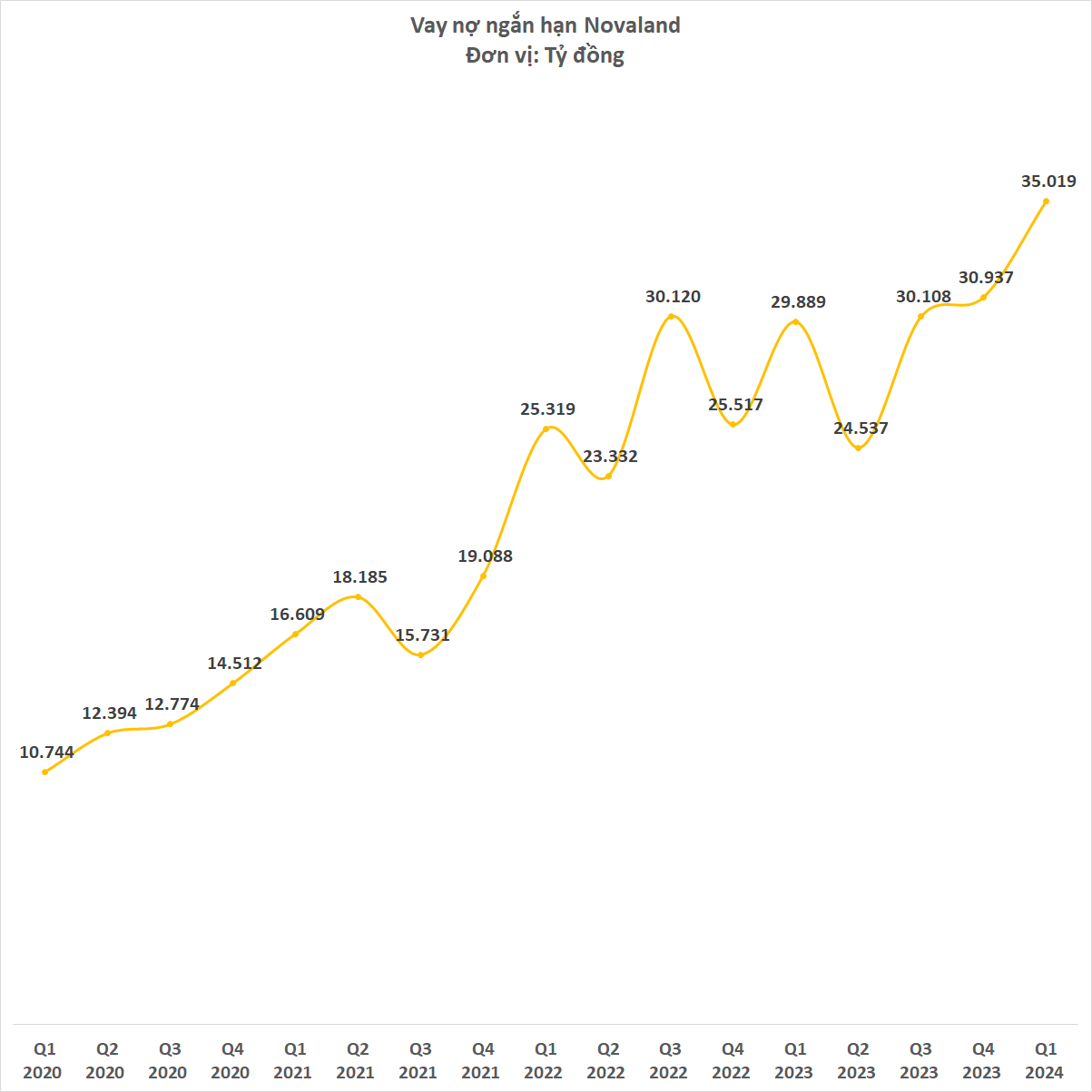

Novaland, one of the leading real estate groups in Vietnam, has recently published its financial report for the first quarter of 2024. Notably, the company’s short-term debt has surged to VND 35,019 billion, the highest in Novaland’s history, reflecting an increase of nearly VND 4,100 billion compared to the beginning of the year.

According to Novaland’s report, the significant rise in short-term debt is mainly attributed to the reclassification of bonds, leading to a more than VND 2,800 billion increase in short-term bond debt, totaling VND 22,472 billion. Additionally, bank loans and third-party loans have also increased by VND 636 billion and VND 623 billion, respectively.

