At the seminar “Developing the Corporate Bond Market towards 2030: A Credit Rating Perspective” on May 17, experts assessed that the goal of increasing corporate bond debt to a minimum of 25% of GDP by 2030 is very challenging. The prerequisites and conditions for realizing this goal were also discussed.

Experts discuss at the seminar “Developing the Corporate Bond Market towards 2030: A Credit Rating Perspective” held in the afternoon of May 17

|

Challenging goal that needs prerequisites and necessary conditions to be realized

Commenting on the development and role of the corporate bond market (CBM) for the economy, Mr. Hoang Van Cuong, member of the National Assembly’s Finance and Budget Committee and Vice President of the Vietnam Economic Science Association, said that after the booming period of 2018-2021, peaking in 2022 with bond debt reaching 15-16% of GDP, Vietnam expected to have a financial market, not just a capital market that previously only included credit. However, after many problems occurred, the debt fell to around 11-12% of GDP in the past years and has not shown signs of increasing. New issuances are returning to help restructuring but not new investments.

Capital from CBM compared to the total capital mobilized by the economy is still low, indicating that enterprises have not accessed the capital market through bonds but still rely on banks, so the potential of the CBM is still very large.

There are also quality issues; within the low scale, CBM only focuses on the banking and real estate groups. However, the issuance of bonds by banks is not necessarily for investing in manufacturing enterprises, and the real estate group does not necessarily issue bonds to invest in new products but mostly for speculative purposes. Mr. Cuong emphasized: “The CBM has not clearly shown support for the recovery of production and business in general of the economy.”

Another issue is that the proportion of CBM issued with enterprises being assessed and rated accounts for a very small proportion compared to other markets in the region.

“Obviously, the numbers show that the goal of reaching a minimum of 25% by 2030 is very difficult to achieve, but there are still prospects in the context of enterprises entering the recovery phase, starting to have orders, but wanting to expand but facing difficulties in accessing capital sources, still having old debts, so they have to think about issuing bonds”, said Mr. Cuong.

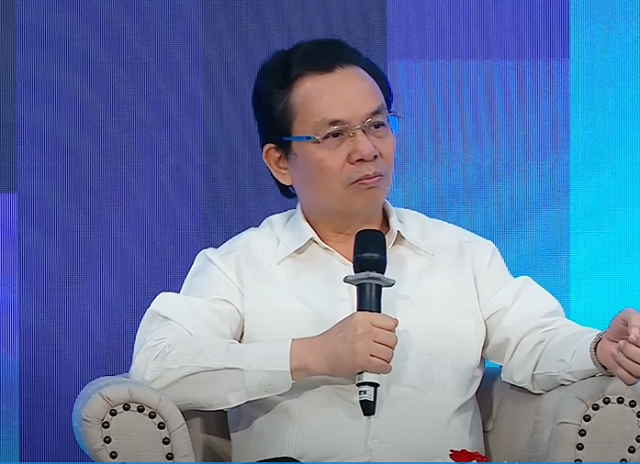

Mr. Hoang Van Cuong, Member of the National Assembly’s Finance and Budget Committee and Vice President of the Vietnam Economic Science Association, discusses at the seminar

|

Sharing the same view on this challenging goal, Mr. Tran Le Minh, General Director of VIS Rating, cited many notable figures.

Specifically, the scale of Vietnam’s CBM is not small, about 47 billion USD, higher than that of the Philippines and Indonesia, but significantly lower than Malaysia and Thailand. Looking at the goal of reaching 25% of GDP by 2030, it is a difficult goal. If Vietnam’s GDP grows at an average rate of 5.5-6% per year until 2030, the scale of CBM in 2030 must reach 160-170 billion USD, which means it has to increase 3.5 times in 8 years. At that time, the scale of Vietnam’s market will be equivalent to that of Malaysia, which means that the market scale must grow at an average rate of 17% per year, and the net issuance value must be 370 trillion VND per year. If so, the new issuance volume each year must be equivalent to that of 2020 – the peak year before the consecutive explosions of problems in the market.

To achieve this, Mr. Minh pointed out the need for a prerequisite, which is market transparency, and three necessary conditions, which include information on the risk level of the issuing organization and the bonds sold in the market; a reference system that is simple and popular enough for investors to know the trading price of the bonds; and finally, a change in the investor structure towards promoting institutional investors.

“If the first two conditions are met, the last condition will come by itself. At present, we are doing very well in terms of prerequisites and taking the first steps to meet the first two conditions”, emphasized Mr. Minh.

Mr. Tran Le Minh, General Director of VIS Rating, discusses at the seminar

|

No need for too many credit rating organizations

According to Mr. Minh, in markets with large CBM scales such as China, with about 7 trillion USD in outstanding bonds and 9 credit rating organizations, or South Korea, with about 1.5 trillion USD in outstanding bonds and 3 rating organizations, it can be seen that markets around the world do not need to have too many credit rating organizations.

In fact, the three most famous credit rating organizations in the market are Moody’s, Fitch, and S&P, with the two largest government organizations related to stock and bond activities located in the US and European markets. In these two markets, the above three organizations account for more than 90% of the total number of credit ratings.

Turning back to the Vietnamese market, there are currently about 740 enterprises with outstanding bonds. If complying with the current regulations on mandatory credit ratings, about 240 enterprises would have to be rated. However, in reality, the number of enterprises that need to be rated is much lower, as ratings are only required when issuing new bonds. In 2024, the total number of enterprises that need to be rated does not exceed 100, so with 4 organizations licensed to conduct credit ratings in Vietnam, this number is not large.

“As the market grows over time, the quality of the rating units will also grow accordingly”, said Mr. Minh.

According to Mr. Minh, there is not much difference in the level of credit ratings between markets. In the international market, Moody’s, Fitch, and S&P dominate, and even in markets like Thailand, Malaysia, India, the Philippines, and South Korea, successful domestic rating companies are essentially linked to these three large organizations.

There are three common points that any credit rating organization must have: first, compliance with the regulations of the management agency; second, a rating method that has been proven over time; and third, integrity in all activities. Therefore, the quality of service will be similar across markets. However, in reality, some large groups of customers will choose a certain group of rating organizations, while smaller rating organizations will serve smaller customers.