In Directive No. 14/CT-TTg dated May 2, 2024, on the deployment of monetary policy tasks for 2024, Prime Minister Pham Minh Chinh requested the State Bank of Vietnam (SBV) to instruct credit institutions to reduce costs and strive to lower lending interest rates to a reasonable level. At the same time, seriously implement the public disclosure of average lending interest rates to facilitate enterprises and people in choosing a bank with low lending rates that suit their capital credit needs.

Actively deploy credit growth solutions, orient credit to production, business, priority fields, and growth drivers; closely control credit to potential risk areas, ensure safety and effectiveness, and control liquidity risks.

Earlier, in Official Dispatch No. 32/CĐ-TTg dated April 5, 2024, the Prime Minister also requested the SBV to direct credit institutions to publicly announce lending interest rates and deploy credit packages before April 10, 2024.

After the Prime Minister’s Official Dispatch, banks also started to publicly list their average lending interest rates.

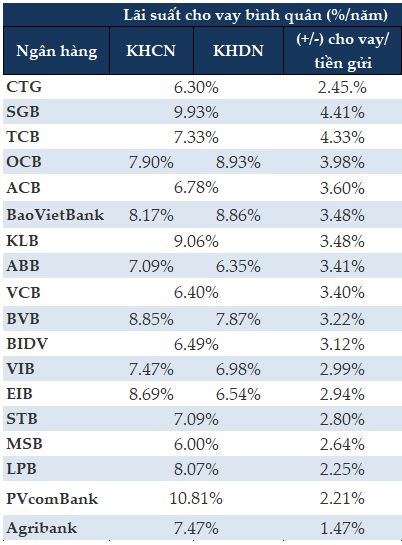

|

Average lending interest rates at banks

Bank announcements as of April 2024

|

In the group of state-owned banks, VietinBank (CTG) announced an average lending rate of 6.3%/year. The difference between lending and deposit interest rates is 2.45%/year.

At Agribank, the published average lending rate is 7.47%/year, with a difference of 1.47%/year between deposit and lending rates. BIDV (BID) has an average lending rate of 6.49%/year, with an average difference of 3.12%/year between deposit and lending rates.

Vietcombank (VCB) has an average lending rate of 6.4%/year, with a difference of 3.4%/year between deposit and lending rates. Vietcombank stated that the difference in interest rates, after deducting related costs of capital mobilization and utilization activities, is 1.8%/year.

In the group of private banks, Techcombank (TCB) applied an average lending rate of 7.33%/year, with an average difference of 4.33%/year between lending and deposit rates. Sacombank (STB) publicly announced an average lending rate of 7.09%/year, with an average difference of only 2.8%/year. At MSB, the average lending rate is 6%/year, with an average difference of 2.64%/year.

Some banks publicly announced the average lending interest rates applicable to specific customer segments. For example, at OCB, the average lending rate for individual customers is 7.9%/year, and for corporate customers, it is 8.93%/year. The difference between lending and deposit rates is 3.98%/year.

VIB applies an average lending rate of 7.47%/year for individual customers and 6.98%/year for corporate customers, with an average difference of 2.99%/year between deposit and lending rates.

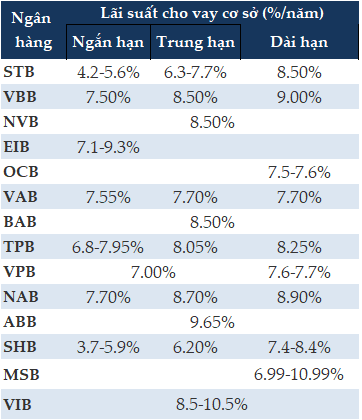

Some banks announced their base lending rates instead of average rates.

OCB’s base lending rate remains unchanged from March. The bank offers a base lending rate of 7.5%/year for a 12-month term and 7.6%/year for a 13-month term, applicable to loans with a term of 6 months or more. The floating lending rate is adjusted periodically every 6 months.

VietBank (VBB) provides more specific details for each term, with a reference rate of 7.5%/year for loans under 6 months and 8.5%/year for loans between 6 and 12 months. The medium and long-term lending rate for terms exceeding 12 months is 9%/year.

The latest base lending rate for short-term loans at Nam A Bank (NAB) is 7.7%/year, while the medium and long-term rates are 8.7%/year and 8.9%/year, respectively. Nam A Bank also applies this interest rate schedule to loans granted before April 5.

ABBank (ABB) has maintained a base lending rate of 9.65%/year for individual customers since February 2024.

At SHB, the base lending rate has remained unchanged since the end of February. The base lending rate for individual and corporate customers with a term of 6-12 months is 6.2%/year, 12-36 months is 7.4%/year, 36-60 months is 8.1%/year, and over 60 months is 8.4%/year.

Since the end of March, VPBank (VPB) has maintained a reference rate for unsecured personal loans with a term of less than 12 months at 7%/year, 12-36 months at 7.6%/year, and 36-60 months at 7.7%/year.

At MSB, the lending rate for a term of 12-24 months is 10.99%/year (fixed for the first 12 months), 24-36 months is 6.99%/year (fixed for the first 6 months), 36-48 months is 7.99%/year (fixed for the first 12 months), and over 48 months (fixed for the first 24 months) is 9.15%/year.

VIB has maintained its base lending rate since March 2024. For loans disbursed in 2024, the lending rate for real estate purchases is 8.5%/year, and for car purchases, it is 9%/year. The lending rate for business loans ranges from 8.5-9.5%/year, while the rate for consumption loans with collateral is 10.5%/year.

At Sacombank, the base lending rate is applied to different terms, ranging from 4.2-7.7%/year for loans with a term of 6-12 months and 8.5%/year for loans over 12 months.

|

Base lending rates at some banks

Bank announcements as of April 2024

|

Dr. Dinh Trong Thinh, an economic expert, assessed that the average lending interest rates announced by banks are still relatively high compared to deposit rates. However, this is understandable. In addition to the deposit rates, banks have other related expenses, which results in the calculated lending rates.

Typically, in Southeast Asian countries, the difference between deposit and lending rates is around 2%. For example, with a deposit rate of about 5%/year, the minimum lending rate would be around 6.5-7%/year. In Vietnamese banks, this difference could be higher due to the capital mobilization costs, which often include additional rates or promotions for large depositors, pushing up the cost of capital mobilization. Theoretically, there should be a gap between deposit and lending rates.

The Prime Minister has requested banks to reduce costs to lower lending rates and support businesses. However, in reality, commercial banks have already cut costs significantly and even reduced staff.

“Although the lending rates announced by banks are still considered high by businesses, a certain level of interest rates is necessary to maintain the trust of depositors and shareholders. Because banking is a business based on trust and reputation,” added Dr. Thinh.

In other news, since the beginning of April, banks have started to increase deposit interest rates for long-term deposits, with a slight increase. As of May 2024, savings deposit rates for terms of 1-3 months are maintained between 1.6-3.4%/year, 6-9 months at 2.9-4.8%/year, and 12 months ranging from 4.8-5.1%/year.

Will increasing interest rates be a long-term trend?