According to preliminary statistics from the General Department of Customs, in the first three months of 2024, the country imported 541,020 tons of various types of paper, equivalent to over 483.39 million USD, with an average price of 893.5 USD/ton, an increase of 8.9% in volume, 4.8% in value but a decrease of 3.8% in price compared to the first three months of 2023.

In March 2024 alone, paper imports increased by 52.8% in volume and 48.9% in value compared to the previous month, reaching 200,648 tons, equivalent to 177.61 million USD; compared to the same month in 2023, it decreased by 0.7% in volume and 3.9% in value.

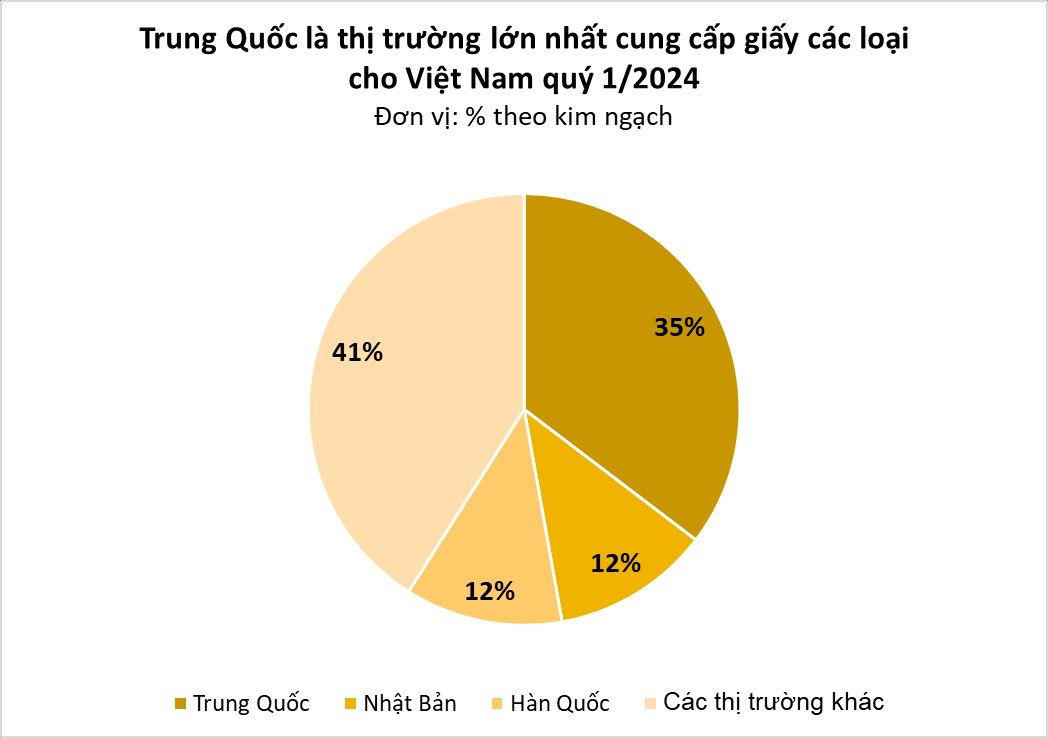

China, Korea, and Japan are the major markets supplying various types of paper to Vietnam in the first quarter of 2024.

Of which, imports from China reached 179,913 tons, equivalent to 170.84 million USD, with a price of 949.6 USD/ton, an increase of 19% in volume, 15% in value but a decrease of 3.3% in price compared to the first three months of 2023, accounting for 33.3% in the total volume of imported paper of all kinds in the country and accounting for 35.3% in the total import turnover.

Japan is the second largest import market with 68,475 tons, equivalent to 57.23 million USD, import price of 835.8 USD/ton, an increase of 35.9% in volume, 23.3% in value but a decrease of 9.3% in price compared to the same period last year, accounting for over 12.7% in total volume and 11.8% in total import turnover of paper of all kinds in the country.

