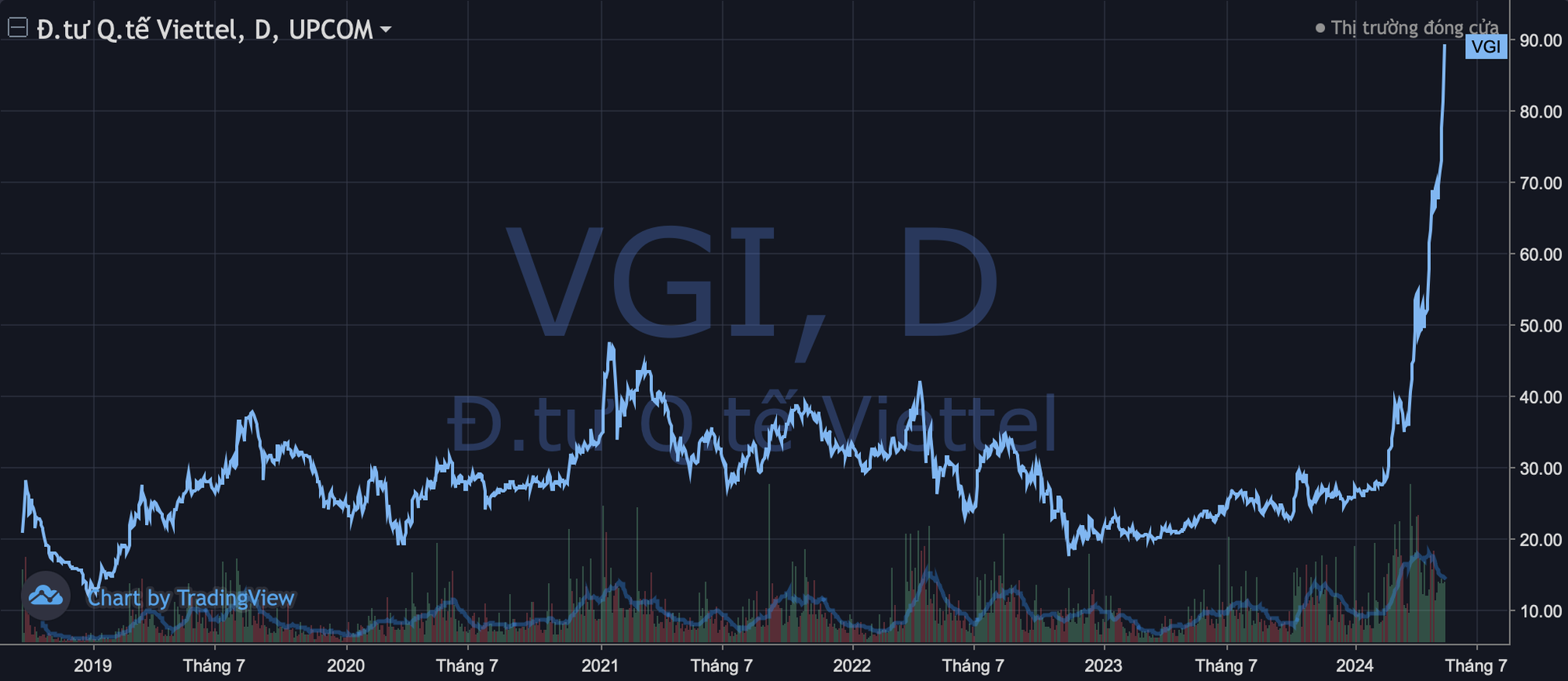

In the midst of the telecom and tech stock fever on the Vietnamese stock market, **Viettel Global (VGI)** has been the center of attention with its scorching hot streak to record highs. Within just 3 months, VGI’s share price tripled to 89,000 VND/share. Market capitalization also surged to nearly 271,000 billion VND (over $11 billion), an increase of 192,400 billion VND (approximately $7.9 billion) since the beginning of 2024.

