Credit started to improve from March

In the first three months, the Government and the State Bank (SBV) continued to implement and promote policies to boost capital into the economy and support businesses in recovering production and business activities. After two months of negative growth, credit rebounded in March, bringing credit growth to 0.26% at the end of the first quarter compared to the beginning of the year.

The SBV assessed that there were difficulties in providing credit in the first months of the year, partly due to seasonal factors – the demand for credit tends to increase towards the end of the year and before the Lunar New Year, making it challenging to achieve rapid credit growth in the first two months.

In addition, weak demand and low absorption capacity of the economy also impacted credit growth. Many businesses scaled down or ceased operations due to inflationary pressures, rising material costs, lack of orders, high input costs, and production expenses. As a result, they had no demand for loans. Moreover, people increased their precautionary savings and reduced borrowing for consumption.

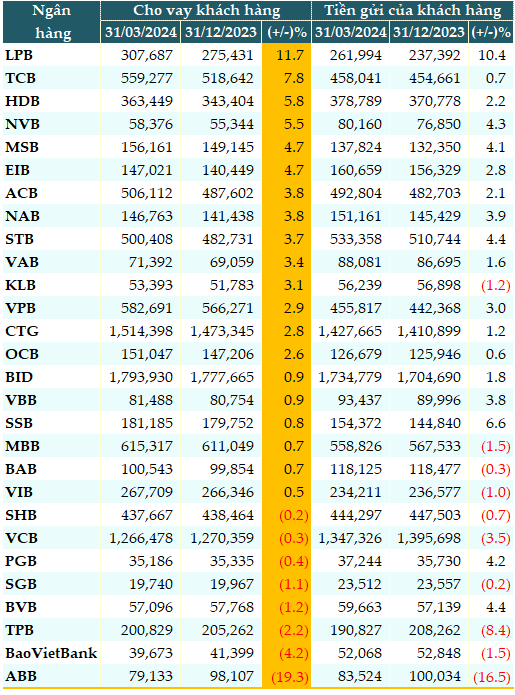

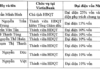

Data from VietstockFinance also showed that as of March 31, 2024, total customer loans at 28 banks that have published financial statements amounted to nearly VND 10.3 quadrillion, only a slight increase of 2% from the beginning of the year.

Eight banks experienced negative credit growth, while the remaining banks achieved an average growth rate of 4% compared to the start of the year.

LPB led the industry in credit growth, with a 12% increase as customer loans reached VND 307,687 billion. This was followed by TCB, which posted an 8% increase in customer loans to VND 559,277 billion, and HDB with a 6% rise to VND 363,449 billion.

In terms of absolute value, thanks to their scale advantages, state-owned banks continued to dominate the industry. BIDV (BID) topped the list with customer loans of nearly VND 1.8 quadrillion, a 1% increase from the beginning of the year. VietinBank (CTG) followed with over VND 1.5 quadrillion in customer loans, marking a 3% increase, while Vietcombank (VCB) ranked third with nearly VND 1.3 quadrillion despite negative credit growth.

|

Customer Loans and Deposits as of March 31, 2024 (Unit: VND trillion)

Source: VietstockFinance

|

Despite deposit interest rates being at their lowest, the amount of deposits in banks continued to grow as other investment channels had not yet recovered. As of the end of March 2024, total customer deposits at 28 banks exceeded VND 9.9 quadrillion, a nearly 0.7% increase compared to the beginning of the year.

Ten out of 28 banks experienced negative deposit growth, while the remaining banks achieved positive growth with an average rate of 3%.

LPB led the industry in deposit growth, with a 10% increase in deposits amounting to VND 261,994 billion. This was followed by SSB, which posted a 7% increase (VND 154,372 billion), and Sacombank (STB) with a 4% rise (VND 533,358 billion).

Credit in the second quarter is expected to improve significantly.

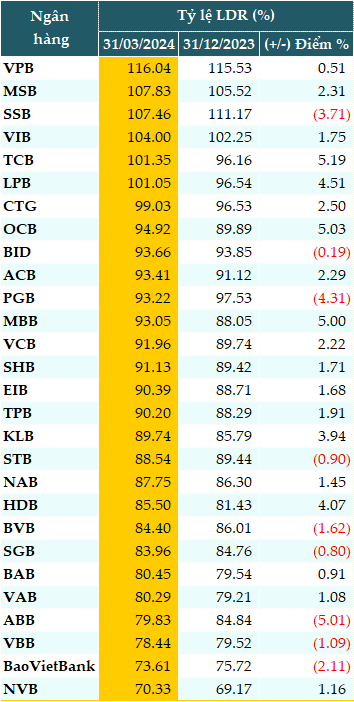

As the gap between mobilized capital and loan balances was not significant, the maximum loan-to-deposit ratio (LDR) also remained largely unchanged. However, due to higher credit growth compared to deposit growth, 19 out of 28 banks witnessed an increase in their LDR at the end of the first quarter compared to the beginning of the year. As of March 31, 2024, eight out of 28 banks had an LDR below 85%, indicating that these banks were lending at a lower rate and had lower credit quality compared to their mobilized capital.

Notably, some banks reported an LDR exceeding 100%, including VPB (116.04%), MSB (107.83%), SSB (107.46%), VIB (104%), TCB (101.35%), and LPB (101.05%). A high LDR indicates that a bank is lending more than its mobilized capital, which poses liquidity risks.

|

LDR of Banks as of March 31, 2024

Note: Mobilized capital includes customer deposits and capital raised through the issuance of securities. Source: VietstockFinance

|

Assoc. Prof. Dr. Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City, predicted that credit in the second quarter would definitely improve compared to the first quarter, and the recovery momentum would continue until the end of the year, assuming no unexpected negative developments in the global economy. Essentially, credit recovery would follow a linear and gradual path.

There are several reasons to expect an improvement in credit in the second quarter. The PMI index for April surpassed 50, indicating a recovery in the manufacturing sector. Additionally, exports showed signs of recovery, albeit modestly. The tourism industry also witnessed a strong rebound, especially during the recent holidays, which would positively impact economic growth.

The main drivers of credit growth are the recovering manufacturing sector and exports, and it is hoped that the second quarter will see further improvements.

Assoc. Prof. Dr. Dinh Trong Thinh, an economic expert, also affirmed that credit in the second quarter would be more positive than in the first quarter, as indicated by the SBV’s April report, which showed better credit growth than in March.

Credit growth is returning as businesses experience improved production and operations, leading to increased capital demands. Secondly, the SBV has instructed commercial banks to offer not only secured loans but also unsecured loans in the form of project financing and cash flow lending. Therefore, banks can consider providing project or cash flow-based loans to businesses with orders and ongoing production and operations. Consequently, this will increase the overall lending of banks to businesses in the economy.