The energy sector is buzzing with activity as oil and gas stocks surge amidst a volatile market. PVS, PVC, PVD, PLX, OIL, and BSR have all seen significant gains, with PVT even reaching its historical peak with a stunning performance. Trading in oil and gas stocks is lively, with volumes already surpassing full-day averages during the morning session.

This momentum in oil and gas stocks can be attributed to positive news from offshore developments. Petrovietnam (PVN), the Vietnam Oil and Gas Group, has announced two new oil and gas discoveries at the Rong and Bunga Aster fields. These discoveries, made in the first four months of the year, hold an estimated preliminary reserve of over 100 million barrels of oil equivalent. One well, BA-1X, has already been successfully drilled and put into immediate production.

The Rong and Bunga Aster finds are a significant boost for PVN, offering new directions for exploration and production. They also highlight the potential for further exploration in already producing or previously explored blocks, optimizing the utilization of existing infrastructure.

Beyond the news catalyst, the rally in oil and gas stocks is also driven by a rotation of funds. Money has already flowed into most sectors, including securities, retail, and steel, and now the oil and gas sector is attracting attention.

According to FiinGroup, the cash flow in the oil and gas exploration sector remains robust, and the sector’s valuation is below the 5-year average with a P/E of 20.6 times and P/B of 1.3 times.

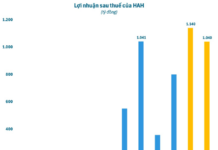

The oil and gas exploration sector also witnessed a remarkable profit growth of 320% in Q1 2024. PVD’s profit increased by 184%, while PVS’s profit rose by 34%, the highest in five quarters. PVB also reported its highest quarterly profit in four years, a turnaround from its loss in the same period last year.

Given the attractive valuations, strong fundamentals, and supportive cash flow, FiinGroup anticipates that the oil and gas sector will attract substantial investment in May.

Multiple Positive Factors for the Mid-Term

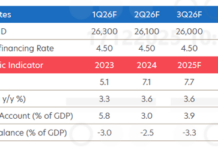

Looking ahead, oil and gas stocks are expected to continue benefiting from sustained high oil prices due to tight global supply. VNDirect notes that global oil demand is on the rise as key economies like the US and China show signs of recovery. Meanwhile, OPEC+’s decision to extend voluntary production cuts into Q2 2024 and escalating geopolitical tensions could further tighten supply.

The current supply-demand balance in the global oil market supports Brent crude oil prices averaging $85 per barrel in 2024. This environment bodes well for exploration and production (E&P) activities worldwide.

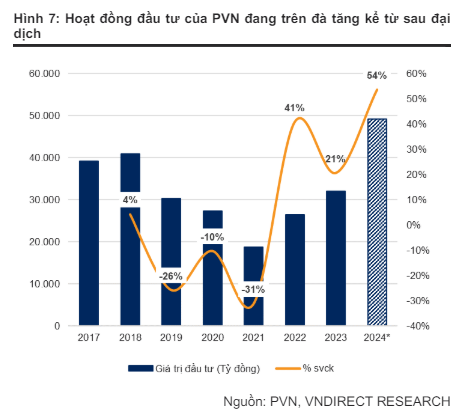

Additionally, PetroVietnam’s investment activities are on an upward trajectory. In 2024, PVN plans to invest approximately VND 50 trillion (USD 2 billion), a 54% increase from 2023. Upstream investment will account for 52% of this total. Given the multi-year nature of oil and gas projects, VNDirect anticipates that PVN will continue to ramp up investment in the coming years, signaling a vibrant domestic E&P landscape from 2024 onward.

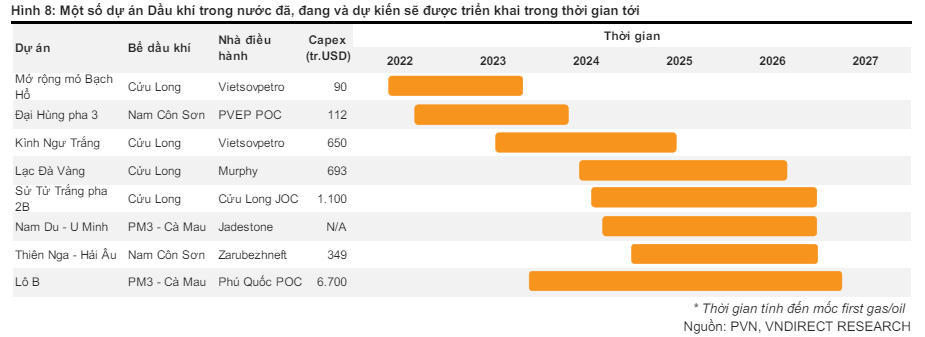

Furthermore, the B-O Mon project, valued at billions of dollars, remains a key driver for the industry. Significant progress has been made in recent months, and VNDirect expects PVN to resolve remaining bottlenecks and reach a final investment decision (FID) in Q2 2024. This milestone will pave the way for the project’s synchronized implementation, offering a substantial scope of work for upstream service providers.

In summary, the vibrant E&P landscape in Vietnam bodes well for the growth prospects of upstream service providers, with PVS and PVD well-positioned to capitalize on this trend in the coming years.