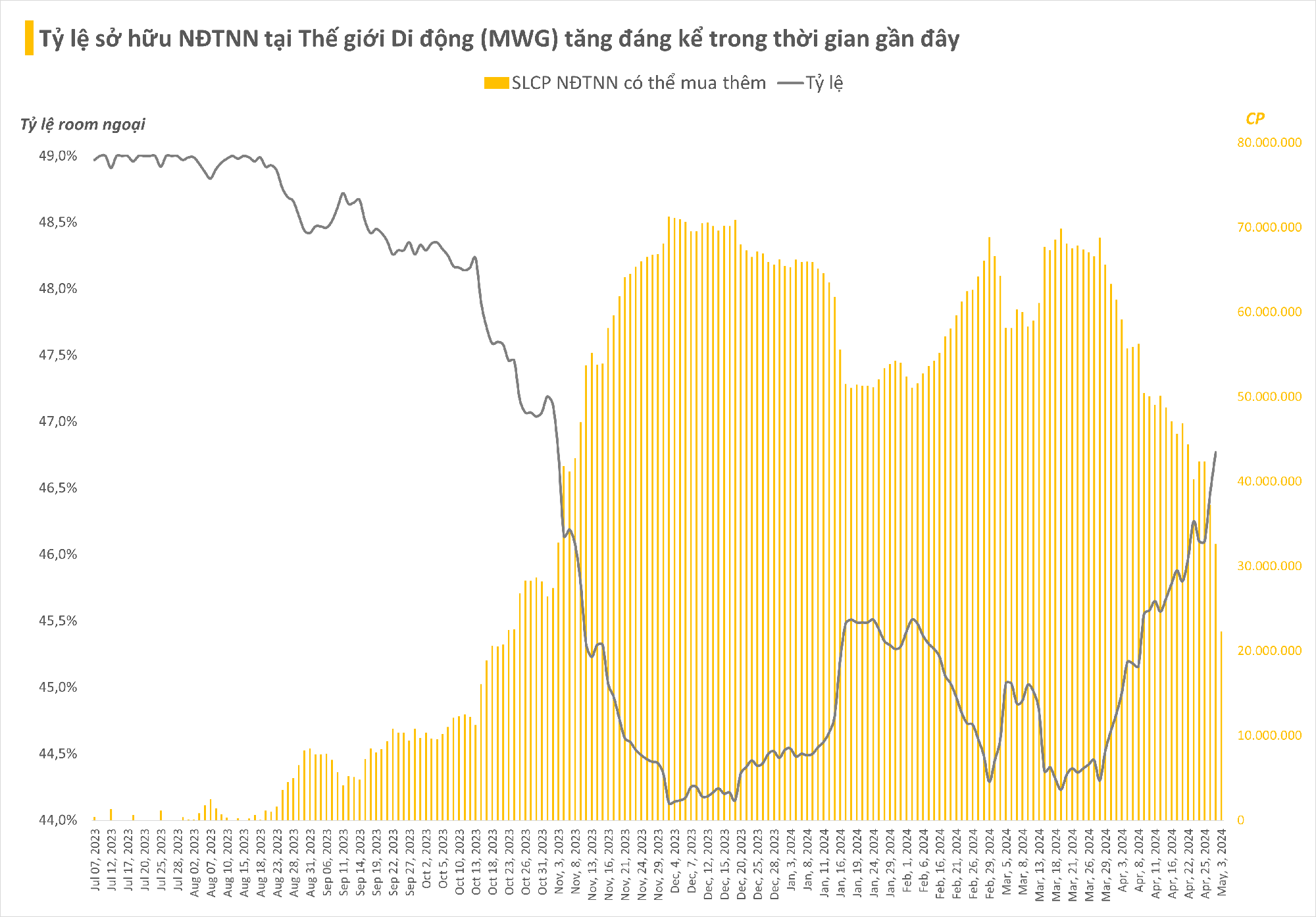

In recent weeks, there has been a strong “buy” sentiment for Mobile World Group Joint Stock Company (MWG) shares from foreign investors. Over several trading sessions, this stock has consistently topped the list of net purchases, with values consistently exceeding a hundred billion per session. In the past month, foreign investors have net bought over 38 million MWG shares, worth over VND 2,000 billion, mainly through matched orders, overshadowing the value of the next most popular stock, MBB (VND 430 billion).

