The VN-Index witnessed a rapid gap increase at the opening of the session, but overwhelming selling pressure quickly sent the market into a downward spiral. At one point, the index lost nearly 10 points before recovering towards the end of the trading day. It eventually closed on May 10 with a decline of 3.94 points, settling at 1,248.6 points. Trading volume dipped, with matching orders on HOSE surpassing 14.6 trillion VND. Foreign investors maintained their net selling streak, offloading a combined net sell value of 490 billion VND across all stock exchanges.

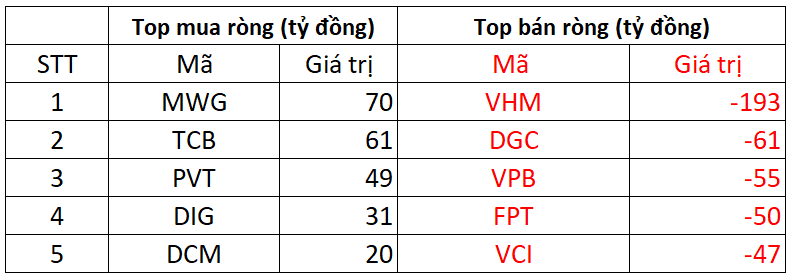

On the Ho Chi Minh Stock Exchange (HOSE), foreign investors net sold approximately 502 billion VND worth of shares.

In terms of purchases, MWG once again topped the list of foreign favorites, with a net buy value of 70 billion VND. TCB and PVT followed suit, attracting net buys of 61 billion VND and 49 billion VND, respectively. Additionally, foreign investors also showed interest in DIG and DCM, net buying 31 billion VND and 20 billion VND worth of shares in these companies.

On the other hand, VHM faced intense selling pressure from foreign investors, who offloaded shares worth over 193 billion VND. This marked the third consecutive session of significant net selling in VHM by foreign investors. DGC and VPB also witnessed net sell-offs of 61 billion VND and 55 billion VND, respectively.

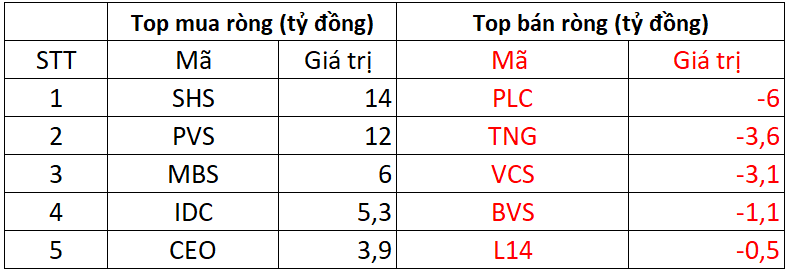

On the Hanoi Stock Exchange (HNX), foreign investors net bought 29 billion VND worth of shares.

SHS was the most notable stock on the buy side, with a net buy value of 14 billion VND. PVS followed closely, with foreign investors net purchasing 12 billion VND worth of shares. Additionally, they also invested a few billion VND each in MBS, IDC, and CEO.

On the sell side, PLC faced the most significant net selling pressure, with foreign investors offloading nearly 6 billion VND worth of shares. TNG, VCS, and BVS also witnessed net selling in the range of a few billion VND.

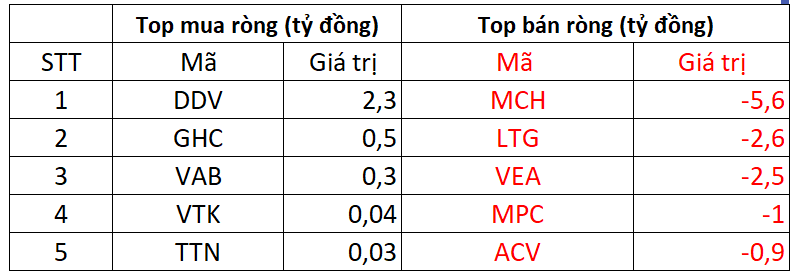

On the Unlisted Public Company Market (UPCOM), foreign investors net sold 12 billion VND worth of shares.

Contrarily, MCH faced net selling pressure of approximately 5.6 billion VND from foreign investors. They also net sold shares of LTG, VEA, MPC, and a few other stocks.