Long-Term Potential Driven by the New Wave of FDI

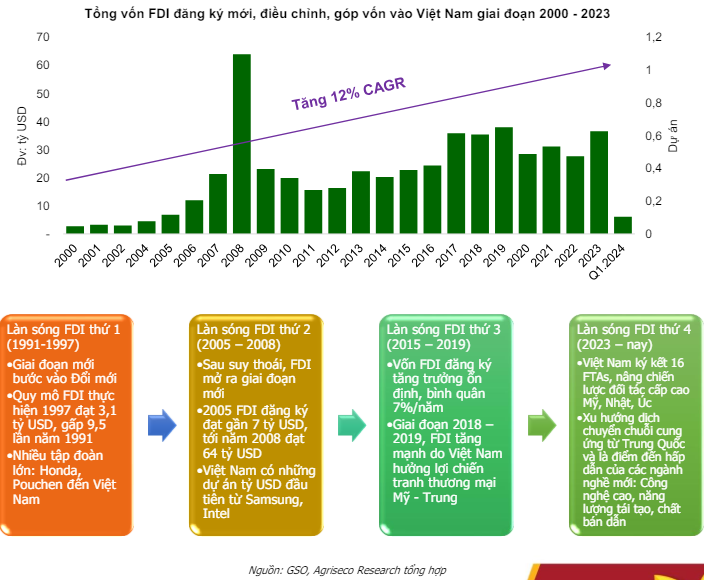

In a recent report, Agriseco Securities suggests that foreign direct investment (FDI) in Vietnam is on an upward trajectory. According to the Ministry of Planning and Investment, total FDI in the first quarter of 2024 reached $6.17 billion, a 13% increase compared to 2022. Notably, newly registered FDI surged by 58% year-on-year to $4.77 billion, while realized FDI stood at $4.63 billion, the highest level in the past five years.

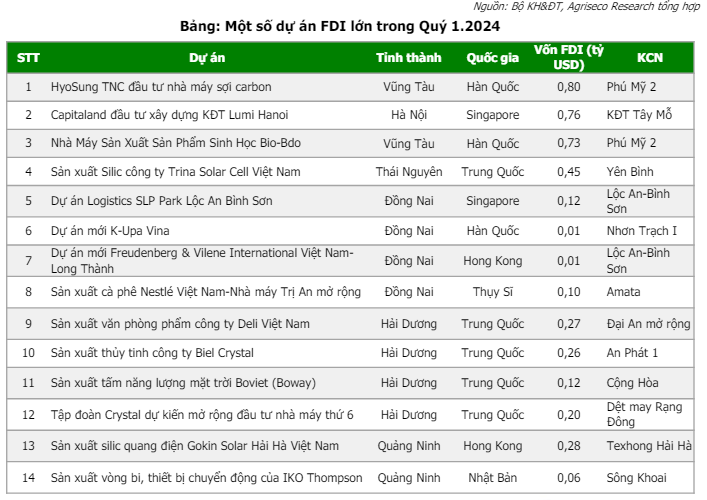

Industrial parks and economic zones continue to attract foreign investors with high-quality projects in the fields of electronics manufacturing, electronic components, and chips. Notable FDI projects in the first quarter include Hyosung’s carbon fiber plant, Trina Solar Cell’s silicon production project, and Gokin Solar’s photovoltaic silicon production project.

Agriseco believes that new FDI inflows into industrial parks are expected to continue their positive growth trajectory, driven by the recovery of capital flows from traditional partners such as South Korea and Singapore, thanks to improved economic growth forecasts for 2024. Additionally, the trend of capital shifting from China to neighboring countries remains intact.

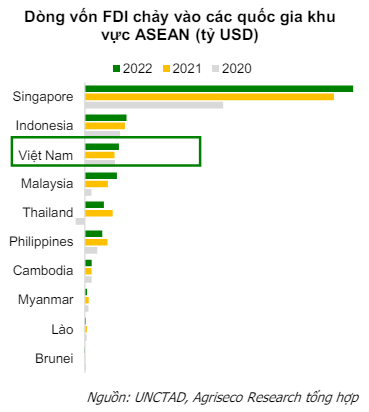

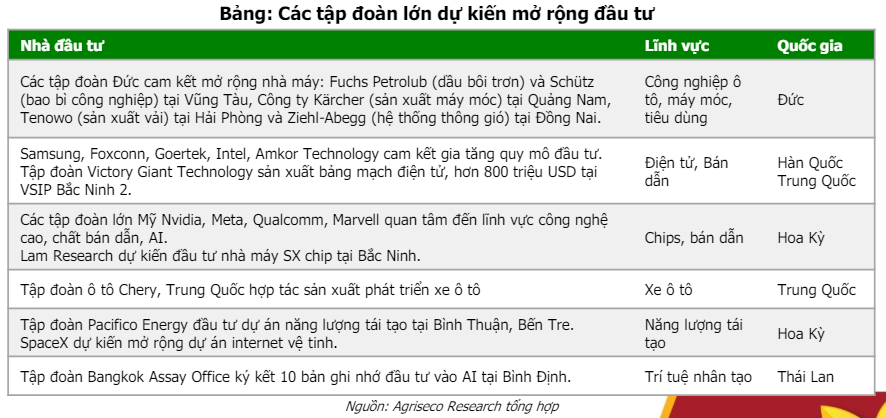

Notably, the new wave of FDI, encompassing high-tech, electric vehicles, renewable energy, and semiconductors, is emerging as a global trend, and Vietnam is well-positioned to benefit from this shift. The country’s participation in 16 free trade agreements, enhanced comprehensive strategic partnerships with the US, Japan, Australia, and South Korea, as well as its commitment to net-zero emissions and attractive policies for new industries, make it a desirable destination for investors. Vietnam has consistently ranked third in attracting FDI within the ASEAN bloc in recent years.

