The Ministry of Finance reports on the bond market: From the beginning of the year to April 19, 2024, there were 27 issuers with a volume of VND 36.9 thousand billion, down 43.4% over the same period last year.

Of which, real estate businesses accounted for an overwhelming 55.23% (VND 20.4 thousand billion) and credit institutions accounted for 27.5% (VND 10.1 thousand billion). The average interest rate of issuance was 9.51%/year and the average term of issuance was 4.31 years; 38.1% of the issued bonds are secured.

The volume of bonds repurchased before maturity was VND 29.2 thousand billion, down 26.6% over the same period last year.

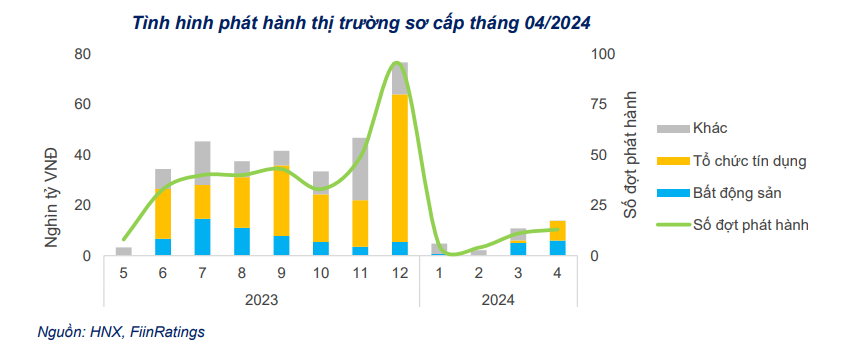

Analyzing in detail the issuance activities in April 2024, in the report just released by FiinRatings, the corporate bond market in April was more vibrant and the largest since the beginning of the year, with a total value of VND 13.9 thousand billion, up 29.1% over the previous month and equivalent to 5.2 times over the same period last year.

Notably, besides the real estate sector still dominating, banks also increased capital mobilization activities through bonds in the context of excess liquidity in the system. Banks also actively issued new bonds to compensate for the amount of bonds to be repurchased due in the following year, thereby restructuring medium and long-term capital sources to meet regulations.

Large-value bond issuances include: Vingroup issued 2 lots of bonds with a total value of VND 4,000 billion, with a term of 2 years and an interest rate of 12.5%. Vinhomes issued 1 lot of bonds worth VND 2,000 billion, with a term of 2 years and an interest rate of 12%. Techcombank issued 1 lot of bonds with a total value of VND 3,000 billion, with a term of 3 years and an interest rate of 3.7%. Vietnam Maritime Commercial Joint Stock Bank (MSB) issued 2 lots of bonds with a total value of VND 2,800 billion, with a term of 3 years and an interest rate of 3.9%. Military Commercial Joint Stock Bank (MB Bank) issued 6 lots of bonds with a total value of VND 2,000 billion, all with terms of over 5 years and interest rates ranging from 6.2% to 6.8%.

Although the pressure of bond maturities and fulfilling debt obligations after rescheduling or restructuring remains, businesses are still meeting their deadlines. As of May 2, 2024, the estimated value of corporate bonds maturing this year stands at VND 257,170 billion.

FiinRatings’ Market Update Report

Some businesses with plans to issue bonds in the coming time include HDBank and three real estate businesses, namely Vingroup, Vinhomes, and Investment and Development Corporation (DIG).

In the secondary market, according to the Ministry of Finance, transactions of 314 bond codes from 129 issuers have been made. The total trading value of the whole market reached nearly VND 506,300 billion, with an average trading value of VND 2,600 billion/session.

As of April 25, 2024, the number of bond codes registered for trading on the Hanoi Stock Exchange’s Enterprise Bond Information Disclosure Website was 1,018 codes from 283 enterprises, with a registered trading value of nearly VND 715,200 billion.

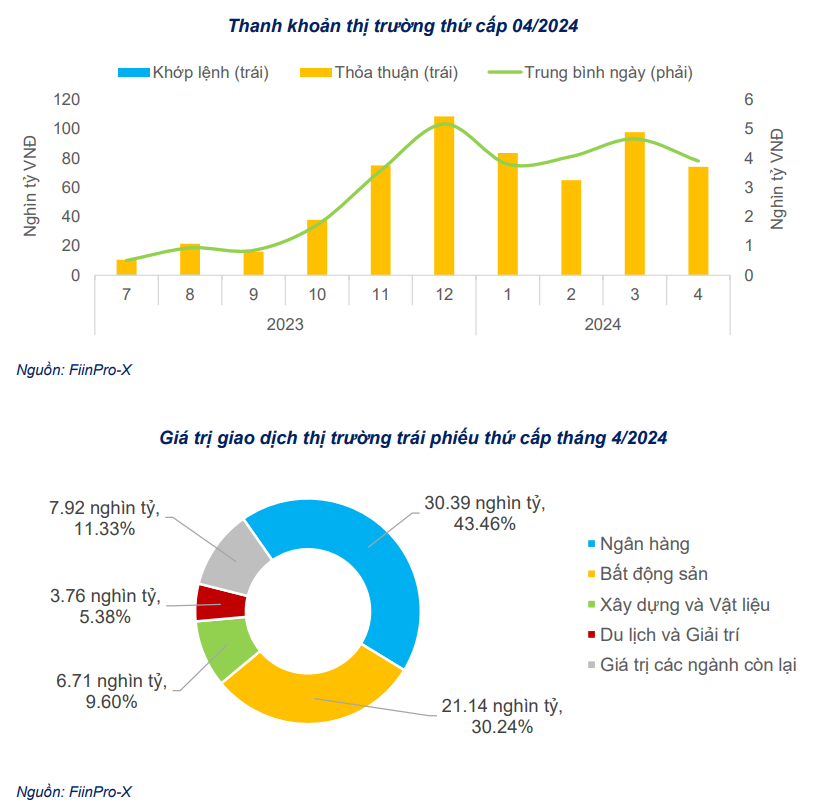

Analyzing transactions on the private placement bond trading floor in April 2024 in more detail, FiinRatings reported a total trading value of private placement bonds of more than VND 74,000 billion, down 24.2% compared to the previous month.

The trading volume through the matching method doubled that of March but still accounted for a small proportion of the market liquidity at only 0.37%. The average daily liquidity in April reached VND 3,900 billion, equivalent to 83.8% of the previous month.

The credit institution and real estate sectors still accounted for the majority of the trading volume this month, with respective proportions of 43.5% and 30.2%. Following the vibrant performance in March, the volume of bank bonds decreased by 42.3% this month, leading to a drop of over 12% in the transaction value of this sector.

In addition, other sectors also witnessed slight shifts in structure, with a 5.8% increase in the construction and materials sector and a 3.3% decrease in the tourism and entertainment sector.