The race to increase capital for lending activities remains heated

In 2024, the race to increase capital among securities companies shows no signs of cooling down. Many securities firms have presented capital increase plans to their annual general meetings of shareholders (AGMs) to expand their business operations and enhance their competitiveness in anticipation of the promising prospects of the stock market in the coming years. As a result, transactions by investors are predicted to increase, along with a rise in margin lending demand.

Mr. Do Anh Tu, Chairman of Tien Phong Securities (TPS, HOSE: ORS), stated that the stock market will witness significant development in 2024-2025, with attractive P/E ratios. Therefore, to achieve growth, TPS needs to strengthen its margin lending business and increase its charter capital.

At the 2024 AGM, the company approved a plan to raise its charter capital to a maximum of VND 5,608 billion through three capital increase methods: issuing dividend payout shares, ESOP shares, and issuing preferential rights shares to existing shareholders.

Similarly, Rong Viet Securities JSC (HOSE: VDS) also received shareholder approval to issue 114 million shares, increasing its capital to VND 3,240 billion, through two phases of dividend payout share issuance and private placement. The additional capital will be used to supplement its primary activities, including lending.

Mr. Nguyen Mien Tuan, Chairman of VDS, stated that if the capital increase is approved, they will boost the margin lending segment to generate more fixed income.

Regarding SSI Securities Corporation (HOSE: SSI), the target outstanding debt by the end of 2024 is set at VND 20,000 billion, accompanied by customer risk management. Ms. Vu Ngoc Anh, Director of the Retail Block, shared that the two benefits of margin lending are increased revenue and optimized capital. The company continues to promote lending, primarily driven by expanding the target customer base.

At this year’s AGM, SSI did not present a new capital increase plan but mainly sought shareholder approval to continue executing previously announced share issuance plans. In addition to equity capital, SSI also raises funds through borrowing for margin lending activities. The company’s chairman, Mr. Nguyen Duy Hung, stated that SSI borrows at low-interest rates.

Notably, Vietcap Securities JSC (HOSE: VCI) has been approved to utilize over VND 2,100 billion to supplement its margin lending activities. This is part of the plan to use the capital raised from the private offering of more than 143.6 million shares at a price not lower than the company’s book value per share as of December 31, 2023, which is VND 16,849 per share. Additionally, VCI has two more capital mobilization methods: issuing 4.4 million ESOP shares at VND 12,000 per share and issuing 132.5 million bonus shares. If these plans are successfully implemented, the company’s charter capital is expected to increase from VND 4,375 billion to VND 7,181 billion.

As for Ho Chi Minh City Securities Corporation (HSC, HOSE: HCM), the margin lending target for the end of this year is set between VND 18,000 and VND 20,000 billion. By the end of April, the company had achieved nearly VND 15,000 billion, with the current growth rate outpacing the market average. Mr. Trinh Hoai Giang, CEO of HSC, shared at the 2024 AGM that revenue from this activity is expected to grow significantly in 2024, along with proprietary trading and brokerage activities. He also emphasized the importance of managing margin lending risks and not compromising on these risks to meet debt growth pressure.

Regarding funding sources, he assessed that borrowing is more accessible this year than in previous years, benefiting the company’s margin lending and proprietary trading activities.

Unlike the majority, HSC did not seek capital increase approval at this year’s AGM. Mr. Johan Nyvene, Chairman of the Board of Directors, informed the meeting that they currently expect to utilize the over VND 1,700 billion contributed by shareholders in the recent issuance first and do not have immediate plans to raise additional capital this year until the existing funds are fully utilized.

Record-high debt balance at the end of Q1; risks are not overly concerning

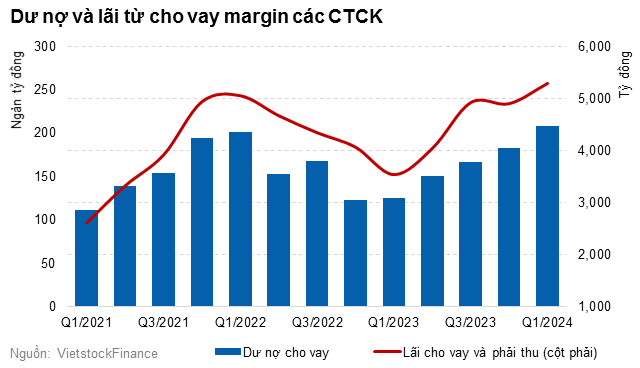

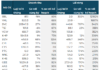

As of the end of Q1/2024, the outstanding debt balance of securities companies hit a new record, surpassing VND 208,400 billion, a 14% increase compared to the beginning of 2024. This occurred amid a five-month bull run in the stock market from November 2023 to March 2024, followed by the most substantial drop in two years in April.

