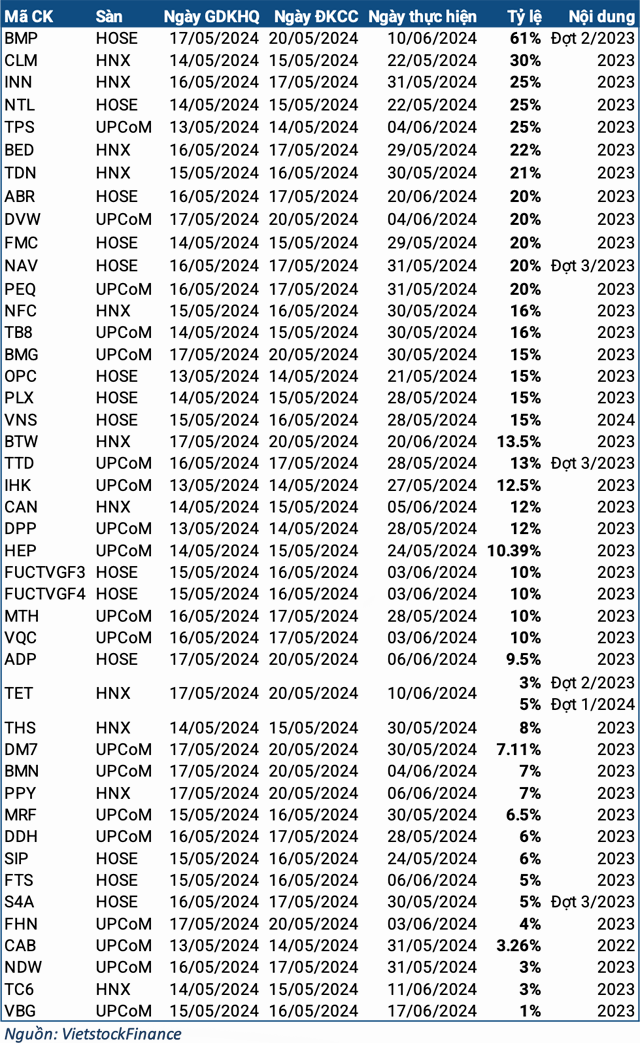

Upcoming Corporate Events: Dividend Payouts for the Week of May 13-17

|

Companies Finalizing Cash Dividend Payouts for the Week

|

The standout in this week’s “dividend shower” is BMP (Binh Minh Plastic Joint Stock Company), which will finalize the dividend payout at a rate of 61%, marking the second dividend installment for 2023. With nearly 81.7 million circulating shares, BMP is estimated to disburse over VND 498 billion to complete this payout. The ex-dividend date is set for May 17, and the expected payment date is June 10, 2024.

BMP’s parent company, The NawaPlastic Industries (Saraburi) Co. Ltd., which holds 54.99% of the charter capital, will receive more than VND 274 billion in this payout. The second largest shareholder, KWWE Beteilgungen AG, with an 11.02% stake, is expected to receive approximately VND 55 billion.

Previously, in late November 2023, the company distributed the first dividend installment at a rate of 65% (VND 6,500 per share). Thus, the total dividend rate that BMP paid out for 2023 reached 126%, setting a record high since its stock market debut.

CLM ranks as the second-highest dividend payer for the upcoming week, with a payout rate of 30% (VND 3,000 per share). This marks the consecutive year that the company has maintained this dividend rate. Notably, the 30% dividend rate for 2023 was only recently approved at the 2024 Annual General Meeting of Shareholders on April 25, superseding the initial plan mentioned in the 2023 Annual General Meeting, which stated a minimum dividend rate of 9%.

In the market, CLM has 11 million circulating shares, translating to a payout amount of approximately VND 33 billion. Its parent company, the Vietnam National Coal-Mineral Industries Group (Vinacomin), which owns 55.41% of CLM’s capital, is expected to receive nearly VND 18.3 billion. The ex-dividend date is May 14, and the payment is scheduled for May 22.

Additionally, three companies will finalize dividend payouts at a rate of 25% (INN, NTL, TPS), while seven others will finalize payouts with rates of 20% and above (BED, TDN, ABR, DVW, FMC, NAV, PEQ).

Looking ahead to next week, two companies will finalize dividend payouts in the form of stock dividends: BWE (14%, meaning that for every 100 shares held, investors will receive 14 new shares) and BAF (17%, translating to 17 new shares for every 100 shares held). The ex-dividend date for both companies is May 17, 2024.

Châu An