The market closed sideways for the sixth consecutive session, unable to break out of its range. Today’s attempt at a breakout was quickly halted as large-cap stocks, including VIC, failed to provide the necessary momentum.

While the decline in stock prices was not significant, most stocks fluctuated intraday, unable to sustain their intraday highs and facing selling pressure. This indicates the presence of active daily supply forces. However, liquidity remained low during these fluctuations, and price damage was within the typical range of volatility.

Nonetheless, a prolonged period of sideways trading is not ideal. The market has been consolidating for a few days after a recent uptrend and has not yet encountered significant resistance. Many investors are still holding onto their stocks, anticipating a breakout. The volume of stocks trapped near the peak at higher price levels is concerning. On the upside, new buying interest is relatively small, and the trading intensity of 16-18k billion/day (excluding matched transactions) is not negligible. Prolonged sideways trading at this level of liquidity could indicate a distribution phase.

The market still has the potential for another upward move, but it is contingent on increased liquidity. The selling pressure is not overwhelmingly high, and sellers are selective due to the small price adjustments. This week marks the maturity of derivatives, so incoming cash flow may be waiting on the sidelines. Nonetheless, it is crucial to prepare for various scenarios.

Some stocks still have upside potential, and investors can consider holding onto them while monitoring supply and demand dynamics. For others, profit-taking is advisable, as further price increases may not justify the associated risks. It is prudent to reduce equity exposure to a low level. There are no new catalysts to drive a market surge at this point.

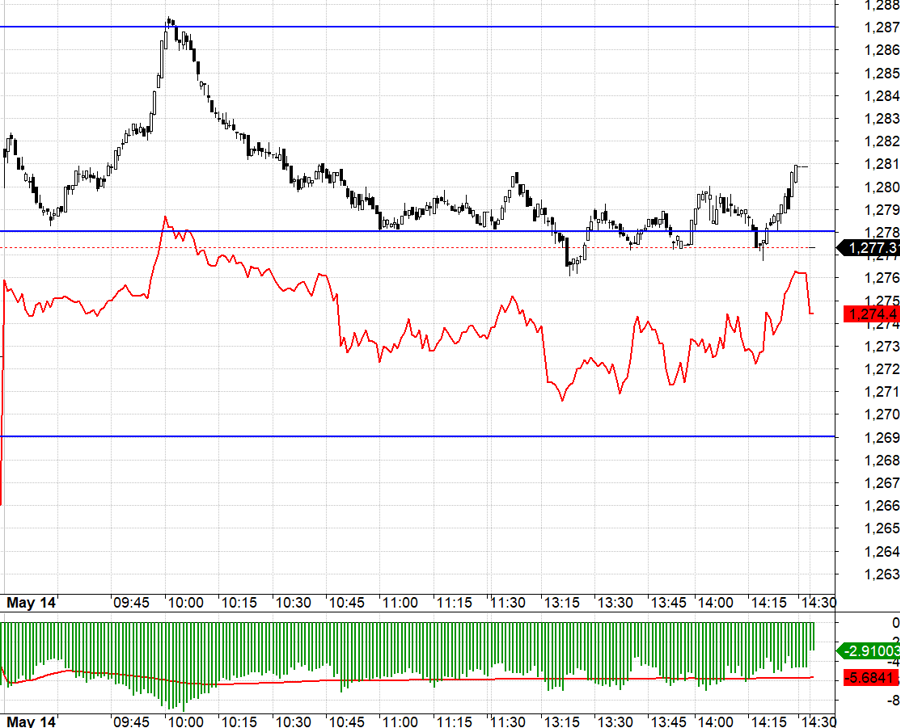

In the derivatives market, despite the upcoming maturity of F1, the basis remained significantly discounted during today’s session. VN30 traded within a tight range of 1278.xx to 1287.xx, but both Long and Short positions faced limited profit potential due to basis dynamics. For instance, a successful Short position at the retest of 1287.xx on VN30 would have faced a 9-point discount on F1, and as the index declined towards 1278.xx, the basis narrowed. Trading on F2, which has a tighter basis, was subdued.

Currently, VN30 lacks strong momentum and has been hovering around its previous peak. The support level is also unclear, and VIC faced profit-taking today after a brief rally. It is likely that the current state of VN30 will persist until maturity. Consider Short positions on F2.

VN30 closed today at 1277.31. Near-term resistance levels for tomorrow are 1278; 1287; 1292; 1299; 1307; 1314. Support levels are 1271; 1262; 1259; 1253; 1247.

“Stock Market Blog” reflects the personal views and opinions of the author and does not represent the views of VnEconomy. The opinions and assessments expressed are solely those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment views.