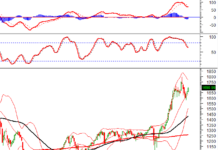

Today’s trading session witnessed a tug-of-war among blue-chip stocks, resulting in more volatile movements compared to the morning session, but without causing significant losses by the end of the day. On the other hand, small-cap stocks garnered exceptional attention, with their index rising positively and witnessing a surge in trading volume, increasing by over 34% to reach its highest level in 15 sessions.

The small-cap basket was the only group to witness an increase in trading volume today. Specifically, while the mid-cap basket remained unchanged, the VN30 basket witnessed a 7% decrease in trading volume compared to the previous week’s closing session, reaching just over VND 5,123 billion and accounting for 34.7% of the total matched volume on the HoSE. This marks the weakest trading proportion in 24 sessions. In the previous week, blue-chips accounted for approximately 40% of the market’s trading volume. During the previous 13 sessions’ upward trend, the VN30 basket accounted for an average of 42.4% of the total trading volume, confirming its ability to attract positive cash flow and align with the VN30-Index’s faster growth rate compared to other indices.

In the last three sessions, the VN30-Index has shown a stronger decline than the VN-Index, while the VNMidcap-Index has remained sideways, and the VNSmallcap has risen. Today’s significant improvement in trading volume among small-cap stocks confirms a certain shift in cash flow. Of course, small-cap stocks with low market capitalization and share prices cannot compete with blue-chips in terms of trading volume, but many stocks are witnessing an increase in trading volume compared to their own averages.

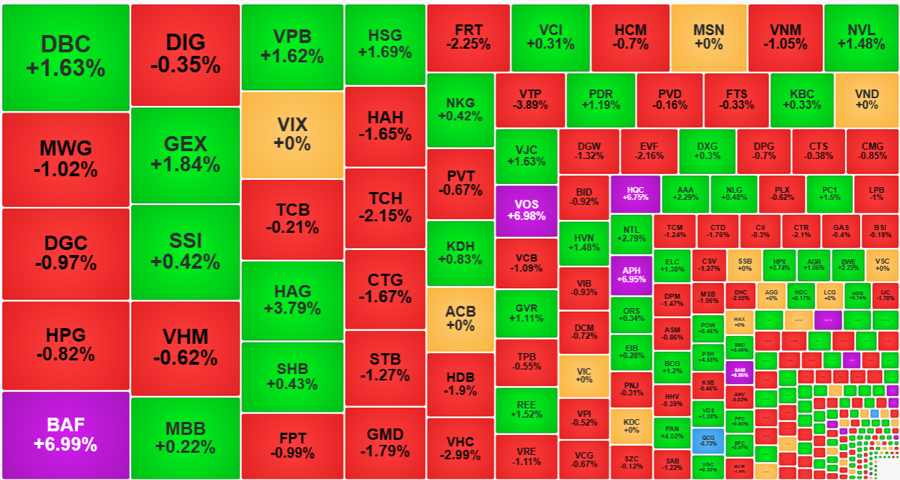

Several small-cap stocks witnessed impressive gains today: BAF hit the ceiling with unprecedented trading volume, reaching VND 397.5 billion, even ranking among the top 5 stocks in terms of trading volume in the market. The share price also reached a 21-month high. VOS also reached the ceiling, with a trading volume of VND 115 billion. HQC, APH, and SAM also rose to their maximum daily limits, with trading volumes of several billion each. Stocks such as NTL, ELC, AGR, PSH, VDS, BFC, and KHG also witnessed positive gains with acceptable trading volumes.

Overall, the HoSE floor today had 13 stocks hitting the ceiling, none of which belonged to the VN30 basket. Additionally, 90 other stocks rose by more than 1%, with the VN30 basket contributing only 3 stocks: VJC rose by 1.63%, VPB by 1.62%, and GVR by 1.11%. The VN30 basket even traded rather negatively, with 7 stocks rising and 19 falling at the closing bell. The VN30-Index closed down 0.39%, the VN-Index fell by 0.36%, the Midcap decreased by 0.23%, and the Smallcap rose by 0.52%.

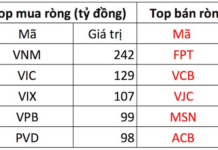

Despite the lackluster performance of blue-chip stocks in terms of share prices, this group played a crucial role in maintaining the market’s momentum this afternoon. While small-cap stocks exhibited strong share prices, they could not solely support the VN-Index. If the index had lost too many points, penny stocks would have struggled to maintain their positive trajectory. At 2:25 pm, the VN-Index fell to its intraday low, losing more than 11 points, equivalent to a 0.89% decrease compared to the reference price. This was also the time when the VN30-Index hit its intraday low, falling by 11.2 points (-0.88%). Without the recovery of the blue-chip group – even though their share prices did not fully surpass the reference price – the VN-Index would not have been able to narrow its loss to just 4.52 points by the end of the trading day. Notable recovery efforts include VIC, which surged to 1.47% before returning to the reference price; VHM, which regained 1% but still closed 0.62% lower; and GVR and VPB, which successfully reversed their negative trends. Other pillars, such as VCB, VNM, TCB, and MSN, also witnessed price recoveries to varying degrees.

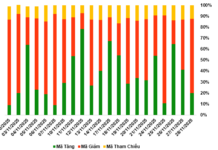

The afternoon session witnessed improved bottom-fishing cash flow, mainly focused on blue-chip stocks, and strong price-pushing cash flow, predominantly in penny stocks, resulting in a 26% increase in trading volume compared to the morning session. Specifically, the trading volume on the HoSE in the afternoon session rose by 29%. This indicates that the market continues to attract bottom-fishing cash flow, even though the overall matched volume for the day remains unchanged from the previous session.

Additionally, the concentration of cash flow remained impressive. Out of 203 stocks on the HoSE, 104 stocks witnessed a price increase of more than 1%, accounting for 26.4% of the floor’s trading volume. On the other hand, 233 stocks decreased in price – a higher number than the increasing stocks – but only 72 stocks fell by more than 1%, accounting for 22.9% of the trading volume. The group with the deepest price drop included MWG, HAH, TCH, CTG, STB, GMD, FRT, VNM, HDB, and VHC. These 10 stocks accounted for 62% of the group’s total trading volume.