In recent times, several large corporations have either expanded their investments or committed to doing so in Vietnam. Traditional partners such as Samsung, LG, Foxconn, and Amkor plan to expand their manufacturing operations in the country, focusing on semiconductors, AI, and electronics. US giants Intel and Nvidia have also pledged investments in AI and semiconductors.

The first quarter of 2024 witnessed a significant increase in new FDI projects, investment commitments, and expansion plans. There has been a growing demand for leasing in secondary provinces such as Vinh Phuc, Ha Nam, Quang Ninh, Bac Giang, Tay Ninh, and Vung Tau, attributed to lower land rental costs and improved infrastructure development. The northern region is expected to attract more tenants from China in the industrial manufacturing sector (semiconductors and electronics), while the southern region primarily focuses on production, exports, and consumption.

Additionally, supportive policies implemented in recent years have contributed to a stable and transparent investment environment, enhancing Vietnam’s competitive position. The development of social housing and worker accommodation also lays the foundation for sustainable industrial park growth.

The industrial real estate sector stands to benefit from accelerated public investment in infrastructure development. Completed public investment projects foster sustainable linkages between regions, thereby positively impacting industrial parks. Consequently, infrastructure development will attract more investment to the provinces, leading to increased demand for industrial land leases.

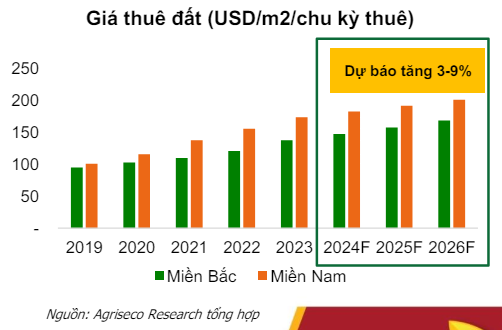

Rental rates for industrial land are expected to maintain their upward trajectory due to strong demand. Currently, rental rates in Vietnam are 15-20% lower than in regional countries like Indonesia and Malaysia, making it an attractive investment destination.

Numerous Industrial Real Estate Enterprises Anticipate Benefits

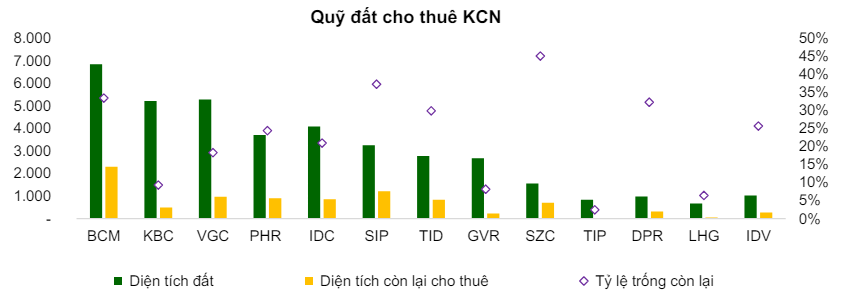

Based on the aforementioned factors, Agriseco anticipates a promising outlook for the industrial real estate sector in 2024. Rubber companies with large land banks transitioning into industrial parks are expected to reap long-term benefits as expedited compensation and land conversion processes are implemented. Several rubber companies with substantial land assets have already embarked on this transformation, including GVR, PHR, and DPR.

The financial performance of industrial real estate enterprises in 2024 is forecast to continue its growth trajectory, albeit with distinct differentiations. Prospects appear brighter for companies with substantial land banks available for lease, pre-signed memorandums of understanding, or land assets in secondary provinces. Rental rates are projected to increase by 3-9% in provinces with favorable locations and infrastructure development, such as Bac Ninh, Hai Phong, Vung Tau, and Dong Nai.

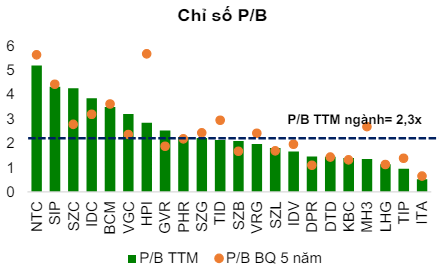

Industrial real estate enterprises are currently trading at a P/E ratio of 16.1x and a P/B ratio of 2.3x, lower than the five-year average. Overall, the sector’s valuation remains attractive compared to the growth potential of individual companies and the industrial real estate market as a whole in the coming years.

Agriseco suggests investors consider the following criteria: (1) Enterprises with substantial land banks available for lease in potential areas, (2) Reasonable P/B and P/E ratios compared to industry averages, (3) High unearned revenue or positive business transformations, and (4) Promising business plans for 2024. Based on these criteria, KBC, IDC, and SZC are identified as prospective enterprises.