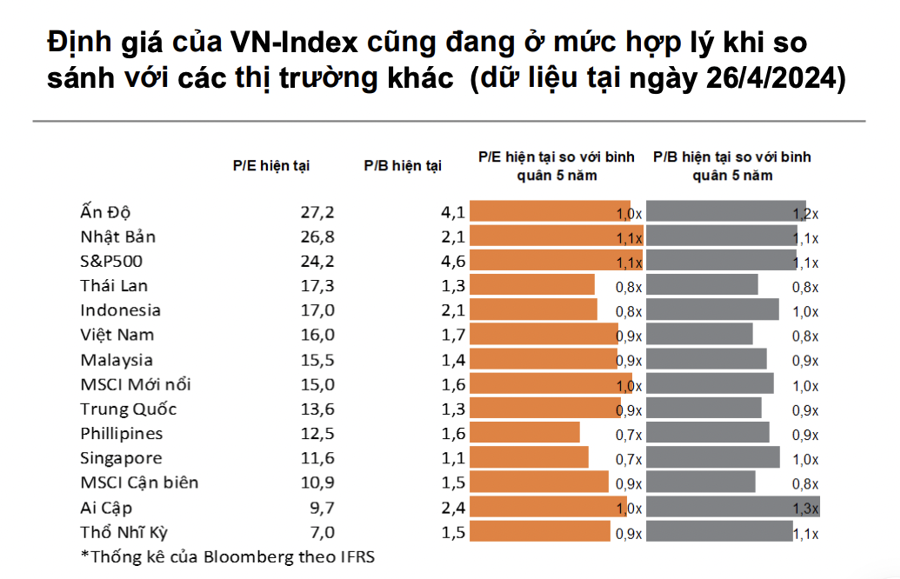

VnDirect predicts an improving business trend in 2024, which will strongly support the stock market. The projected P/E ratio for the VN-Index in 2024 is 11.9, considered reasonable compared to other emerging markets. There is an inverse relationship between the 10-year Government Bond Yield and the P/E ratio of the VN-Index. While the yield has slightly increased in recent weeks, it remains low and has not significantly affected the market valuation. With inflation expectations cooling down after the Fed’s May meeting, the upward trend in government bond yields is expected to slow down.

As of May 4, 2024, 955 listed companies, accounting for 95.3% of the market capitalization, have announced their Q1/24 financial results, with a net profit growth of 11.3%. The risk of a market downturn has eased as listed companies reported recovering business results, and the Fed’s “dovish” speech on monetary policy eased pressure on domestic exchange rates.

The scenario of VN-Index forming a second bottom lower than the first has been essentially ruled out. The market is expected to enter an accumulation phase with strong support around 1,170 (+/- 10 points) before forming a new uptrend. With the VN-Index recovering strongly from its lows, investors should prioritize risk management. Investors should maintain a safe stockholding ratio (<70% of the total portfolio) and avoid using leverage.

If the market corrects to support levels, it will provide an opportunity to buy and increase stock exposure. The market’s support levels are the psychological mark of 1,200 points and the strong support zone around 1,170 points. In the near term, investors should monitor the DXY index and US government bond yields.

VnDirect also updates its base scenario to reflect the changing macro context domestically and globally. The number of expected Fed rate cuts in 2024 has been adjusted to 1-2 times (previously 3) due to higher-than-expected US inflation data. The projection for Vietnam’s export growth in 2024 has been increased to 8-10% year-on-year. The research team maintains its projection of a 16-18% growth in profits for listed companies on the HOSE in 2024.

Therefore, the VN-Index is expected to reach 1,300-1,350 by the end of 2024, corresponding to a target P/E ratio of 14-14.2. Regarding foreign capital, after net selling VND 9.2 trillion (USD 366.3 million) in Q3/24, foreign investors reduced their net selling to VND 5.2 trillion (USD 202.8 billion) in Q4/24. Thus, from the beginning of the year, foreign investors have net sold VND 14.9 trillion (USD 581.1 million). The trading value ratio of foreign investors increased to 13.2% in Q4/24 from 7.9% in the previous month.

While domestic investors continued to sell, foreign investors reduced their net selling in April. In other words, foreign investors chose to “stay on the sidelines” as the market fell 6.1% in April. In the medium term, with the Fed preparing for a rate cut, the anticipated pivot will eventually weaken the DXY, which will positively impact capital inflows into emerging markets, including Vietnam.

In terms of sectors, Travel and Entertainment was the best-performing sector this month. While the P/E ratio remains high as the industry recovers from a low base, the P/B ratio indicates reasonable valuation. The Banking sector has experienced a strong upward trend in the past three months but saw a slight correction in April. The P/B ratio suggests reasonable valuation, along with a maintained high ROE.

Retail and Technology both had a positive month and have been showing robust investment performance since the beginning of the year. While Technology may seem a bit expensive based on the P/E ratio, it has delivered superior price growth over time.