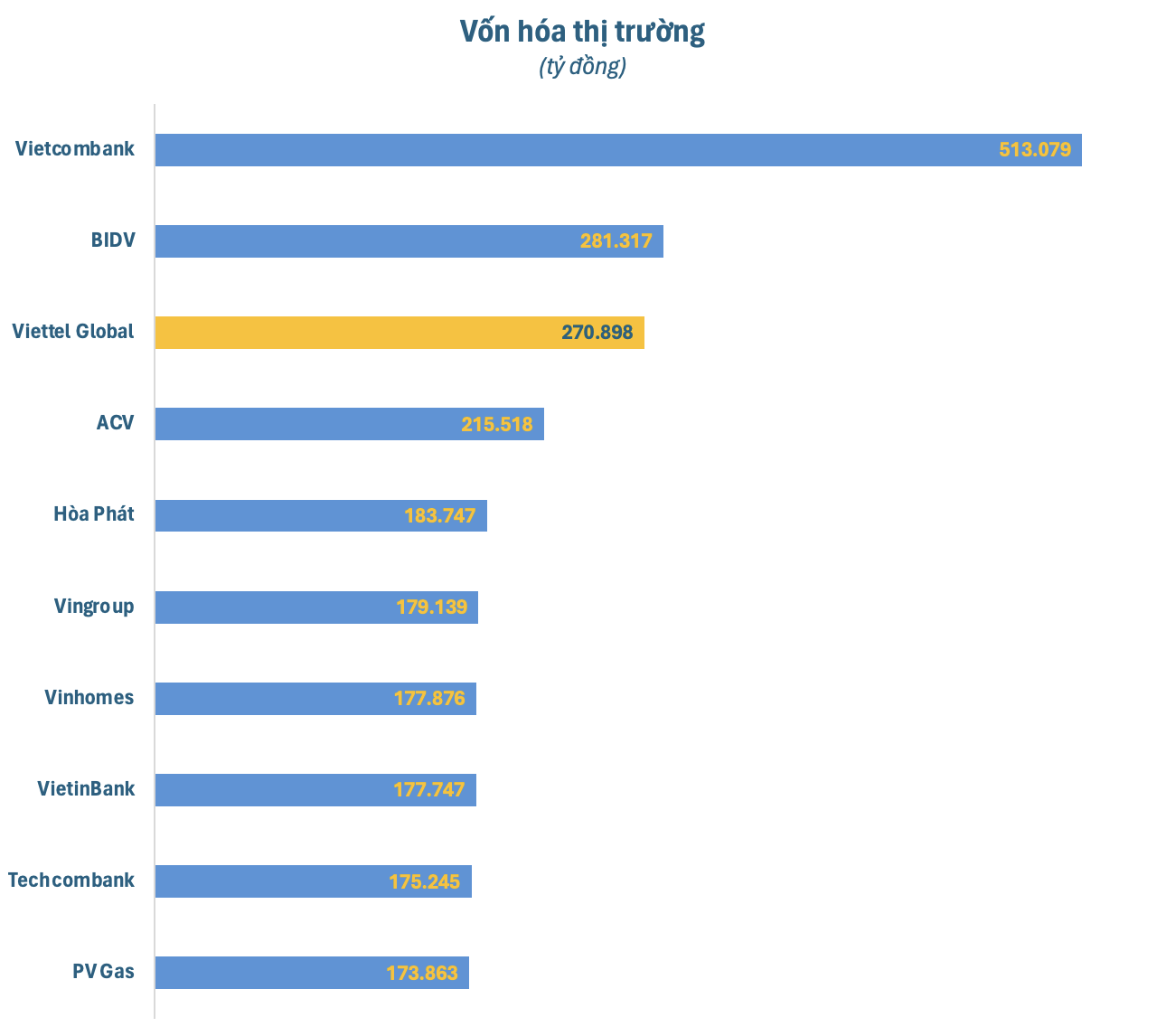

With a market capitalization of over $11 billion, Viettel Global surpassed numerous prominent names such as Vingroup, Vinhomes, Hoa Phat, Vinamilk, FPT, PV Gas, and multiple banks, to secure the 3rd position in the ranking of the largest companies on the Vietnamese stock market. The company’s value is now second only to Vietcombank and BIDV.

