The afternoon session witnessed the largest volume of shares in the current uptrend being deposited into accounts. However, contrary to the morning session, the market maintained a slow and steady recovery pace. While the blue-chip stocks still showed widespread losses, their prices gradually improved, helping the VN-Index close with a minimal decrease of 0.94 points, or 0.32%, a significant recovery from the over 11-point drop at the session’s low.

The trading volume in the afternoon session on the two exchanges was quite high, with a matching value of over 9,618 billion VND, a 42% increase compared to the morning session. HoSE recorded a 39% increase in trading volume, reaching 8,508 billion VND. It was evident that the market experienced an additional volume of shares being sold, along with improved buying interest.

This afternoon session marked the settlement of nearly 920 million shares worth nearly 21,500 billion VND from the session on May 8th. This large volume of shares likely contributed to the market’s weakness in the morning session, or at the very least, caused a contraction in capital inflows, creating an opportunity for the afternoon sell-off at lower prices.

The market hit a new low in the first five minutes of the afternoon session and then traded sideways near the lows until around 2:15 PM, but it did not create a deeper bottom. In the final minutes, buying pressure started to lift prices, resulting in a positive recovery.

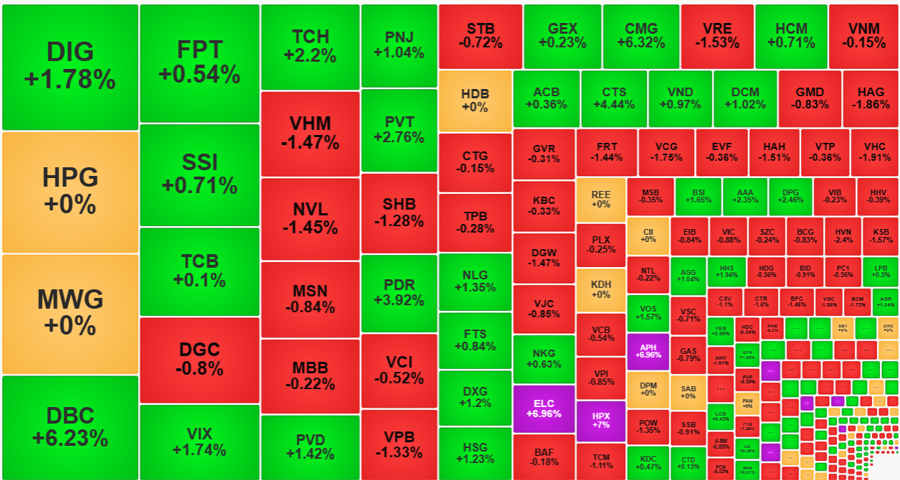

Statistics show that blue-chip stocks recovered quite well. The VN30-Index closed 0.31% lower, a significant improvement from its intraday low of 0.98%. Except for POW, SHB, STB, and VHM, which closed at their intraday lows, all other stocks in the VN30-Index recovered. FPT had the most impressive recovery, reversing from a 0.84% intraday loss to a 0.54% gain compared to the reference price. SSI also quickly bounced back and rose by 0.71%, equivalent to a recovery of 1.39% from its intraday low. TCB took a bit longer, gaining momentum from around 2:15 PM onwards, and managed to close 0.1% above the reference price, equivalent to a recovery of 1.25% from its intraday low. ACB also rose by 0.91% and turned positive by 0.36%. These were the only stocks in the basket that recovered beyond the reference price.

Many other stocks closed in negative territory but managed to recover by more than 1% from their intraday lows, including GVR, HDB, HPG, MWG, PLX, and VIC. Expanding to the entire HoSE floor, 52% of traded stocks recovered by at least 1% from their intraday lows. Of course, not many stocks were able to turn green, and the HoSE floor closed with 165 gainers and 261 losers. In comparison, the morning session recorded 98 gainers and 324 losers.

Despite the breadth indicating that a majority of stocks were still in a recovery phase within a downtrend, the bottom-fishing demand sent a clear signal of support. Today’s market was aware of the large volume of shares being deposited and, given the prolonged uptrend, the risk of selling was predictable. Therefore, those looking to buy could afford to wait for better prices. The strong increase in trading volume during the afternoon session clearly reflected this perspective.

Small speculative stocks even hit the daily limit-up in many cases. HPX, PSH, ELC, APH, SAM, DRH, and SMC rose to their daily limit with high trading volume. A group of stocks with gains of over 2% and large trading volume included CMG, DBC, CTS, PVT, and TCH. This group even reversed their intraday losses, posting gains of 3% to 6% from their daily lows. Due to limited capital inflows, small-cap stocks seemed to be more prone to price reversals compared to blue-chip stocks.

Around 74 stocks still witnessed losses of over 1% in value, but their trading volume accounted for only 17.6% of the total matched volume on the HoSE floor, a small proportion. VHM, NVL, SHB, PDR, VPB, VRE, HAG, DGW, and FRT were among the stocks with trading volume exceeding 100 billion VND in this group, with a few managing to recover somewhat, albeit far less impressively than the small-cap stocks.