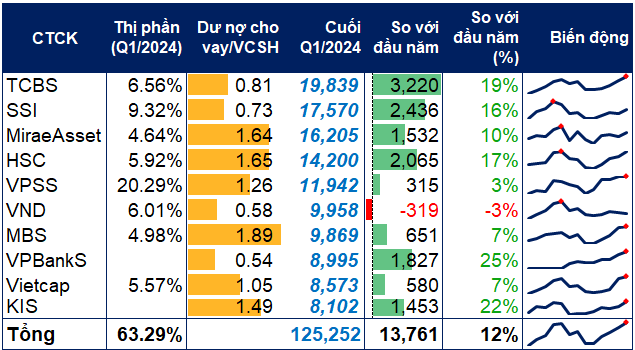

Among them, the top 10 securities companies with the largest debt balances in the market accounted for 60%, reaching over VND 125,000 billion. This is also the highest number ever recorded by this group. Except for VNDIRECT Securities Corporation (VND), which experienced a 3% decrease in debt balance compared to the beginning of the year (recording VND 9,900 billion) due to a cyberattack on its information technology system in late March, the remaining securities firms witnessed growth compared to the previous year.

The record-high total market debt balance raises concerns about margin lending risks. However, analysts have stated since the beginning of the year that margin risks are not overly concerning. Many large securities companies in the market have implemented or are in the process of executing capital increase plans, implying that there is still ample room for collateral lending once these firms complete their capital increases. Moreover, the loan-to-equity ratio of these companies remains within legal limits. In a recent report, VDS assessed that while the margin lending balance of securities companies has surpassed historical peaks and increased by 11% compared to the previous quarter, the loan-to-equity ratio only rose slightly from 75% to 79% compared to the previous quarter and is still well below the peak level in Q1/2022 (121%). This is attributable to the substantial capital increases undertaken by securities companies in 2022 and the favorable market conditions, which have consistently boosted the profits of this group over the quarters of 2023 so far.

|

Top 10 Securities Companies with the Largest Debt Balances in the Market

Source: VietstockFinance

|

Among the top 10 securities companies with the largest debt balances, Ky Thuong Securities (TCBS) held the highest margin lending balance, reaching a record high of over VND 19,800 billion, a 19% increase. Additionally, VPS Securities (VPSS), MB Securities (MBS), VPBank Securities (VPBankS), Vietcap (VCI), and KIS Securities also achieved record-high debt balances in Q1.

Meanwhile, SSI Securities and HSC, which lead the market in terms of debt balance and market share, have not yet reached their peak debt levels, with SSI recording VND 17,600 billion and HSC VND 14,200 billion.

VPBank Securities and KIS Securities are the two companies with the fastest-growing debt balances, despite not being among the top market share holders in Q1.

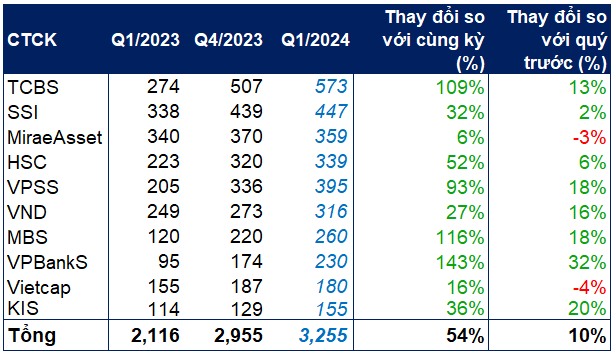

Revenue from lending activities moved in tandem with the margin lending balance, reaching nearly VND 5,300 billion, a 49% increase compared to the same period last year. The top 10 securities companies with the largest debt balances generated over VND 3,200 billion, 1.5 times higher than the previous year. Many securities firms, such as TCBS, MBS, and VPBankS, doubled their revenue compared to Q1/2023.

|

Margin Lending Revenue of the Top 10 Securities Companies with the Largest Debt Balances in the Market

Source: VietstockFinance

|

Given the positive assessments of the stock market in 2024 and the potential for a market upgrade from frontier to emerging status, it is understandable that securities companies have high expectations for the year. Margin lending revenue is expected to contribute significantly to their overall performance.

Duy Khanh