Existing shareholders want to divest 100% of capital

HVS Securities has just announced the transfer of shares of its existing shareholders, including Chairwoman Truong Thi Hong Nga and two Board members, Ngo Van Do and Thai Dinh Sy.

Accordingly, from May 14 to June 14, the above three leaders registered to sell all their held shares in HVS by agreement. Ms. Truong Thi Hong Nga registered to sell 2.45 million shares, equivalent to 49% of capital. Mr. Ngo Van Do registered to sell 1.1 million shares, equivalent to 22.279% of capital. Mr. Thai Dinh Sy registered to sell 1.4 million shares, equivalent to 28.41% of capital.

The total number of registered shares for sale is over 5 million, equivalent to the entire capital of HVS.

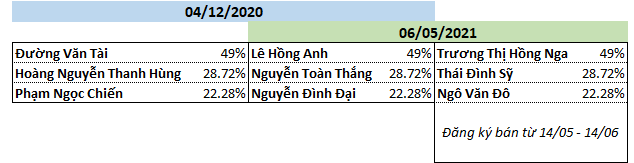

In almost four years, the shareholder structure has changed twice

Since the end of 2020, HVS has gone through two changes in its shareholder structure.

The first change occurred in December 2020 when the three existing shareholders at that time, Duong Van Tai, Hoang Nguyen Thanh Hung, and Pham Ngoc Chien, transferred their shares to three individuals: Le Hong Anh, Nguyen Toan Thang, and Nguyen Dinh Dai.

Soon after, the major shareholder structure of HVS changed again, with the shares being transferred to Ms. Truong Thi Hong Nga, Mr. Ngo Van Do, and Mr. Thai Dinh Sy. Now, these three shareholders intend to divest their entire capital.

|

Ownership structure of HVS Securities

Source: VietstockFinance

|

HVS is “paralyzed”

In reality, HVS Securities is in a state of paralysis.

In August 2018, the State Securities Commission withdrew the brokerage business of HVS. Subsequently, in September 2018 and November 2018, the Ho Chi Minh City Stock Exchange and the Hanoi Stock Exchange terminated the company’s membership.

Furthermore, on December 3, 2018, the company was revoked its depository membership by the Vietnam Securities Depository Center (now the Vietnam Securities Depository and Settlement Corporation).

According to the 2023 audit report, the auditing firm emphasized the company’s operating status. In 2023, the company was still in the process of restructuring, and thus, only interest income from term deposits was generated.

In addition, HVS is still in the process of working with the State Securities Commission, which is considering the conditions for maintaining and licensing the company. This has raised doubts about the company’s ability to continue operating.

However, the Board of Directors of HVS believes that there is no reason for the company to be denied continued operation by the State Securities Commission. Therefore, the financial statements are still prepared based on the assumption that the company will continue to operate.

In terms of business results, in 2023, HVS generated nearly VND 800 million in revenue (entirely from term deposit interest). After expenses, the company made a profit of over VND 290 million.

The company’s total assets amounted to VND 11.2 billion. The accumulated loss of VND 39 billion eroded capital. Almost all of the company’s assets are in the form of term deposits with an interest rate of 5.8%, amounting to VND 10.8 billion.

|

HVS Securities with accumulated losses over the years. Assets mainly in the form of cash or term deposits. |

Despite having no revenue and only earning interest income from bank deposits, the company still incurred over VND 386 million in management staff expenses in 2023 (accounting for 80% of management expenses). The company’s General Director received a salary of VND 120 million, equivalent to VND 10 million per month.

In the first quarter of 2024, the company redeemed the term deposits mentioned above and is currently holding them in cash. The company incurred a loss of VND 600,000 in this quarter.

Restructuring steps in 2024

In 2024, HVS sets a target of VND 20 billion in total revenue and VND 10 billion in pre-tax profit.

The company also plans to increase its charter capital, add business lines, and change its head office.

Specifically, the General Meeting of Shareholders of the company approved the plan to issue a maximum of over 30 million shares to existing shareholders to increase capital by VND 300.2 billion. The offering price is VND 10,000/share.

Sixty percent of the proceeds from the offering will be used to supplement capital for proprietary trading activities. Thirty percent will be used for margin lending and advance payment against the sale of securities. The remaining will be used for other activities such as investing in securities trading software, infrastructure and facilities, registering for depository and trading membership, etc.

Along with the capital increase, the company will add securities brokerage, securities depository, and proprietary trading business lines.

Yến Chi