Ranked third is the Korean market, reaching 64,203 tons, valued at 57.12 million USD, with a price of 889.6 USD/ton, a decrease of 17.6% in volume, 8.6% in value but an increase of 11% in price compared to the same period in 2023, accounting for nearly 12% in total volume and total import turnover.

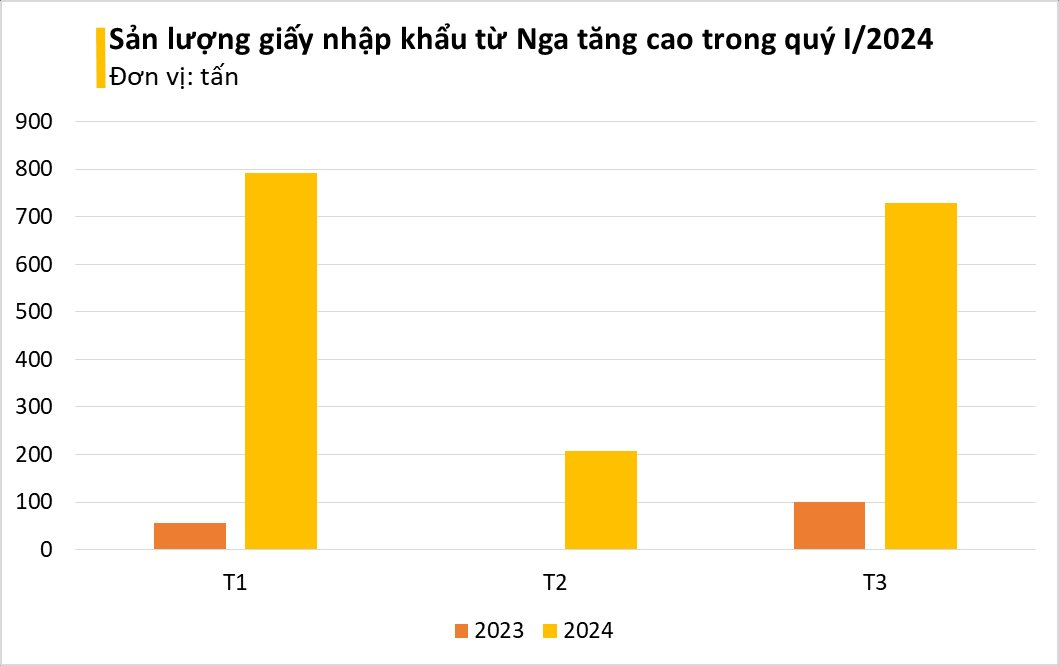

Among all the markets, Vietnam’s imports from Russia had the strongest growth in the first quarter of 2024. Specifically, imports from Russia increased by 1,008% in volume and 897% in value, reaching 1,729 tons, equivalent to 1.06 million USD. However, Russia accounts for only 0.2-0.3% in the total volume and total import turnover of Vietnam.

In fact, the paper industry plays an important role in creating stable jobs for tens of thousands of workers and activities related to a number of important manufacturing industries such as: Paper bag production, publishing printing, processing books and notebooks, paper towels and toilet paper, forestry activities…; waste collection and recycling also create jobs for hundreds of thousands of other workers.

Currently, the country has about 500 enterprises operating in paper production and the number of enterprises belonging to the Vietnam Pulp and Paper Association (VPPA) is only 130 but accounts for 90% of the total industry’s capacity.

Vietnam has great potential for developing its paper industry. Specifically, Vietnam’s per capita paper consumption is about 44 kg/person, the demand for packaging paper for domestic consumption and export products has a high growth rate (paper demand increases by 8-10%/year, of which the demand for packaging paper increases by about 15%/year).

Notably, wood chips are one of the raw materials for paper and pulp production. There is a paradox that although Vietnam is a country with many forest resources and a large exporter of wood chips, it still has to import the majority of its paper and pulp from other countries. The reason is that paper production will have a significant impact on the environment.