Source: SRF

|

Mr. Luan submitted his resignation as Deputy General Director of SRF on April 23, 2024, with his last working day being May 31, 2024.

In his resignation letter, Mr. Luan stated that after much thought and consideration, he decided to branch out and seek new challenges that better align with his personal direction.

Notably, Mr. Luan was appointed to the position of Deputy General Director of SRF on October 1, 2023. According to SRF’s financial statements for Q4 2023 and Q1 2024, his total salary during the period from October 1, 2023, to March 31, 2024, amounted to more than VND 385 million, averaging over VND 64 million per month.

According to information disclosed by SRF, Mr. Luan was in charge of Investment and Business Development, encompassing activities such as investment, mergers and acquisitions (M&A); seeking new business opportunities; participating in capital-related activities; and supporting SRF’s bidding processes.

Mr. Luan holds a Ph.D. in Civil Engineering from the University of Queensland, Australia; a Master’s degree in Construction Mechanics from the University of Liège, Belgium; and a Bachelor’s degree in Business Administration from the University of Economics Ho Chi Minh City.

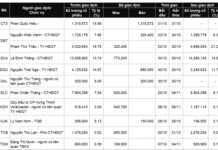

From March 15-19, 2024, Mr. Luan purchased 50,000 SRF shares (0.14%) with an estimated value of VND 475 million. However, less than ten days later, from March 28 to April 19, he sold all these shares, earning an estimated VND 495 million and making a profit of nearly VND 20 million.

Mr. Luan’s move comes amid SRF’s lackluster financial performance in Q1 2024, with net profit declining by 65% year-on-year to just over VND 500 million. This was mainly due to a decrease in gross profit margin, which led to a 17% drop in gross profit despite a 6% growth in revenue. Additionally, a 26% increase in management expenses further eroded the gross profit.

Moreover, SRF’s stock was shifted from the warning status to the controlled status by the Ho Chi Minh City Stock Exchange (HOSE) on May 14, 2024, as the company delayed the submission of its 2023 audited financial statements beyond the 30-day deadline.

SRF has provided explanations to HOSE regarding the reasons for the delay, along with measures and improvements. The company has finalized the list of shareholders to obtain their approval for changing the independent auditing firm for the 2023 financial statements.

As the audited financial statements require additional time for completion, SRF’s Board of Directors announced that the 2024 Annual General Meeting of Shareholders, initially planned for April 11, will be postponed to June. The record date for this meeting remains March 12, 2024.

Net profit of VND 500 million, stock under control, what’s happening at Searefico?