Assessing market trends at the “Pulse of Money Flow” seminar, Ms. Do Hong Van, Head of FiinGroup’s Analysis Department, evaluated three factors: profit growth, valuation, and cash flow.

Statistics on the profit growth of 541 listed companies representing 33% of market capitalization show that, although profit in Q1 maintained a growth momentum compared to the same period last year, the pace has shown signs of slowing down. Profit growth in Q1/2024 was only half of the 40-50% growth rate in Q4/2023, despite being based on a low base in Q1 last year.

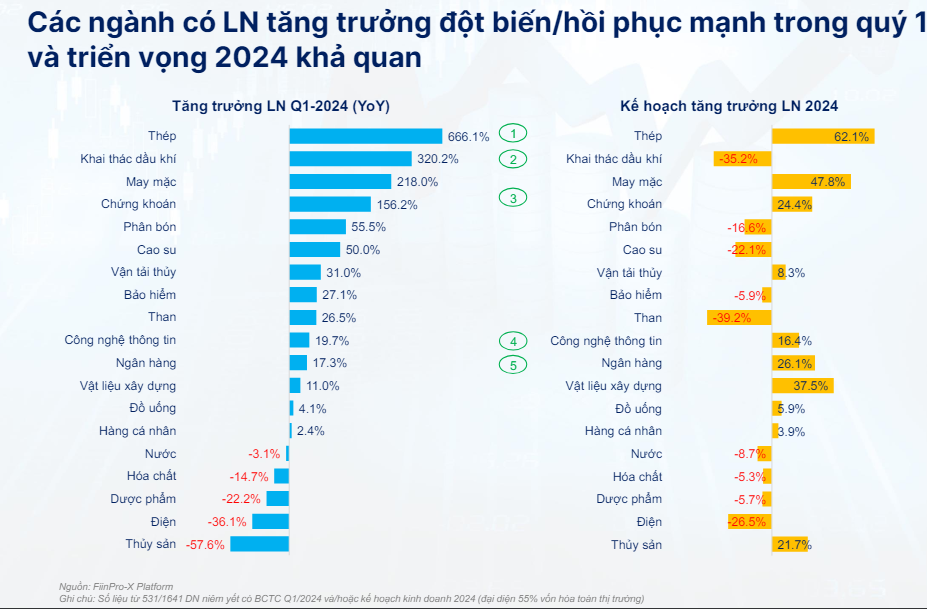

Industries with explosive profit growth in Q1 and a positive outlook for 2024 were identified by FiinGroup as steel, apparel, securities, information technology, and banking. In contrast, electricity, seafood, and pharmaceuticals recorded profit declines due to reduced demand and increased raw material costs. In addition, real estate and retail will also be two notable industries, but retail will recover early in 2024, while real estate will be the story of 2025.

