Interest rate cuts of 5-7% offered by state-owned banks

A recent survey shows that interest rates on home loans are currently hovering between 5% and 6% for the first 6 to 36 months of the loan term. After the promotional period, floating interest rates for existing borrowers at state-owned banks range from 9% to 10%, while private banks mostly charge over 12%.

Accordingly, interest rates on loans for business, consumer spending, and home purchases by state-owned banks such as BIDV, Vietinbank, Vietcombank, and Agribank fall between 5% and 7%, depending on the loan term.

Specifically, for BIDV in Hanoi and Ho Chi Minh City, the promotional interest rate is 5% for the first six months, with a minimum loan term of 36 months. If you take advantage of the minimum promotional rate of 5.5% for the first 12 months, the minimum loan term will be 60 months;

For other localities, the minimum fixed interest rate for home loans is 6%/year, applicable for the first 24 months. Or home loans with a minimum interest rate of 7%/year for the first 36 months;

The aforementioned policies at BIDV will be effective from now until June 30, 2024. After the promotional period, the floating interest rate will be calculated based on the base loan interest rate plus a spread of 3.7%. The prepayment fee is 1% for the first 2 years and 0.5% for the next 3 years.

Interest rates on loans for business, consumer spending, and home purchases by state-owned banks range from 4% to 7%. |

At VietinBank, short-term loan interest rates start at 5.2%/year, while medium- and long-term loans start at 5.8%/year, applicable to customers borrowing for production, business, or consumption purposes.

At Vietcombank, individual customers taking out home loans, auto loans, or consumer loans can enjoy promotional interest rates from 6%/year for the first six months on short-term loans (under 12 months); or 6.3%/year for the first six months on medium- and long-term loans. After the promotional period, the floating interest rate will be around 9%/year and will change every three months.

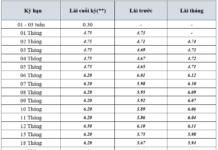

Meanwhile, at Agribank, the minimum loan interest rate starts at 4.0%/year for loans up to 3 months, 4.5%/year for loans over 3-6 months, 5.0%/year for loans over 6 to 12 months, 6.0%/year for loans over 12 months, and 6.5%/year for loans over 24 months;

However, starting in the third year of the loan term, Agribank‘s loan interest rates will start to float, with an estimated floating rate of around 8-9%/year under this loan package.

Joint-stock commercial banks offer rates between 5% and 6.5%

For joint-stock commercial banks, loan interest rates range between 5% and 6.5%, depending on the loan term.

Accordingly, BVBank offers loan interest rates starting at 5%/year, applicable to loans for purchasing, building, or renovating homes. The spread after the promotional period is 2%/year. The floating interest rate ranges from 9.5% to 10%/year.

VPBank offers a rate of 5.9%/year for the first six months. After the promotional period, the floating interest rate will be calculated by adding a 3% annual spread to the reference interest rate. The floating interest rate ranges from 9.5% to 10%/year.

Sacombank offers fixed interest rates of 6.5%/year for six months, 7%/year fixed for 12 months, and 8%/year fixed for 24 months on loans for living expenses (purchasing, building, or repairing real estate; purchasing automobiles; consumer spending). After the fixed period, the interest rate will be adjusted every three months.

Loan interest rates for joint-stock commercial banks range between 5% and 6.5%, depending on the loan term. |

MSB offers 6.2% interest rate for short-term loans of 5 months, 6.8% for short-term loans of 6 months, 6.5% for medium-term and long-term loans fixed for 12 months, and 8% interest rate for medium-term and long-term loans fixed for 24 months.

TPBank offers a variety of优惠 packages for customers borrowing less than 65% of their total assets. These include a package with an interest rate of 0%/year for the first three months, 9%/year for the next nine months, or a fixed loan package for 12 months: 7.5%/year interest rate, a fixed package for 24 months: 8.6%/year, and a fixed package for 36 months: 9.6%/year. This bank’s floating interest rate goes up to 12-12.5%/year.

ACB Bank offers home loan interest rates between 7-8%/year or a fixed rate of 9%/year for the first two years.

SeABank offers an interest rate of only 6.5%/year, fixed for 12 months. After the promotional period, the floating interest rate is subject to a spread of 3.35%/year, resulting in an estimated floating rate of 10.5-11%/year.

SHB offers a promotional interest rate of only 5.79% for medium- and long-term loans, and 6.39% for short-term loans.

For VIB bank, customers have four options for fixed interest rates starting at 5.9%/year. After the promotional period, the principal interest rate will be calculated based on the bank’s cost of capital plus a spread of 2.8%/year. VIB currently applies a floating interest rate of 9-10%/year to home loans after the promotional period.

Lap Dong