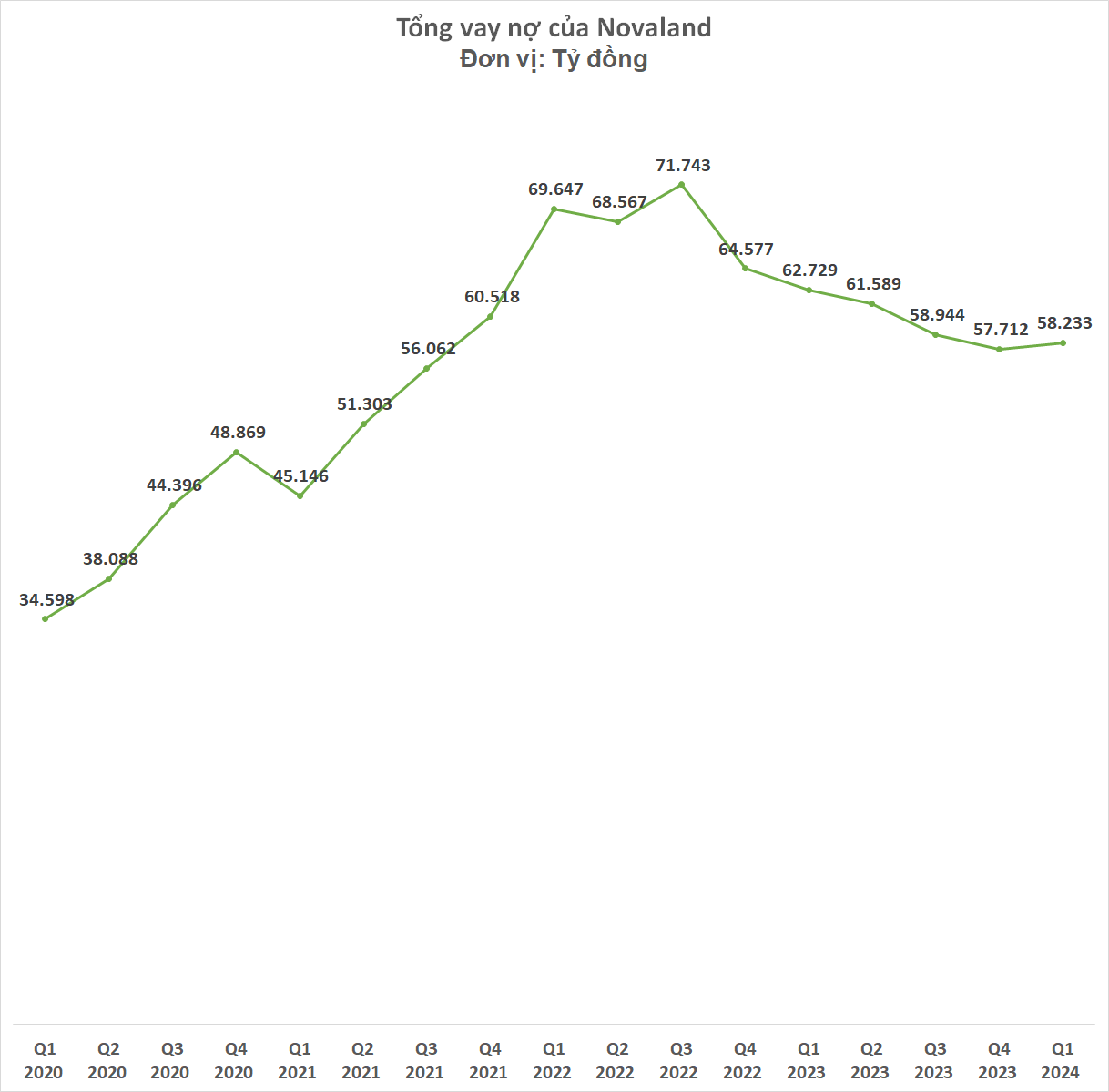

In contrast, Novaland’s long-term debt has decreased by VND 3,561 billion. As a result, the company’s total debt currently stands at VND 58,233 billion.

This marks the first time Novaland’s total debt has increased after five consecutive quarters of decline. The company has been undergoing debt restructuring and asset sales to alleviate financial pressure.

For the first quarter of 2024, Novaland reported interest expenses of VND 75 billion, a decrease of more than half compared to the same period last year. Total financial expenses for the quarter amounted to VND 773 billion, including a foreign exchange loss of VND 452 billion.

