The VN-Index closed the 19th trading week of 2024 at 1,244.70 points, a rise of 23.67 points or 1.94% compared to the previous week’s close. This marks a significant improvement from the 17th week (April 22-26), where the index gained 35.18 points, equivalent to a 2.91% increase.

The average trading value for the week across all three exchanges was VND 22,526 billion. Specifically, for matched orders, the average trading value was VND 18,769 billion, a 21.6% increase from week 18 and a 16% rise from week 17. However, this level is still relatively low compared to the liquidity seen in March and April 2024.

Analyzing by sector, the average trading value of matched orders increased in the Real Estate, Banking, Securities, Construction, Steel, Chemicals, Agro-Forestry-Fisheries, Food, and Oil & Gas industries, while it decreased significantly in Retail and remained stable in Information Technology. All these sectors witnessed gains.

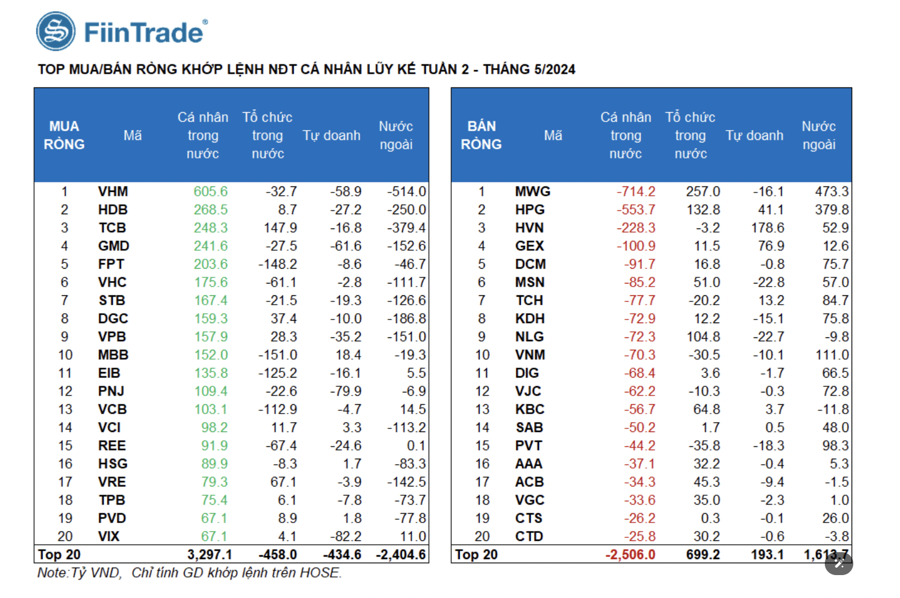

Foreign investors sold a net amount of VND 3,139.1 billion, and for matched orders alone, they sold a net amount of VND 1,147.5 billion. Their main net buying sectors for matched orders were Retail and Basic Resources. The top stocks bought by foreign investors on a net basis included MWG, HPG, VNM, PVT, TCH, KDH, DCM, VJC, and DIG.

This is the second consecutive week that foreign investors have net purchased MWG stock.

On the selling side, for matched orders, foreign investors offloaded stocks mainly in the Banking sector. The top stocks sold by foreign investors on a net basis included VHM, TCB, HDB, DGC, GMD, VRE, STB, VCI, and VHC.

Individual investors net bought VND 3,458.86 billion, including VND 1,415.6 billion in matched orders. For matched orders, they net bought in 10 out of 18 sectors, mainly in Banking. The top stocks accumulated by individual investors included VHM, HDB, TCB, GMD, FPT, VHC, STB, DGC, VPB, and MBB.

On the selling side, they net sold in 8 out of 18 sectors, mainly in Retail and Basic Resources. The top stocks sold by individual investors included MWG, HPG, HVN, GEX, DCM, MSN, KDH, NLG, and VNM.

Domestic institutional investors net bought VND 928.85 billion. However, for matched orders, they were net sellers at VND 88.6 billion. Analyzing their matched orders, domestic institutions net sold in 7 out of 18 sectors, with the highest value in Industrial Goods & Services. The top stocks sold by domestic institutions included MBB, FPT, EIB, VCB, NVL, REE, VHC, HAH, SSI, and BAF.

In terms of net buying, they focused on the Retail sector, with the top stocks being MWG, TCB, HPG, NLG, VRE, FUEVFVND, KBC, MSN, ACB, and DGC.

Proprietary trading accounts net sold VND 1,248.6 billion, and for matched orders, they net sold VND 179.5 billion. Looking at their matched orders, proprietary trading accounts net bought in 5 out of 18 sectors, with the strongest sectors being Tourism & Entertainment and Electricity, Oil & Gas. The top stocks bought by proprietary trading accounts included HVN, GEX, GAS, FUESSVFL, HPG, CTG, MBB, E1VFVN30, NVL, and TCH.

On the selling side, the top sector was Banking. The most sold stocks by proprietary trading accounts included VIX, PNJ, GMD, VHM, VPB, HDB, REE, PLX, MSN, and NLG.

Money flow trend: Looking at the weekly picture, the money flow allocation ratio declined in many large sectors (Real Estate, Banking, and Securities) while increasing in smaller sectors with supportive stories (including export-oriented sectors such as Steel, Seafood, Chemicals, and Textile & Garment).

The money flow allocation ratio improved from its bottom in Steel, Chemicals, Agro-Forestry-Fisheries, Food, Oil & Gas Equipment & Services, Water Transport, Textile & Garment, and Gasoline & Oil Distribution.

Sectors decreasing from their peak: The money flow allocation ratio decreased from its peak in Retail, Warehousing & Logistics, Information Technology, Personal Goods, Industrial Machinery, Electricity, and Telecommunications.

Sectors bottom-fishing: The money flow allocation ratio continued to decline in Real Estate, Banking, Securities, Electrical Equipment, and Building Materials.

Money flow strength: The money flow allocation ratio improved in the mid-cap VNMID and small-cap VNSML groups, while it weakened in the large-cap VN30 group.

During the 19th week of 2024, money flow concentrated in the mid-cap VNMID group, with a trading value ratio of 44.2%, up from 43% in week 18 and 41.4% in week 17. The money flow allocation ratio also improved in the small-cap VNSML group, reaching 9.1%, the highest in eight weeks.

In contrast, the large-cap VN30 group saw its ratio decline to 41% from 44.4% in week 18 and 45.1% in week 17.

Analyzing by market capitalization, the average trading value of matched orders increased in all three groups. The VNMID group led the way with a rise of VND 1,989 billion, or 29.5%, followed by VN30 with an increase of VND 1,142 billion (+16.4%), and VNSML with a gain of VND 735 billion (+69.4%).

In terms of price movements, the VNSML index recorded the strongest gain (+53.18 points or +3.82%). Meanwhile, the VN30 index rose by 1.74%, and VNMID increased by 2.73%.