The dividend ratio corresponds to the plan approved at the 2024 Annual General Meeting of Shareholders. With nearly 42 million shares currently in circulation, EVE is estimated to spend approximately VND 21 billion on dividends, sourced from 2023 post-tax profits and undistributed post-tax profits.

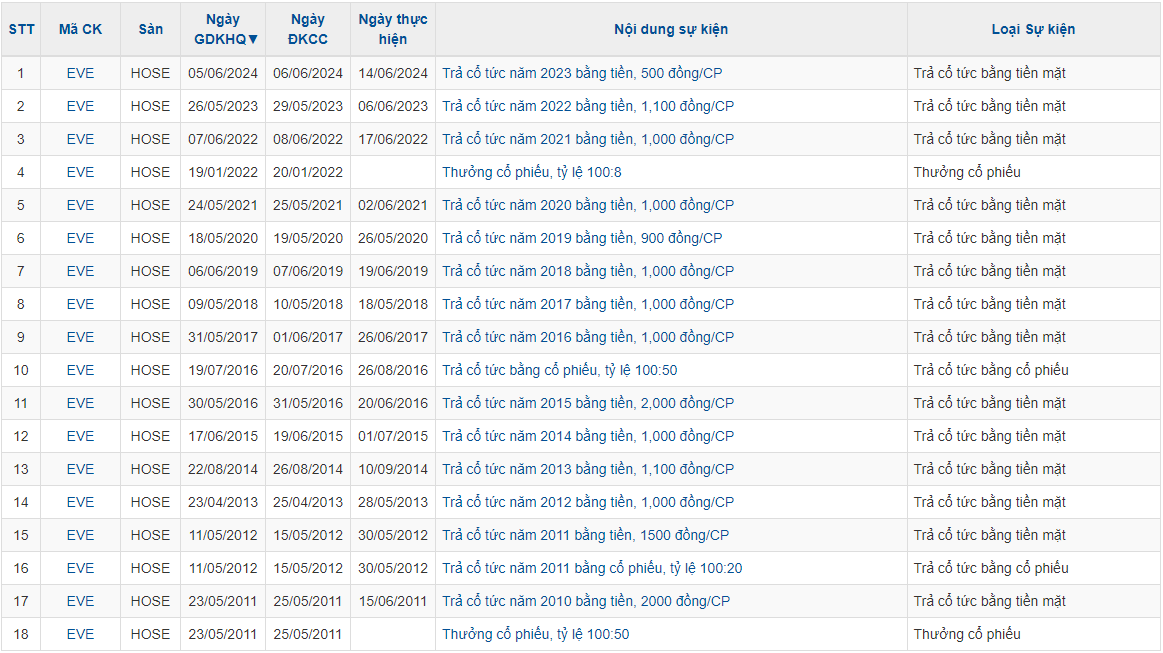

Overall, this dividend ratio is not particularly high when compared to EVE’s historical performance, as it typically offers dividends of VND 1,000 per share and above.

|

EVE’s Dividend History Over the Years

Source: VietstockFinance

|

Everpia’s origin can be traced back to the establishment of Viko Moolsan Co., Ltd., a South Korean company specializing in the manufacturing and trading of cotton pads, in 1993. It initially served as a supplier of raw materials to export-oriented garment companies. In 1995, the company expanded its product range to include bedding, and by 1999, the Everon brand was officially introduced to the market.

On September 4, 2003, Everpia Vietnam Joint Stock Company was established as an independent entity. Its primary business activities included the manufacturing and trading of cotton pads and bedding, with a focus on the Northern market in its initial years. The company later expanded its presence to the Southern market in October 2005.

In June 2007, the company transformed into a joint-stock company with a charter capital of VND 48 billion. In 2015, it changed its name to Everpia Corporation as it is known today. Through multiple capital increases, Everpia’s charter capital reached nearly VND 420 billion by the end of the first quarter of 2024.

Over nearly 30 years of operation, Everpia has established three manufacturing facilities in Hanoi, Hung Yen, and Dong Nai, specializing in the production and distribution of bedding, cotton pads, towels and wipes, curtains, furniture, and other products.

In recent quarters, EVE’s business performance has shown a declining trend, with net profits not exceeding VND 7 billion per quarter since the first quarter of 2023. Notably, in the first quarter of 2024, EVE recorded a net profit of just over VND 1 billion. The company’s highest net profit since its listing was VND 57 billion in the fourth quarter of 2010.

| EVE’s Recent Business Performance |

EVE’s shares were officially listed on the Ho Chi Minh Stock Exchange (HOSE) in December 2010, reaching a high of VND 24,730 per share in June 2016. As of the market close on May 17, 2024, EVE’s share price stood at VND 14,150, reflecting a 6.6% decline since the beginning of the year. The average trading volume was nearly 95,000 shares per day.

| EVE’s Stock Performance Since Listing on HOSE in December 2010 |

Huy Khai