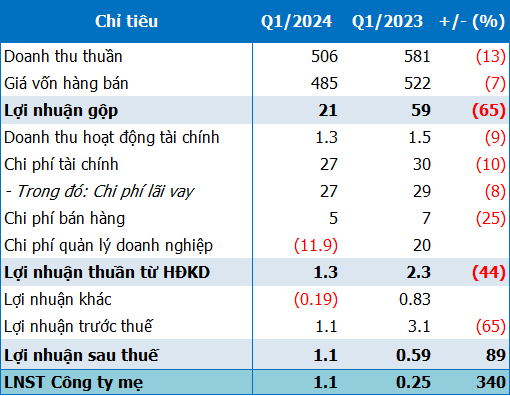

RDP’s Q1 2024 Business Results

|

RDP Q1 2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

In the first 3 months of the year, the Company’s consolidated net revenue reached VND 506 billion, a 12% decrease year-on-year. Gross profit witnessed a sharp decline of 65% to VND 21 billion, corresponding to a gross profit margin of 4%, 10% lower than the same period last year.

Financial revenue also fell by 9% to VND 1.3 billion, due to decreases in interest on deposits, loans, and foreign exchange differences.

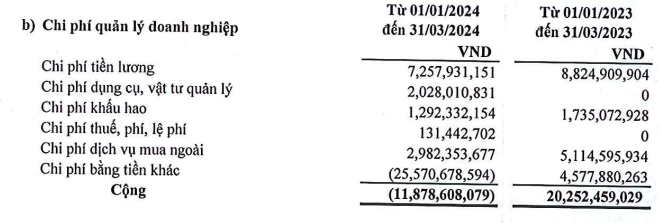

Most expenses decreased in Q1. Of which, interest expense recorded VND 27 billion, down 8% year-on-year. However, the cost of business administration recorded a negative VND 12 billion (in which expenses in kind recorded a negative VND 25 billion), thereby increasing the Company’s profit. As a result, RDP had a net profit of VND 1.1 billion in Q1, more than 4 times higher than the same period last year.

Source: Company’s Financial Statements

|

As of March 31, 2024, the Company’s total assets were over VND 2,074 billion, a 3% decrease compared to the beginning of the year. Of which, cash and cash equivalents (mainly non-term bank deposits) were nearly VND 8 billion, down 75%, and short-term investment held to maturity was over VND 41 billion, down 37%

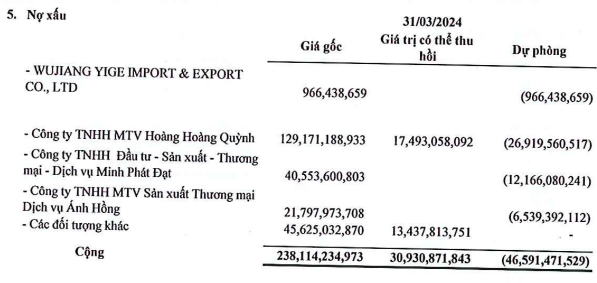

In addition, the value of inventories was nearly VND 856 billion, excluding the provision for inventory write-down (raw materials and supplies) of VND 36 billion. Furthermore, RDP had VND 238 billion in bad debt (VND 269 billion at the beginning of the year), with a provision value of over VND 46 billion.

Source: Company’s Financial Statements

|

On the other side of the balance sheet, total liabilities recorded VND 1,729 billion, a 4% decrease year-on-year. The Company had short-term debt of VND 1,077 billion and long-term debt of VND 177 billion.

In the stock market, RDP shares are still under warning. According to the Company’s latest document, the measures and roadmap to address this situation include: exploiting and expanding markets to increase revenue, especially in the areas of packaging, artificial leather, and thin films; expanding export market share for medical products and artificial leather; improving productivity, reducing product costs; cutting operating expenses and finding strategic investors to collaborate with.

With these measures, RDP expects to overcome the negative retained earnings (accumulated loss) by December 31, 2025.

At the end of 2023, RDP had an accumulated loss of nearly VND 206 billion. This figure was close to VND 205 billion at the end of Q1.