Strong buying demand for large-cap stocks helped the market maintain its upward momentum, with the VN-Index closing 11 points higher at around 1,254. Trading liquidity also surged compared to the previous session, with matching value on the HOSE reaching over VND19 trillion.

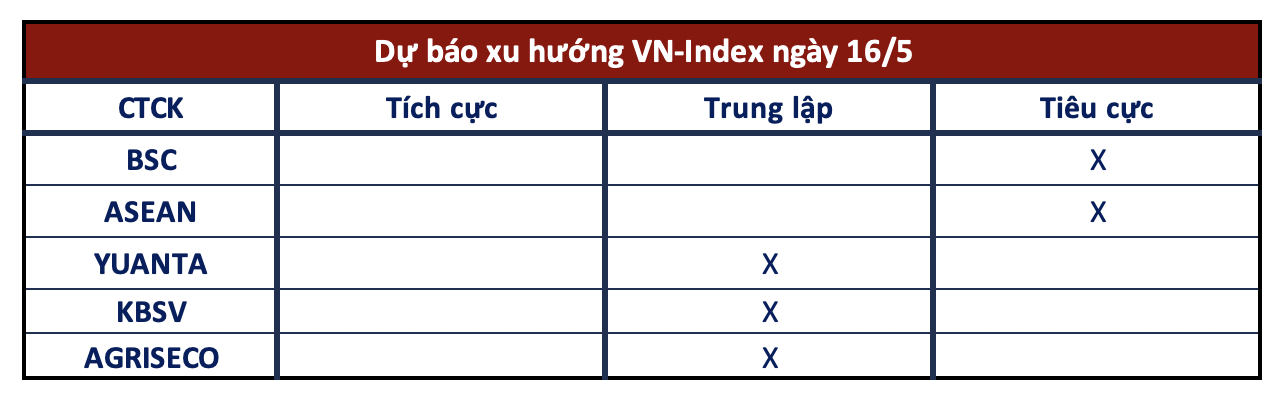

Looking ahead to the next trading session, most securities companies expect the VN-Index to face profit-taking pressure during the futures contract expiration.

Profit-Taking Likely in Futures Contract Expiration

BSC Securities

In the upcoming sessions, the VN-Index may continue to experience volatility as it approaches the resistance level of 1,260. Investors should pay attention to the VN30 futures contract expiration on the next day.

Asean Securities

The VN-Index closed the trading session without breaking above the resistance level of 1,259, and the sharp increase in market liquidity indicates that investors are exhibiting “FOMO” buying behavior. Therefore, Asean Securities maintains the view that the market will undergo a corrective phase this week, and investors should use this opportunity to restructure their portfolios.

Yuanta Securities

The market may witness a corrective phase at the beginning of the next trading session, with the VN30-Index likely to retest the new support level of 1,285. At the same time, Yuanta expects the market to resume its upward trajectory in the following session, with improved trading liquidity and a more balanced distribution of funds across stock groups. Additionally, the short-term sentiment indicator suggests that investors are more optimistic about the current market situation.

Avoid Chasing Prices during Early Recovery

KBSV Securities

Despite the improved liquidity accompanying the recent uptrend, which presents an opportunity for the VN-Index to break through resistance, the risk of corrective pressure remains. It is likely that the recovery potential will become more apparent when the index pulls back to around the support level of 1,220 (+-5). Investors are advised to refrain from chasing prices during early recovery phases. Instead, they can consider placing small trading orders as the index retreats to the nearby support level of 1,220 (+-5).

Agriseco Securities

According to Agriseco Research, the VN-Index will likely experience another period of volatility to confirm its ability to break through the MA50-day level, equivalent to 1,250 points. In the event of a successful breakthrough, the index is expected to target the range of 1,270-1,280 points. As the short-term uptrend is still intact, Agriseco recommends that investors hold on to their existing trading positions.