The Lumen Vietnam Fund (LVF) has reported a negative investment performance of 6.6% for April compared to the previous month, bringing year-to-date performance to a positive 2.1%. The top 10 investments currently account for over 45% of the fund’s portfolio and include FPT, VNM, MWG, MSN, PLX, STB, CTG, HPG, VRE, and BVH.

According to the fund, LVF’s performance in April can be attributed to its strategic allocation to small and mid-cap stocks and successful stock picking in specific sectors such as Consumer, Information Technology, and Industrials.

Information Technology continued to be the best-performing sector, delivering a return of 3.4% and maintaining its strong year-to-date trend of 22.8%. Throughout April, there were several positive developments in this sector.

In addition to positive first-quarter earnings results, which showed a growth of over 20% year-over-year, there were meetings and collaborations with major global technology corporations. Notably, the announcement by the Vice Chairman of Nvidia about a $200 million project with FPT to establish an AI factory in Vietnam stood out. The outlook for this sector remains positive.

The Consumer sector follows with a year-to-date return of 2.0%, contributing to a 20.5% increase in the first four months compared to a 3.4% return of the VNAS in the same period. Initial results for the first quarter of 2024 indicate that companies’ restructuring efforts to improve performance and adapt to the new situation have yielded positive results. The pace of recovery has far exceeded market expectations, helping stocks counter the market’s downward trend during this period.

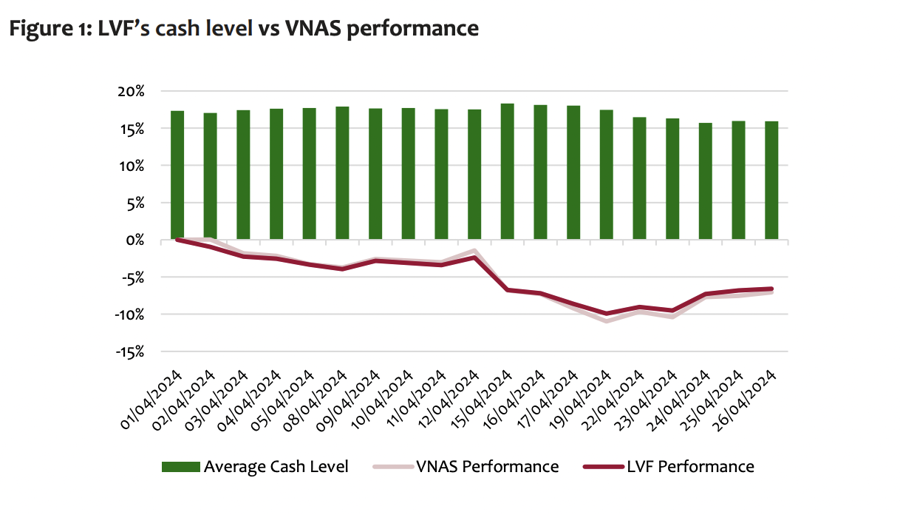

Finally, increasing cash positions at opportune times and allocating the portfolio to select stocks in the Consumer Staples and Transportation sectors helped reduce the portfolio’s volatility compared to the overall market in April.

The market experienced a correction in April after a prolonged period of strong growth due to profit-taking by investors. Additionally, the announcement of lower-than-expected financial results by some companies led to a decline in their stock prices, impacting the overall market sentiment. The depreciation of the Vietnamese dong against the USD and rumors involving senior officials also contributed to the market’s negative psychology.

In anticipation of short-term risks and recognizing the overheating of specific stocks, the fund proactively increased its cash position since the end of February 2024.

Taking advantage of the market correction in April, the fund continued to restructure its portfolio by selling stocks deemed overvalued and starting to buy select quality stocks at more favorable prices. This investment strategy will continue in the coming months with flexible adjustments based on market conditions.

During this period, the fund will prioritize stocks in sectors expected to show improved financial results in the coming quarters.

The fund maintains a positive outlook on the market and the economy. Currently, the economic growth drivers are very strong, with consumption and export activities recovering as expected. Companies are now in a better position than in 2022 and 2023 due to restructuring efforts and debt reduction.

In the opinion of the Lumen Vietnam Fund, an interest rate hike of 50 to 100 basis points, if necessary to support exchange rate stability, would not significantly impact the economic recovery but would be essential for creating a more stable macroeconomic environment.