For many young people, owning a condo by the age of 30 is a dream. Meet Nguyen Minh Quan, a 30-year-old office worker in Ho Chi Minh City, who made it happen by taking a bold step and thinking outside the box. With a monthly income of VND 25 million and savings of VND 900 million, Minh Quan took out a bank loan to purchase a VND 3 billion condo, defying the odds.

|

The journey to achieving the dream of homeownership was not easy, but Minh Quan’s determination and financial strategy paid off. From the very beginning of his career, he prioritized savings and financial planning, allocating 50% of his monthly income to savings, 30% to living expenses, and investing 20% in self-improvement.

After nearly a decade of hard work and dedication, Minh Quan had accumulated initial capital of VND 900 million. Sharing the mindset of many Vietnamese, he believed that settling down is a prerequisite for career success. He started exploring the real estate market, comparing prices, and scrutinizing home loan packages offered by different banks. After months of thorough research, he decided to purchase a VND 3 billion condo in an area with well-developed infrastructure and convenient transportation.

The turning point came when Minh Quan discovered VIB’s condo loan package, offered by one of the leading banks in personal customer lending. The package allowed him to borrow up to 85% of the condo value, with a repayment period of up to 30 years and attractive interest rates. The real deal-maker was the option to defer principal payments for the first five years.

The solution to owning a condo: VIB’s fast loan, easy repayment.

|

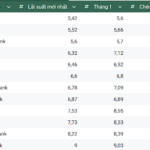

With his initial capital of VND 900 million, Minh Quan sought advice from a bank officer. They suggested a plan to borrow VND 2.1 billion over 30 years to purchase the VND 3 billion condo. To ease the financial burden, Minh Quan asked his family for additional support of VND 300 million and took out a loan of VND 1.8 billion over 30 years from VIB. With a preferential interest rate of 6.9% fixed for the first 12 months, his monthly payment to the bank was only VND 10 million during the initial period. Even after the promotional period ended and the interest rate was adjusted, the rate remained competitive, with a maximum margin of 2.8%, ensuring peace of mind in financial planning.

Repayment schedule illustration

|

Minh Quan shared that the interest payment was comparable to his current rent, but now he was investing in his own home. Moreover, with the potential for condo prices to increase, he believed that buying now was a wise decision.

VIB’s condo loan solution offered Minh Quan the advantage of not having to repay the principal for the first five years. After this period, he could choose to make periodic principal payments every six months or opt for early repayment of up to VND 25 million (VND 300 million per year) without any prepayment fees.

According to experts, owning a condo with a monthly income of VND 25 million at the age of 30 requires determination, perseverance, and a well-thought-out financial plan. Here are some key strategies that can help make this dream a reality:

- Create a clear savings plan: Set specific savings goals and break them down into smaller, achievable milestones.

- Research the real estate market thoroughly: Compare prices, locations, and amenities of different projects before making a decision.

- Choose a suitable home loan package: Compare interest rates, loan terms, and preferential conditions offered by different banks.

- Develop a reasonable spending plan: After purchasing a home, ensure that your monthly expenses are managed effectively to maintain your ability to repay the loan.

Minh Quan’s story serves as an inspiration for other young people chasing their homeownership dreams. He encourages them to pursue their goals despite financial constraints: “Owning a home is a significant milestone in life. Don’t let a low income hold you back. Property prices tend to increase over time, so if you have the opportunity to buy with the support of a bank, don’t hesitate. Stay determined, create a sensible financial plan, and you can turn your dream into a reality.”

|

VIB offers an attractive mortgage package for condos with pink books, starting at a competitive interest rate of 5.9% fixed for the first six months. For 12 and 24-month terms, the fixed rates are 6.9% and 7.9%, respectively. The bank has also reduced the interest rate margin after the promotional period to 2.8%, making it easier for customers to manage their finances without worrying about interest rate fluctuations. In addition to the preferential interest rate, VIB’s condo loan package includes three valuable benefits: deferred principal payments for up to five years, a loan-to-value ratio of up to 85%, and a quick approval process within eight hours. For more details, please visit here. |