|

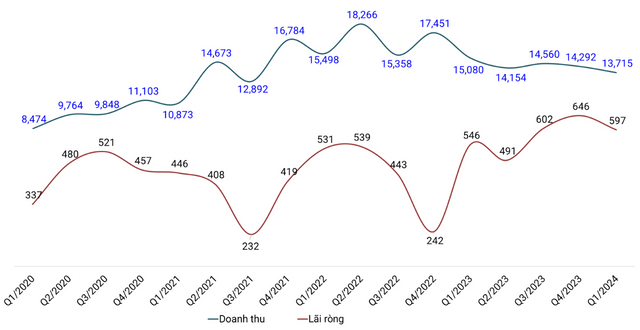

Revenue and net income of the plastic industry by quarter from 2020 until now (Unit: billion VND)

Source: VietstockFinance

|

The consumption of Vietnam’s plastic industry mostly comes from the demand for construction materials and consumer goods such as plastic pipes and packaging. The difficulties in the real estate market and the tightening of spending in the past have caused a noticeable decline in the revenue of the plastic industry – a continuous decrease since the fourth quarter of 2022, currently at its lowest since the third quarter of 2021.

However, the industry’s net profit did not follow this trend. The first-quarter net profit of 2024 reached one of the highest points in many years. The gross profit margin for the first quarter of 2024 was about 15.2%, down from 16.7% in the last quarter of 2023, but still the highest since the third quarter of 2020. In the same period in 2023, this ratio was only 13.9%.

As of May 11, statistics from VietstockFinance show that 28 plastic companies announced their first-quarter business results in 2024, with most results being positive compared to the previous year. Among them, more than half reported increased profits (16 enterprises), 2 companies turned losses into profits, and 3 companies reduced losses. On the contrary, 6 companies reported decreased profits, and 1 company turned profits into losses.

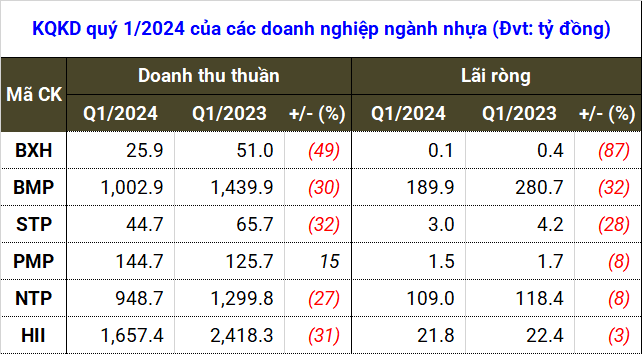

Revenue of the leading plastic companies decreased simultaneously

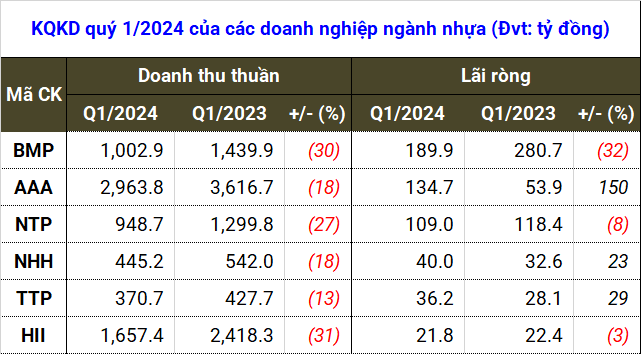

The six profitable companies, including BMP, AAA, NTP, NHH, TTP, and HII, accounted for nearly 54% of the industry’s revenue and 89% of its net income. The common point of this group is that their revenue decreased simultaneously.

|

Revenue and net income of the leading profitable companies

Source: VietstockFinance

|

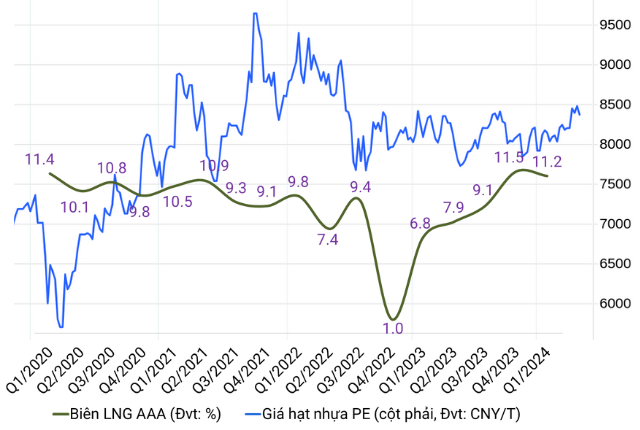

One of the largest companies in plastic trading, Nhựa An Phát Xanh (HOSE: AAA), made a profit of 135 billion VND in the first quarter, up 150% compared to the same period last year and the highest since 2019. The gross profit margin remained above 11% thanks to the stability of the raw material, PE plastic pellets.

Similarly, the price of PP plastic pellets – the material with the largest proportion of Nhựa Hà Nội (HOSE: NHH) – is also at a low level compared to the period of 1-2 years ago, helping the gross profit margin to be high, at nearly 20%. Thanks to this, NHH’s net profit increased by 23%, to 40 billion VND, despite a decrease of 18% in revenue.

|

Movement of PE plastic pellet prices and AAA’s gross profit margin from 2020 until now (Unit: %)

Source: Author’s compilation

|

In the same plastic industry, the construction plastic segment suffered more losses during this period. For example, the revenue and net income of Nhựa Bình Minh (HOSE: BMP) fell by more than 30% in the first quarter of 2024, reaching only 1,000 billion VND and 190 billion VND, partly due to the high base of the previous year.

