of this amount, short-term assets account for VND23.2 trillion, mainly financial assets including FVTPL financial assets, loans, and available-for-sale (AFS) financial assets.

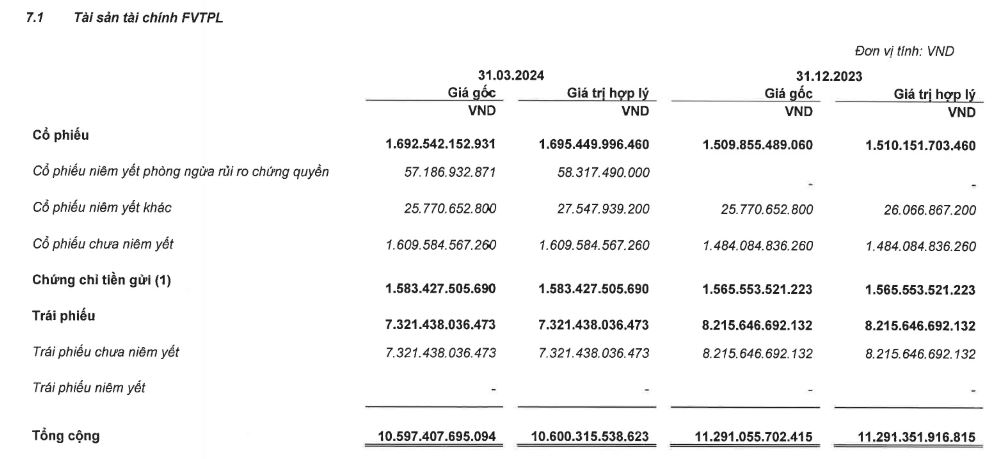

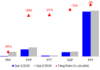

The company’s FVTPL asset portfolio decreased by 6% to VND10.6 trillion. Conversely, loan balances increased by 25% to nearly VND9 trillion.

The value of the company’s AFS asset portfolio also increased significantly to over VND2.1 trillion, four times the amount at the beginning of the year.

Specifically, VPBank’s FVTPL asset portfolio consists primarily of unlisted bonds, similar to its AFS asset portfolio. The total value of bonds held by the company at this time is over VND9.4 trillion, accounting for 40% of total assets.

|

VPBank’s FVTPL and AFS Financial Asset Portfolio

|