**Savings Interest Rate Surge**

Effective May 1, 2024, ACB Bank formally raised **savings interest rates**. Accordingly, they increased interest rates for terms ranging from 1 to 6 months with an average increase of 0.2 percentage points.

Prior to that, in April alone, our research indicated that as many as 14 banks raised savings interest rates. The banks that increased rates during this period included: HDBank, MSB, PVComBank, CBBank, Eximbank, NCB, VPBank, KienLong Bank, VietinBank, Bac A Bank, GPBank, OceanBank, BVBank, and TPBank. It was also the first time in a year that a surge in the number of banks adjusting interest rates occurred.

On the other hand, banks that decreased interest rates in April included: Vietcombank, PGBank, SCB, Techcombank, ABBank, Dong A Bank, Viet A Bank, Eximbank, Nam A Bank, NCB, VIB, and more.

According to statistics, the highest average regular savings interest rate on the market currently hovers slightly over 6% per year for terms of 24 to 36 months. For instance, OceanBank offers an interest rate of 6% per year for a term of 24 months. SHB, MB, VPBank, TPBank, Nam A Bank, HDBank, and more currently list average interest rates ranging from 5.3% to 5.7% per year.

For a term of 12 months, the highest savings interest rate is around 5% per year. Specifically, OceanBank maintains a savings interest rate of 5.4% per year for a 12-month term, followed by VietBank at 5.2% per year, Nam A Bank at 5.1% per year, and more.

For a term of 6 months, the highest savings interest rate at banks is less than 5% per year. Some banks offering high interest rates for this term are Kienlong Bank (4.7% per year), OCB (4.6% per year), HDBank (4.5% per year), and more.

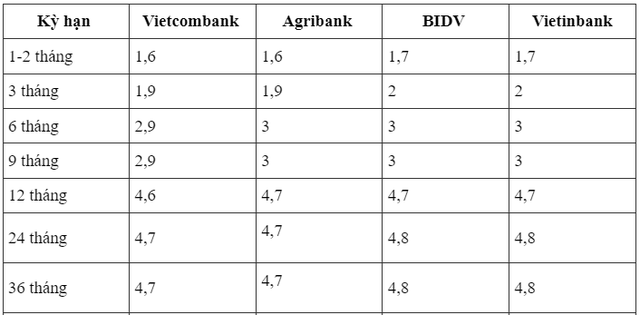

The lowest interest rate for a term of 1 month belongs to the Big 4 banking group, with Vietcombank and Agribank maintaining an interest rate of 1.6% per year, followed by VietinBank and BIDV offering 1.7% per year.

Big 4 is the group of banks with the lowest savings interest rates on the market.

Despite the trend of increased savings interest rates at banks, overall interest rate levels are still considered low.

**Have Savings Interest Rates Hit Rock Bottom?**

Commenting on current savings interest rate trends, Mr. Đinh Đức Quang, Executive Director of the Monetary Business Division, UOB Vietnam Bank, stated that UOB Vietnam Bank’s recent quarterly report assesses that overall savings interest rates are at a record low and may have reached a bottom in the overall evaluation of this lowest-risk investment channel in comparison to inflation, exchange rates, and capital demand in the economy.

Mr. Quang further analyzed that although economic activity has shown improvement in Q1/2024, particularly the recovery in foreign trade, other factors such as industrial production, domestic consumption, retail, and new orders still require further data in the coming period to confirm a stable growth trend; thereby supporting the confidence of businesses and investors to actively access credit, expand production investments, and consumption. Looking at data from before the Covid pandemic also shows that domestic credit has typically tended to increase very slowly in Q1 and only begins to recover in Q2 of each year.

“Based on that assumption, we believe that savings interest rates will increase again by 0.5%-1% across various terms from the second half of 2024,” Mr. Quang predicted.

A recent report by UOB also indicated that the Vietnamese dong and other currencies are likely to appreciate against the USD in the second half of 2024, as USD interest rates may be cut while VND interest rates are unlikely to decline further and will increase again.

“We also expect domestic economic recovery to be stronger, particularly in the manufacturing and retail consumption sectors, which will support VND interest rates in moving towards a more reasonable level compared to overall growth and inflation in a developing market like Vietnam,” Mr. Đinh Đức Quang emphasized.