With the influx of foreign capital, the foreign ownership ratio (“foreign room”) at MWG has increased significantly. As of the end of 3 May, the foreign room at MWG was approximately 47.5%, the highest since the end of October 2023, which corresponds to over 22 million shares that foreign investors can still buy. Thus, in one month, the foreign room at this retail company has been filled by almost 3%.

MWG shares became a hot commodity after the stock was excluded from the VNDiamond index in the Q1/2024 restructuring, and BMP was added instead. The new index will take effect from 6 May 2024. Currently, 4 ETFs on the market use the VNDiamond index as a benchmark, including DCVFMVN DIAMOND, MAFM VNDIAMOND, BVFVN DIAMOND, and KIM GROWTH VN DIAMOND, with total net asset value of approximately VND 16,000 billion. It is estimated that these ETFs hold about 50 million MWG shares in their portfolios and will need to sell all of these shares.

It is possible that foreign investors have aggressively invested to buy the large number of shares sold by ETFs during this restructuring.

Boost from strong business performance recovery

Looking back at the end of 2023, MWG witnessed an outflow of foreign capital and topped the list of stocks sold on the entire market. From always having the maximum foreign ownership ratio of 49% and having foreign investors willing to pay a premium of up to tens of percent through agreements to own it immediately, MWG saw a situation where over 71 million shares were sold but there was no competition to buy. The foreign room fell to close to 44%, corresponding to an “open room” of over 4% – a record high in many years.

Along with the selling pressure from foreign investors, MWG’s share price then plunged by almost 40% in just over a month, to a low of VND 35,100 per share. At that time, many shareholders were confused and questioned Mr. Nguyen Duc Tai, Chairman of Mobile World Investment Corporation. At that time, Mr. Tai confidently stated that anyone who believed in the corporation would act calmly and might even see it as an opportunity to buy. Anyone who did not have enough confidence in the company could sell off their shares.

“As an insider, I know very well where I am headed, so I intend to increase my ownership ratio,” said the Chairman.