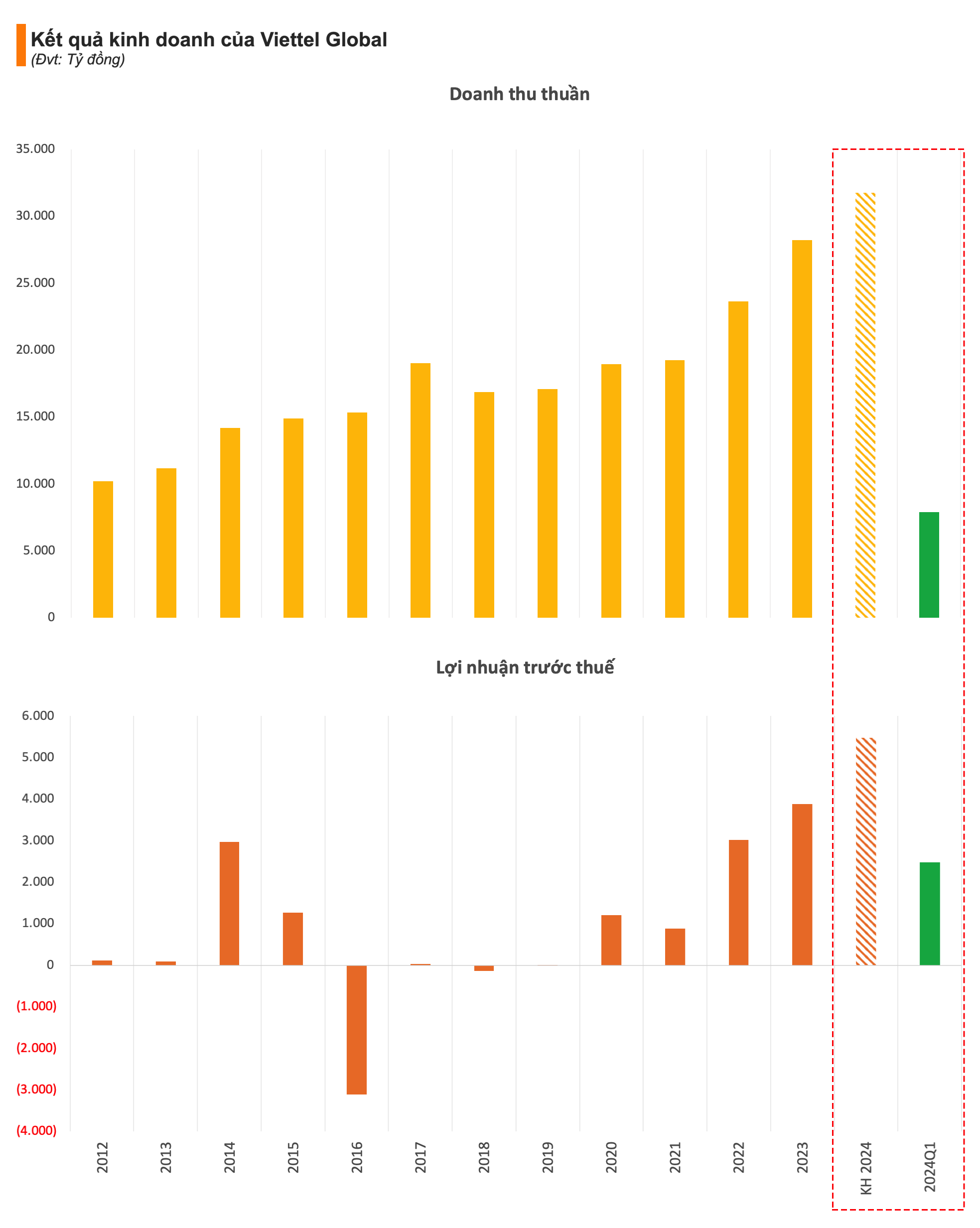

The upward momentum of VGI’s stock is supported by positive developments in its financial performance and the company’s ambition to address lingering issues. According to the 2024 Annual General Meeting documents, Viettel Global plans to present shareholders with a 2024 plan that includes a consolidated revenue target of 31,746 billion VND and a consolidated pre-tax profit of 5,477 billion VND. This figure is 41% higher than the previous year’s performance and would be a record for the company.

Viettel Global attributes the expected profit increase in 2024 to anticipated improvements in the performance of its investment markets and a reduction in provisions at the parent company. Specifically, Natcom is projected to increase by 231 billion VND (+18%), Halotel to reduce losses by 392 billion VND, Metfone to increase by nearly 139 billion VND (+7%), and Movitel_E to rise by 105 billion VND (+40%). Simultaneously, the parent company expects a boost of 1,260 billion VND due to reduced provisions and lower foreign exchange rate differences compared to the previous year. The company also aims to add a minimum of 2 million telecommunications subscribers and increase digital subscribers by a minimum of 6 million.

Viettel Global’s ambition is not without foundation, as the company has already witnessed a vibrant first quarter. According to the consolidated financial statements for Q1 2024, Viettel Global achieved a remarkable revenue of 7,907 billion VND, reflecting a 22% increase compared to the same period last year. This is an impressive feat for a telecommunications company, considering the near-saturation of this service globally.

