|

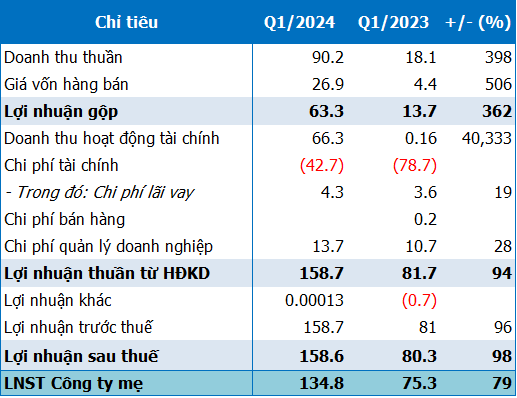

TVC’s Impressive Q1 2024 Financial Results

Unit: Billion VND

Source: VietstockFinance

|

According to the consolidated financial statements for Q1, TVC reported over 90 billion VND in net revenue, nearly five times higher than the same period last year. The largest contribution came from gains on financial assets measured at fair value through profit or loss (FVTPL), amounting to nearly 85 billion VND, a remarkable 161-fold increase year-over-year.

Additionally, profits from buying and selling trading securities brought in 66 billion VND, compared to no revenue in the previous year, pushing financial activity revenue to over 66 billion VND, a significant surge from the 164 million VND recorded in the same quarter last year.

In Q1, TVC also reversed almost 54 billion VND in allowances for declines in the value of securities, resulting in a negative financial expense of nearly 43 billion VND. “The company’s holdings as of March 31, 2024, appreciated significantly compared to December 31, 2023,” TVC stated.

For the quarter, TVC posted a post-tax profit of 159 billion VND, nearly double that of the previous year. Net income attributable to shareholders stood at 135 billion VND, marking a notable 79% increase.

As of the end of Q1, TVC’s asset portfolio neared 2,000 billion VND, a slight increase of 1% from the beginning of the year. Cash and cash equivalents totaled nearly 743 billion VND, predominantly in the form of non-term bank deposits of over 609 billion VND, a substantial 5.6-fold rise year-over-year.

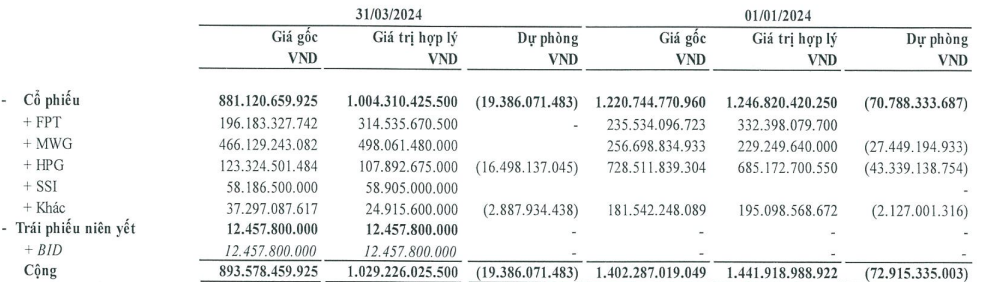

Investments in securities amounted to nearly 894 billion VND, a 36% decrease, while the value of provisions stood at over 19 billion VND, compared to 73 billion VND in the previous year.

TVC’s trading securities portfolio primarily consisted of stocks, with a fair value of over 1,004 billion VND as of the end of Q1, representing a 14% increase from the original value of 881 billion VND, indicating that this stock portfolio is currently yielding corresponding profits. Among the individual stocks, FPT, MWG, and SSI generated provisional gains of 60%, 7%, and slightly over 1%, respectively, while HPG showed a provisional loss of over 12%.

|

TVC’s Investment Portfolio as of Q1 2024

Source: TVC’s Financial Statements

|

Furthermore, the composition of the stock portfolio underwent a shift. Compared to the beginning of the year, TVC reduced its holdings in FPT, with the carrying amount decreasing from 332 billion VND to 196 billion VND at the end of Q1. A similar strategy was applied to HPG, as its carrying amount dropped from 728 billion VND to 123 billion VND. Conversely, TVC increased its investment in MWG and initiated a new position in SSI (58 billion VND).

As of the end of the quarter, the company had 825 billion VND in other short-term receivables, for which they set aside over 512 billion VND in provisions.

On the other side of the balance sheet, payables decreased significantly by 65% from the start of the year to 72 billion VND. TVC had no short-term loans or finance leases as of Q1-end, compared to over 145 billion VND at the beginning of the year. Similarly, the company also had no long-term loans or finance leases.