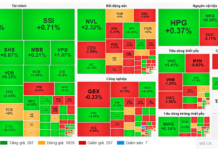

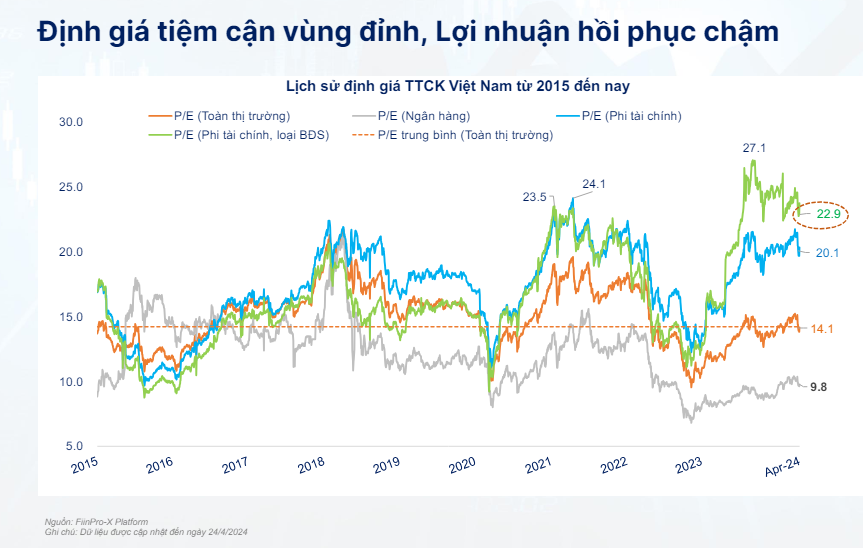

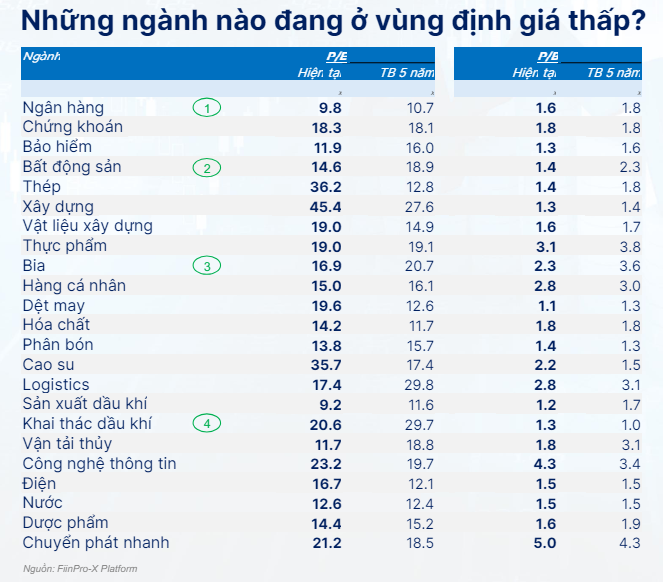

Regarding valuation, the sharp decline has brought market valuations back to a P/E of 13.8 times – below the 5-year average. However, looking deeper into the stock classification, the non-financial group, although down 6-7% from its peak in late March, is still anchored at a high. This is partly due to the fact that many cyclical sectors tend to have “peaking valuations and trough earnings”, but it cannot be denied that many stocks are “running away” from their earnings.

Therefore, FiinGroup experts believe that there are not many industries in the low valuation zone, with banking, real estate, beer, and oil and gas being sectors currently trading at below-average valuations.

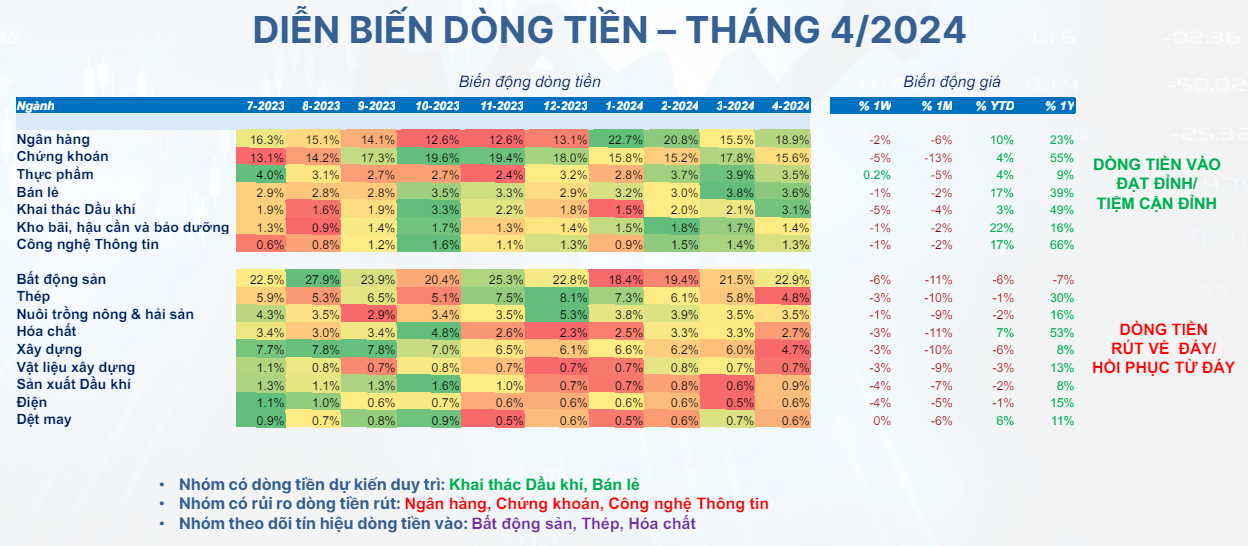

Looking at the cash flow trend, FiinGroup experts believe that the group at risk of cash flow withdrawal is banking, securities, and information technology. Conversely, the group with expected cash flow maintenance is oil and gas extraction, retail, especially the oil and gas industry, due to supporting fundamentals, positive Q1 business results, a positive outlook for 2024, and direct benefits from oil prices.

In addition, investors should also monitor the group by tracking cash flow into real estate, steel, and chemicals. These are the groups that are expected to see cash flows recovering from their lows.

“In times of market correction, investors can consider disbursing stocks in industry groups with deep discounts and cash flow recovering from their lows, prices that haven’t declined too sharply,” Ms. Do Hong Van noted.

Based on all three of the above factors, FiinGroup experts believe that the oil and gas extraction group has both attractive valuations and receives support from both fundamentals and cash flow in May. The steel and chemicals group relies mainly on cash flow, with the fundamental story still not seeing much improvement.

“Market unlikely to recover in a V-shape pattern”

Also providing a viewpoint on the market, Mr. Huynh Hoang Phuong – FIDT’s Director of Analysis, believes that after the correction, P/E and P/B valuations around the VN-Index of 1,160-1,180 are quite attractive for this year and could potentially attract cash flow from value investors who are currently on the sidelines.

With the expectation of approximately 18% growth in profit for listed companies in 2024, a forward P/E of 11.8 is an attractive level to open new positions for the entire year.

Following the abating of panic, there will certainly be recovery rallies and fundamentally sound stocks with good growth in 2024 or a unique story will continue to recover and grow, with less dependence on the general index.

“The market will find it difficult to recover in a V-shape pattern, but rather will need to accumulate to create a new foundation while waiting for short-term risks such as the exchange rate to gradually subside. Therefore, the VN-Index in May will likely move sideways and see strong divergence among stocks”

Looking at the medium and long term, factors such as economic growth, earnings growth of listed companies, interest rates, and the upgrade story are still positive supports for the market.