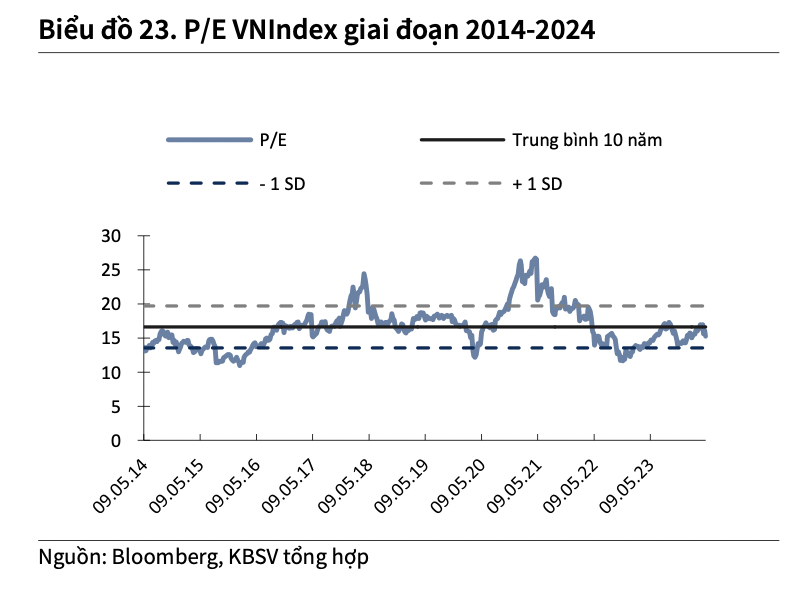

In its May stock market outlook update, KBSV Securities provided insights into the current P/E valuation of the VN-Index, which stands at approximately 15x according to Bloomberg data (excluding extraordinary corporate profits). This valuation is in line with the index’s two-year average and below its ten-year average.

Based on expectations of an economic recovery throughout 2024 and low-interest rates, KBSV believes that the market valuation is reasonably attractive for investors looking to accumulate stocks for medium to long-term goals.

Domestically, the annual general meeting season has provided investors with a clearer picture of companies’ financial performance in the first quarter and their business plans for 2024. Results indicate improvements across most sectors.

In the medium term, analysts maintain the view that corporate earnings will vary across sectors but are expected to recover as no significant factors have emerged to affect the growth prospects of businesses. The recovery of various sectors in the context of sustained low-interest rates is anticipated to boost the stock market.

Forecasting market volatility for May, KBSV presents a base-case scenario: with companies having announced their first-quarter results and a lack of supportive news, the VN-Index will need time to rebalance before witnessing more robust movements as second-quarter business performance becomes clearer.

Factors Influencing the Short-Term Market:

Investors should consider several factors that could impact the base-case scenario in the near term.

Firstly, there is a risk of the Fed delaying interest rate cuts. Economic data from the world’s leading economy in the first quarter of 2024 surprised forecasters. GDP growth fell short of expectations, while inflation fears resurfaced. However, Mr. Powell’s statements suggest no further rate hikes this year, given rising unemployment and lower-than-expected wage growth.

The US stock market reacted positively to this news, and the DXY cooled down, easing pressure on exchange rates. Market expectations have shifted towards the possibility of two rate cuts in September and November 2024 (compared to the previous forecast of three cuts).

Nonetheless, risks remain, and the Fed will only lower rates when there are definite signs that inflation is cooling down to its 2% target. Investors should closely monitor inflation data and related Fed statements to anticipate future trends and mitigate associated risks.

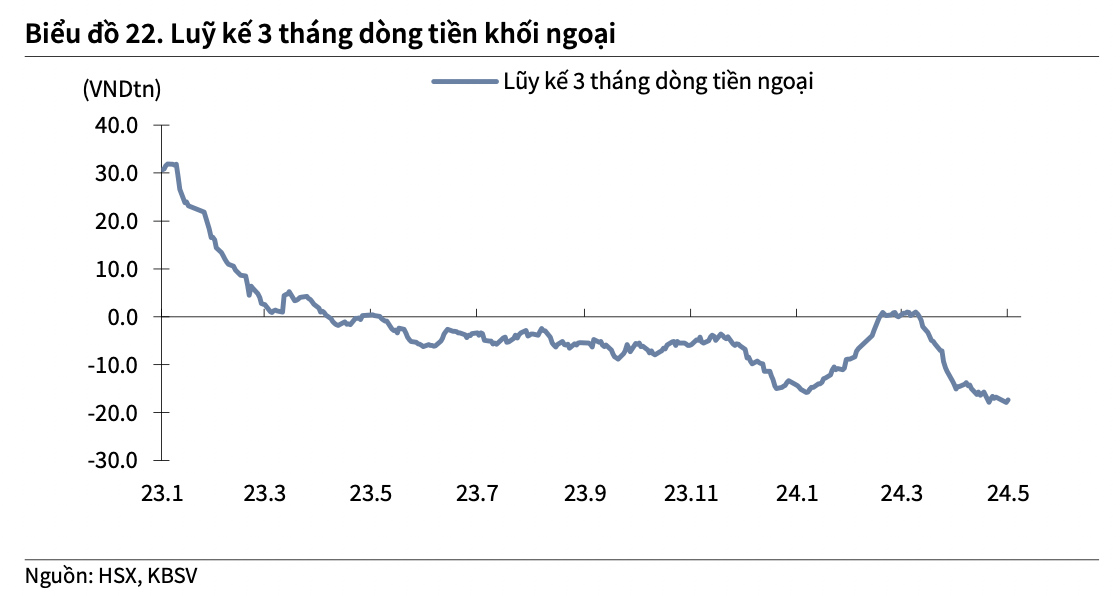

Additionally, foreign investors have been net sellers since March, and if this trend continues, it could impact the recovery of the overall index in the coming months.

Geopolitical tensions and the risk of escalation in the Middle East, which could spread to other regions, also pose a threat to global stability, affecting commodity prices and supply chains.

Two Scenarios for the Stock Market in May:

On the daily chart, the VN-Index has entered its first significant correction phase, losing approximately 10% from its peak of around 1,290 after a five-month consecutive rise. Although the index showed a recovery response after briefly breaking the 200-day MA (around 1,170 points), the signal of the 20-day MA cutting below the 50-day MA, and soon approaching the 100-day MA, indicates that the short-term adjustment trend is likely to continue.

On longer time frames, such as weekly and monthly charts, the sharp decline in April triggered a recovery reaction at the technical support zone, relieving the market’s negative status and creating opportunities to attract accumulation demand. However, the ADX indicator on both weekly and monthly charts is below 20, indicating an unclear trend, coupled with weakening trading volume.

Combining short and medium-term signals, KBSV leans towards a 70% probability scenario where the VN-Index will fluctuate and accumulate with low liquidity in the range of 1,195 – 1,265 before breaking out. The remaining 30% probability suggests that the index could enter a more negative state, breaking the short-term bottom and falling to around the strong support zone of 1,115 (+-15) before a clear recovery.

A risk to monitor during this period, which could affect KBSV’s 70% probability scenario, is the Dollar Index and the US 10-year government bond yield continuing to hit short-term highs, negatively impacting exchange rates and putting pressure on the State Bank’s monetary policy.