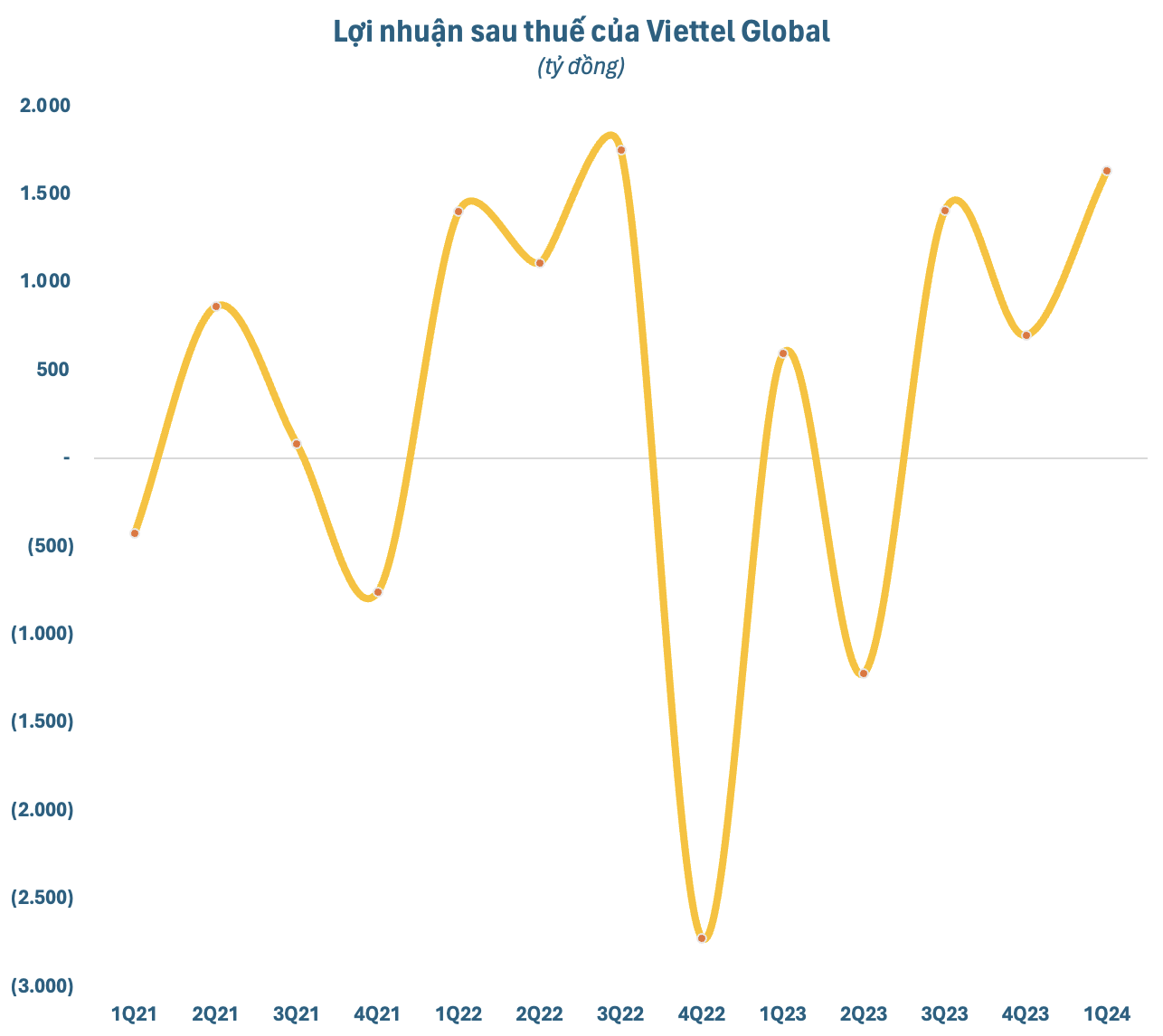

During the first quarter of 2024, all nine markets experienced significant growth, with five markets achieving double-digit increases: Lumitel in Burundi (29%), Unitel in Laos (24%), Movitel in Mozambique (22%), Natcom in Haiti (18%), and Metfone in Cambodia (13%). Viettel Global’s consolidated after-tax profit reached 1,633 billion VND, a surge of 175% compared to the same period in 2023, and the highest since Q3 2022.

If the company successfully executes its business plan for 2024, it may be able to eliminate its accumulated losses from previous years. As of December 31, 2023, the company had accumulated losses of more than 3,377 billion VND, mainly due to significant losses incurred before 2018.

According to Decree 140/2020/ND-CP, which came into effect on November 30, 2020, state-owned enterprises with the government holding more than 50% of the charter capital or total voting shares are required to distribute dividends to shareholders after allocating profits to the owners of capital contributions, compensating for previous years’ losses, allocating funds to the reward and welfare funds, and allocating a maximum of 30% to the development investment fund. The remaining profit must be fully distributed as cash dividends or profits to the shareholders. For the portion of cash dividends or profits belonging to the state capital, it must be paid into the state budget.

Currently, Viettel Global has only one major shareholder, its parent company, Viettel Group, which owns over 99% of the capital, while the remaining less than 1% of shares are held by other shareholders. Since its listing on the stock exchange in September 2018, Viettel Global has never paid cash dividends. **If successful in eliminating accumulated losses, Viettel Global is likely to return profits to its parent company for the first time after years of investing abroad.**

Viettel Global is currently one of the largest overseas investors from Vietnam. The company operates in 9 countries across Asia, Africa, and the Americas, serving a total population of over 200 million people. It holds the number one market share in 6 key markets: Myanmar, Cambodia, Laos, East Timor, Burundi, and Tanzania. These are all developing countries with significant potential for business expansion and growth.

The company’s management assesses that in 2024, 4G mobile will remain a dominant trend and is in a strong growth phase in developing countries. Most of the company’s investment markets still have room for 4G development, and some are even experiencing a boom, as seen in Africa. Additionally, the growth rate of FTTH subscribers is expected to surpass that of mobile subscribers.

Alongside its focus on expanding network infrastructure, especially 4G networks in potential markets, Viettel Global is also working on acquiring frequencies and developing 5G, DataCenter, and Cloud services to gain a competitive edge, as seen in its initiatives in Cambodia, Laos, and Timor.