The Hanoi Stock Exchange (HNX) has approved the trading of over 20.1 million shares of APC on the UPCoM market. The first trading date is May 15, 2024, at a price of 7,100 VND per share.

Previously, more than 20.1 million shares of APC were compulsorily delisted by the Ho Chi Minh City Stock Exchange (HOSE) from April 29, as the company incurred consecutive losses in the 3 years from 2021 to 2023. This was also the first stock to be delisted from HOSE in 2024.

Deputy General Director accumulates more shares before the delisting

Vo Thai Son, Deputy General Director of APC, reported that he had purchased an additional 71,100 shares out of the 100,000 shares of APC he registered to buy from April 9 to 26. Mr. Son attributed the uncompleted registration to unfavorable market conditions.

After the transaction, Mr. Son’s ownership in APC increased from 800,000 shares (4.02%) to 871,100 shares (4.38%). The transaction value was estimated at VND 6 billion.

Notably, Mr. Son’s sister, Ms. Vo Thuy Duong, who is a member of the Board of Directors and General Director of APC, is the largest shareholder, holding more than 8 million shares of APC (40.46%). Together, they hold 44.84% of APC‘s charter capital.

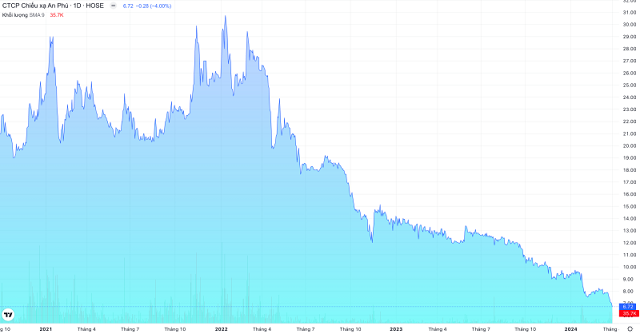

APC was listed on the HOSE in early 2010 and even approached a “triple-digit” price in December 2017 when the market price surged fivefold to a peak of VND 90,000 per share, before plummeting to the VND 30,000 range with a series of unexplained floor sessions from early 2018.

|

Price movement of APC shares

|

Quarterly loss narrowed to VND 5 billion

An Phu Radiation, established in 2003 with an initial charter capital of VND 50 billion, mainly provides radiation services, accounting for about 60% of the market share. Before 2021, APC’s business results were relatively stable, with revenue exceeding VND 100 billion and profits of tens of billions of dong annually.

From 2021 onwards, although revenue remained above VND 100 billion, the company incurred its first net loss of nearly VND 2 billion, far below the VND 45.5 billion profit in 2020. In 2022 and 2023, the company continued to suffer losses of VND 9 billion and VND 36 billion, respectively, mainly due to cost of goods sold and interest expenses.

In the first quarter of 2024, APC recorded revenue of over VND 30 billion, up 54% year-on-year. With no more sales below cost, the company’s gross profit was nearly VND 8 billion, compared to a loss of over VND 600 million in the same period last year. The gross profit margin improved to 26%.

Despite reducing interest expenses, the value remained high, and together with increased selling and management expenses, APC incurred a net loss of over VND 5 billion, an improvement from the VND 15 billion loss in the first quarter of 2023.

|

APC’s loss extends to the sixth consecutive quarter |

In 2024, the company targets revenue of over VND 168 billion and a return to profitability with a net profit of more than VND 975 million. APC’s management forecasts that demand for radiation services in the first half of 2024 will be weak, with increased competition and lower service prices. Demand is expected to pick up from the third quarter and continue through the fourth quarter. Agricultural and aquatic products will remain the main commodities for radiation treatment in the Southern region. In 2024, the company will add a new product group of medical devices to its portfolio.

As of March 31, 2024, APC’s total assets were approximately VND 878 billion, a decrease of VND 12 billion from the beginning of the year, with fixed assets accounting for 72%. Non-term bank deposits increased slightly by VND 1 billion to over VND 7 billion, while inventory increased fivefold to VND 3 billion.

On the liabilities side, total liabilities decreased from VND 300 billion at the beginning of the year to VND 292.5 billion. Total loans accounted for VND 262 billion, including VND 76 billion in short-term loans from Vietcombank, SeaBank, VPBank, and an individual named Tran Ngoc Thien Nga.