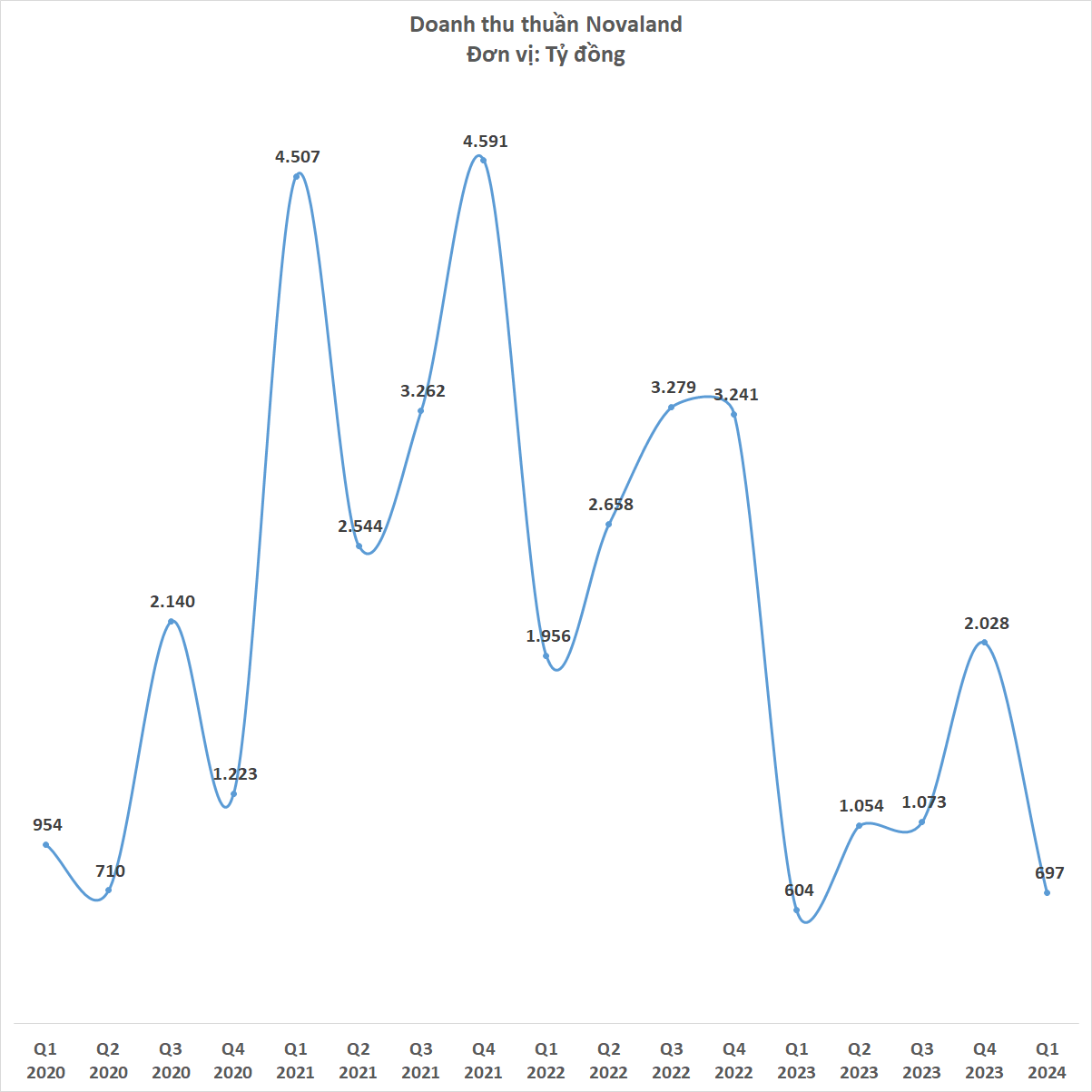

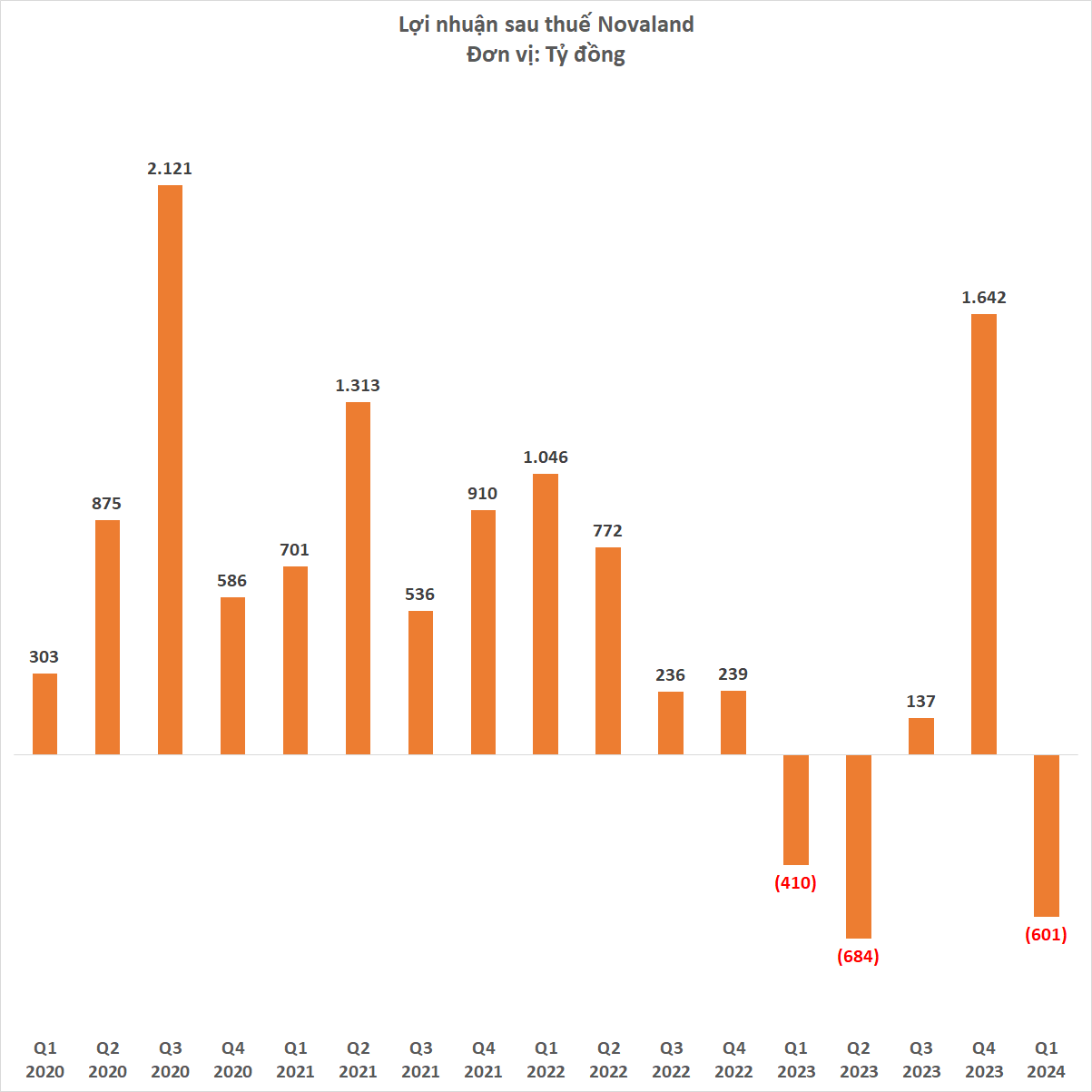

In terms of business results, Novaland recorded a modest revenue of VND 697 billion in the first quarter and reported a loss of VND 601 billion.

As of March 31, 2024, Novaland’s total assets amounted to VND 236,480 billion, a 2% decrease from the beginning of the year. Inventory accounted for a significant 59.57% of total assets, totaling VND 140,881 billion, mainly comprising real estate properties under construction. Novaland has utilized VND 57,798 billion of its inventory as collateral for loans.

The company also holds substantial receivables totaling VND 75,170 billion, a 7.8% decrease from the beginning of the year, equivalent to 31.78% of total assets.

Recently, there have been media reports about the Ho Chi Minh City Police Department requesting the Dong Nai Department of Natural Resources and Environment to provide documents related to Aqua City, one of Novaland’s key projects.

Novaland has attributed this development to a few impatient customers who, amid prolonged financial challenges, chose to approach law enforcement agencies instead of resolving disputes through civil litigation or arbitration. The Ho Chi Minh City Police Department is currently verifying the information as per legal procedures and will provide an official response to the customers.

Following this news, Novaland’s stock witnessed a sharp sell-off during the trading session on May 8, 2024, even hitting the floor price at one point. The trading volume also surged compared to previous sessions.