BSC Securities has released its outlook for the stock market from now until the end of 2024, emphasizing that the market will continue its “bullish” trend.

The firm highlights that stock investment performance will be closely linked to corporate earnings results and growth potential in the 2024-2025 period.

As of May 3, 2024, the total profit of the VN-Index market for Q1 2024 increased by 11.6% compared to the same period in 2023. This modest growth is mainly due to the decline in the real estate sector by 36% and the Electricity, Water, and Oil & Gas sector by 59%.

Opportunities will be more selective, coming from sectors with low profits in Q2 and Q3/2023, maintaining absolute profits improving quarterly, and profit margins tending to recover in the last three consecutive quarters.

Some sectors with low profits in Q2 and Q3/2023, along with a profit recovery trend, may attract investment in the coming period. These include Banking, Retail, Tourism & Entertainment, Personal & Household Goods, Chemicals, Automotive & Components, Basic Resources & Construction Materials, and Oil & Gas.

BSC emphasizes the focus on leading stocks, which tend to benefit earlier than smaller companies in the same industry due to their advantages. By applying the Top-Down investment strategy, investors can select stocks that are truly in a recovery trend.

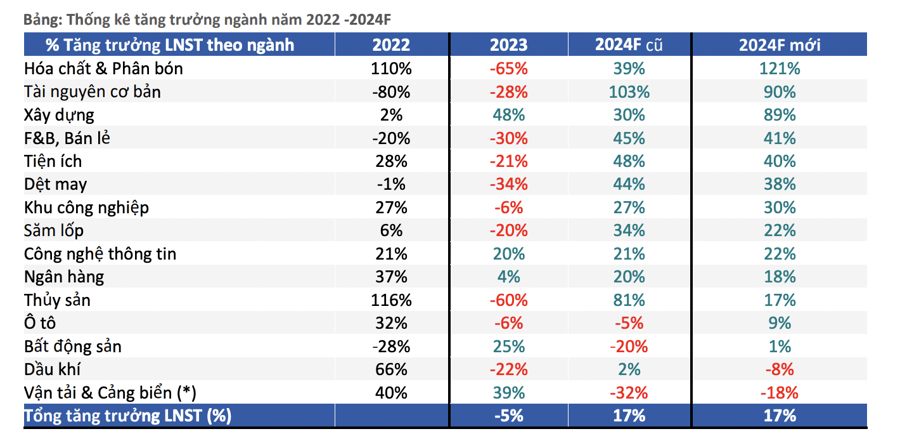

BSC maintains its projection for profit growth in 2024 for the observed companies (~80%-85% of market capitalization) at a similar level as the beginning of the year, about 17%. However, there are adjustments in profit growth expectations for some sectors after the Q1 2024 business results were announced.

Sectors expected to witness a strong profit recovery from low bases in 2023 include Chemicals & Fertilizers (+121%), Basic Resources (+90%), Construction (+89%), Retail & F&B (+45%), Utilities (+40%), Textiles (+38%), Industrial Parks (+30%), and Banking (+18%).

Expectations of economic and corporate profit recovery are driving the narrowing gap between the VN-Index’s E/P and deposit interest rates. In the second half of 2024, BSC forecasts a slight increase in deposit rates of about 0.25%-0.5% in the base case scenario, reaching levels similar to the Covid-19 period in 2020, but still relatively low compared to the 2015-2020 phase.

Based on Q1 2024 business results, the profit recovery momentum of the overall market in 2024F remains positive at ~20% year-on-year. This continues to create a yield gap between the market’s E/P and savings deposits, attracting more funds to flow into the stock market. Corporate profit growth will remain a core factor for the market’s expected upward trend in the medium and long term, similar to the 2016-2018 and 2020-2022 periods.

Market valuations for stock groups are reasonable for accumulation at the beginning of a new cycle, especially for large-cap stocks (Banking and Retail).

Based on BSC’s profit growth projections for 2024, the P/E FWD for mid and small-cap stocks (excluding banks and real estate) is expected to adjust to 15.5 times, below the 10-year average, creating attractive long-term investment opportunities. Meanwhile, the P/E Fwd VN-Index 2024 is trading at 11.8 times, the lowest in the 5-year historical average, while the current P/E trailing is trading at 13.8 times after updating Q1 2024 business results.

“The year 2024 favors ‘cash is king’ rather than ‘expectations.’ In the early stages of a recovery cycle, the market relies on ‘expectations,’ as seen in 2023, making the P/B approach relatively effective.

In the next phase of the recovery cycle, profit recovery momentum will be a decisive factor for investors to avoid a ‘value trap,’ where seemingly cheap stocks fail to recover and grow. Therefore, market funds will prioritize stocks with strong profit growth momentum in 2024-2025,” BSC emphasized.