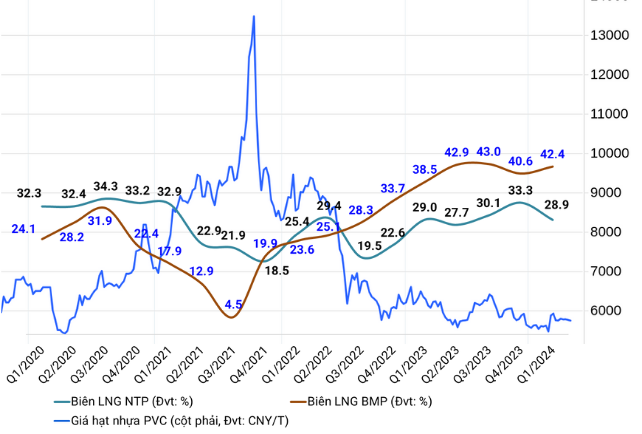

However, the gross profit margin of this plastic pipe manufacturing enterprise remained positive at 42.4%, thanks to the low price of PVC plastic pellets. BMP’s leaders predicted that the PVC market in the second half of the year is likely to continue as in the first quarter, with prices fluctuating slightly but remaining stable.

A well-known plastic pipe brand in the northern market, Nhựa Thiếu niên Tiền Phong (HNX: NTP), did not perform better. Its revenue and net income both decreased by 27% and 8%, respectively, reaching 949 billion VND and 109 billion VND.

The fierce competition among companies in the packaging field and the decline in selling prices caused a 13% decrease in revenue for Bao bì Tân Tiến (UPCoM: TTP), to 370 billion VND. However, by cutting production costs and controlling expenses, the company still made a profit of 36 billion VND, an increase of 30%. TTP’s gross profit margin reached 14.4%, an improvement from 12.7% a year earlier.

|

Movement of PVC plastic pellet prices and gross profit margin of BMP and NTP from 2020 until now (Unit: %)

Source: Author’s compilation

|

Unchanged revenue, doubled profit

If we consider only the 20 enterprises with improved results, the revenue of this group remained unchanged, while their profit doubled. VTZ, TPP, TDP, and DNP achieved growth in both revenue and profits.

According to Sản xuất và Thương mại Nhựa Việt Thành (HNX: VTZ), revenue increased by 43%, reaching 902 billion VND, thanks to the expansion and diversification of sales channels. This consumer plastics business also earned a net income of 16 billion VND, up 60%, the highest since 2020.

Tân Phú Việt Nam (HNX: TPP) attributed the 38% and 67% increases in revenue and net income, respectively, to 695 billion VND and 3.3 billion VND, to the more favorable market conditions compared to 2023.

The revenue of Thuận Đức (HOSE: TDP) benefited from the strong recovery of the export market in the early months of this year, with a 40% increase. Its profit was less affected by interest expenses, reaching nearly 18 billion VND, up 70%.

In the group that turned losses into profits, such as VNP and TPC, or reduced losses, such as DPC and DAG, the main reason was the streamlining of production activities and cost-cutting. VNP reported a profit thanks to the reversal of provisions for inventory devaluation.

For the group with decreasing profits, in addition to BMP and NTP mentioned above, Công nghiệp Thương mại Sông Đà (HNX: STP) experienced a decrease of around 30% in both revenue and net income, partly due to the decrease in the consumption of various types of casings. Meanwhile, An Tiến Industries (HOSE: HII) recorded a slight decrease of 3% in net income, to 22 billion VND, as there was no longer a high dividend payout as in the previous year.

Only Văn hóa Tân Bình (HNX: ALT) reported a loss of 3.3 billion VND, compared to a profit of 2.2 billion VND in the same period last year, due to a significant decrease in revenue from the service and entertainment segments.

|

Revenue and net income of companies with decreased profits compared to the same period

Source: VietstockFinance

|

Low-interest rates are an important driver

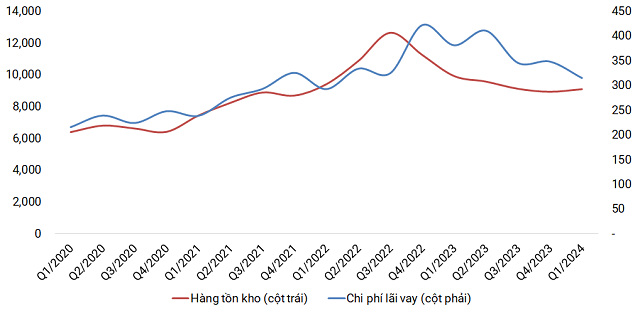

The positive impact on the plastic industry’s profit in the first quarter of 2024 was not only due to stable raw material prices but also thanks to low-interest expenses. This is understandable, given the continuous decrease in market interest rates over the past year.

The plastic industry spent 315 billion VND on interest expenses, a decrease of 17% compared to the same period and a reduction of 25% from the peak in the fourth quarter of 2022. Some companies that spent a significant amount on interest expenses include DNP, TDP, AAA, RDP, and TPP. In contrast, BMP remains committed to its business model of allocating only a few million VND for interest expenses each quarter.

As of the end of the first quarter of 2024, the plastic industry’s inventory was about 9 trillion VND, a release of about 10% compared to the same period last year. However, compared to the peak in the third quarter of 2022, when the market faced many difficulties, especially in real estate and construction, inventory has decreased by nearly 30%.

According to the Vietnam Plastics Association (VPAS), there is very little possibility of a decrease in plastic pellet prices in May due to the narrow profit margin of manufacturers. Therefore, there may not be room for further price increases.

|

Interest expenses and inventory of the plastic industry from 2020 until now (Unit: billion VND)

Source: VietstockFinance

|