The PYN Elite Fund has reported significant negative investment performance in the past month, with nearly half of its portfolio in bank stocks.

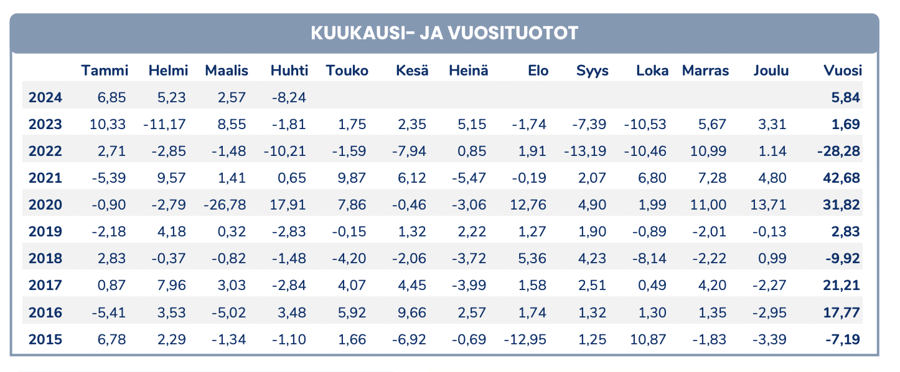

According to the fund, the VN-Index fell by 8.5% in the first half of April but subsequently recovered to a 5.8% loss. PYN Elite declined by 8.2% as the Vietnamese dong weakened and investors took profits on bank stocks.

The Vietnamese currency’s 2.1% depreciation against the US dollar heightened interest rate fears. However, the weakness of the dong, along with other currencies in the region, reflected the recent strength of the dollar. At the end of the month, deposit rates increased by 10-50 basis points, but rates remained low.

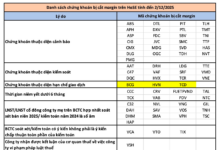

The fund’s top 10 stock holdings by weight are SCB, HDB, CTG, ACV, MBB, TPB, DNSE, SHS, VHC, and FPT, with bank stocks making up 47.4% of the portfolio.

The fund’s stock pick of the month is PLX, a 68-year-old company that leads in fuel distribution. While PLX owns only 28% of the country’s gas stations, it commands a 50% market share. Many of PLX’s 4,790 gas stations are located in urban centers. Although electric vehicles are gaining traction globally, their market share in Vietnam remains negligible, enhancing PLX’s growth prospects. With less than 5% of the population owning cars, there is significant room for growth in fuel demand as car ownership increases.

PLX’s profit surged by 73% year-over-year in Q1, and full-year profit is expected to rise by 36%. The government’s plans to adjust fuel prices will be a significant driver for PLX’s growth in the coming years.

On the macroeconomic front, the Purchasing Managers’ Index rose to 50.3 points in April due to a strong increase in pending orders. Retail sales grew by 9.0% year-over-year. With the return of Chinese tourists, tourist arrivals surged by 58.2% year-to-date compared to pre-COVID-19 levels.

Industrial direct investment realized from the beginning of the year increased by 7.4% year-over-year. In April, exports and imports rose by 10.6% and 19.9%, respectively, resulting in a record trade surplus of $8.6 billion. The government proposed extending the VAT reduction until December to promote more sustainable consumption growth.

In the final weeks of April, domestic investors engaged in profit-taking that seemed entirely disproportionate given the low-interest rates, ample liquidity in the banking system, and the expected earnings growth from listed companies this year.

“The factors for the upward trend remain clear. These quick corrections are unpleasant, but you have to ‘swallow them’ if you want to participate in the market,” emphasized Petri Deryng, head of the investment fund.

Previously, the head of the fund also attributed the negative performance to the strengthening of the US dollar, which had a detrimental effect on the currencies of other developing countries in Asia, including the Euro. The depreciation of the Vietnamese dong and political speculations in the country triggered a significant sell-off in the stock market during the first trading sessions of the week.

“However, the economic growth prospects and the growth of listed companies’ profits this year are excellent. The stock market is very attractively valued compared to profit growth. Vietnam’s interest rates have fallen, and the banking system’s liquidity is favorable. The significant fluctuations in the stock market are undesirable, but they do not change our positive expectations for the development of the Vietnamese index,” concluded the head of PYN Elite Fund.