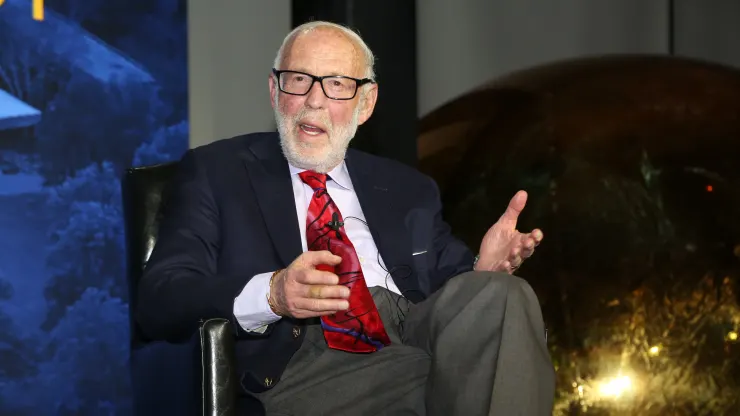

Jim Simons left an indelible mark in the field of investment, and his firm, Renaissance Technologies, achieved remarkable success in creating mathematical models and algorithms for investment decisions.

|

Jim Simons, the legendary quantitative investor |

A pioneer in developing mathematical models and algorithms for investment decisions, Simons left an impressive legacy at Renaissance Technologies, rivaling legends such as Warren Buffett and George Soros. The firm’s flagship fund, the Medallion Fund, delivered a staggering performance of 66%/year between 1988 and 2018, according to data from Gregory Zuckerman’s book, “The Man Who Solved the Market.”

Simons earned his bachelor’s degree in mathematics from the Massachusetts Institute of Technology in 1958 and a Ph.D. in mathematics from the University of California, Berkeley, at the age of 23. Later, at the age of 40, this quantitative investing master founded the predecessor of Renaissance in 1978 after leaving academia and deciding to try his hand at stock trading.

Unlike most investors who scrutinize fundamentals such as revenue, earnings, and profit margins to determine a company’s value, Simons solely relied on automated trading systems to exploit market inefficiencies and trading patterns.

“I have no opinions about any of the stocks,” Simons said in a 2016 interview with CNBC. “The computer has its opinions, and we follow them blindly.”

Simons’ Medallion Fund generated profits of over $100 billion between 1988 and 2018, with an astonishing annualized return of 39% (after fees). This quantitative fund stopped accepting new capital in 1993, and Simons only allowed his employees to invest in it starting in 2005.

The quantitative investment strategies, relying on trend-following models, gained popularity on Wall Street since Simons revolutionized trading in the 1980s. According to estimates from JPMorgan, quantitative funds now account for more than 20% of total equity assets.

According to Forbes, Simons had a net worth of approximately $31.4 billion at the time of his passing.

The quantitative investing guru previously chaired the mathematics department at Stony Brook University in New York, and his mathematical breakthroughs proved valuable in fields such as string theory, connective tissue, and condensed matter physics.

Simons and his wife established the Simons Foundation in 1994 and have donated billions of dollars to charitable causes, including support for mathematical and scientific research. He remained actively involved in the work of the Simons Foundation until his final days.