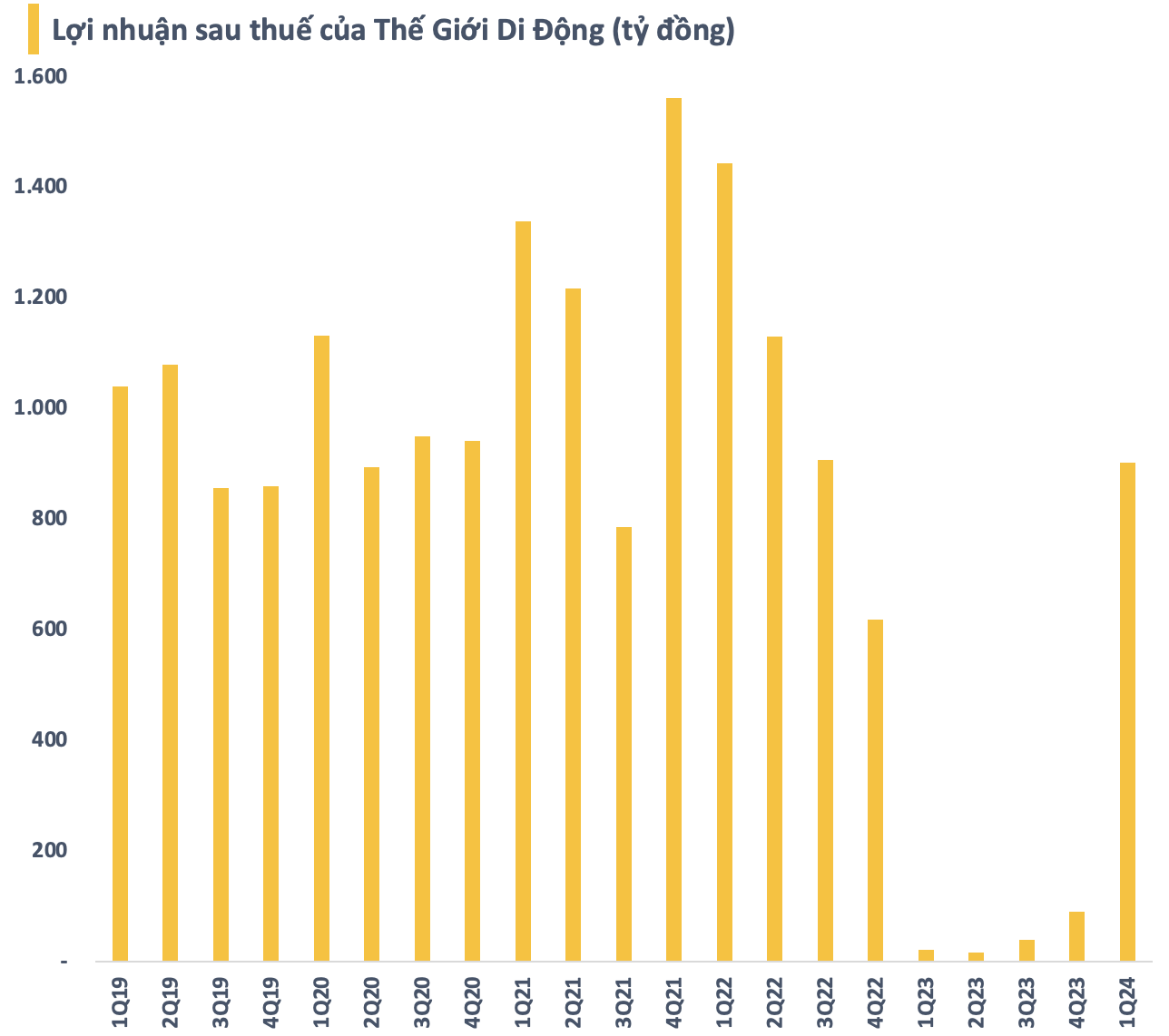

So far, MWG’s business operations have shown strong signs of recovery after 2023, which hit the retail sector hard. Revenue in Q1/2024 reached VND 31,486 billion, an increase of over 16% year-on-year, completing 25% of its full-year revenue plan. After deducting expenses, MWG had a net profit of VND 902 billion, 43 times higher than the same period in 2023 and the highest in six quarters since Q3/2022.

According to MWG, the main growth driver came from the electronics sector with a double-digit increase in revenue, mainly the product line of air conditioners which increased by about 50% year-on-year. The gross profit margin of the two TGDĐ/ĐMX chains both recorded a significant improvement in Q1/2024 as the electronics sector increased its share of total revenue, while this is a product group with a stable profit margin.

For Bach Hoa Xanh, revenue in Q1 reached over VND 9,100 billion, an increase of 44% year-on-year. Average revenue was VND 1.8 billion/store/month, with revenue growth driven by both fresh food and FMCGs, continuing to maintain breakeven after all expenses at the current operating level. The average number of transactions was about 500 invoices/store/day, an increase of 40%, and the average value/invoice increased slightly compared to the same period last year.

This year, MWG set an ambitious plan with revenue of VND 125,000 billion and after-tax profit of VND 2,400 billion in 2024. Chairman Nguyen Duc Tai said that the company is ready to deal with market fluctuations and has the room and determination to realize its goals. In fact, the company has a strong foundation because after the first quarter of the year, it has completed more than 25% of the planned revenue and almost 38% of the full-year profit target.

In addition, MWG shows strong financial potential. According to its consolidated financial statements for Q1/2024, Mobile World Group recorded other investments of over VND 7,000 billion, which are bonds and other investments with maturity from 3 months to less than 1 year and with applicable interest rates. In addition, the amount of cash (cash, cash equivalents, and short-term deposits) was recorded at VND 23,200 billion. It is estimated that in the first quarter of the year, Mobile World Group earned an average of nearly VND 6 billion in interest on deposits and bonds each day.

On the other hand, Mobile World Group also took the opportunity to pay down nearly VND 1,500 billion in financial debt in the first quarter, reducing interest expenses in Q1 by nearly 10% compared to the same period in 2023.

In the market, MWG shares have reacted quickly to the positive news flow, increasing by 30% since the beginning of 2024 to VND 55,700 per share. The trading session on 3 May even recorded record high liquidity with trading volume reaching nearly 30 million units, and the corresponding trading value reaching approximately VND 1,700 billion, the largest on the stock exchange that day.