Data from FiinTrade showed that while foreign investors continued to sell in April, the net selling value halved. Notably, Taiwan and South Korea’s capital inflows through ETFs into Vietnam increased.

WEAK NET SELLING VALUE

The net selling value of foreign investors on the 3 exchanges (HOSE, HNX, and UPCOM) exceeded VND 5.3 trillion in April 2024. This was the third consecutive month of net outflows, but the scale of net selling decreased by 52.8% compared to March 2024. Nearly 81% of the net selling value of foreign investors in April 2024 was done through order matching.

Cumulative for the first four months of 2024, foreign investors’ net selling equaled 73.9% of the whole year of 2023: In the first four months of 2024, foreign investors net sold VND 16.8 trillion, equivalent to 73.9% of the net selling value in 2023 (over VND 22.8 trillion).

Considering the past year, the net selling of foreign investors has not shown any signs of stopping. In the 12-month cumulative period, foreign investors net sold a total of VND 45.3 trillion, focusing on heavy selling in December 2023 and March 2024.

Domestic individuals were the net buyers corresponding to the net selling of foreigners from April 2023 to the present, amid savings interest rates for 12-month terms falling below 5%/year.

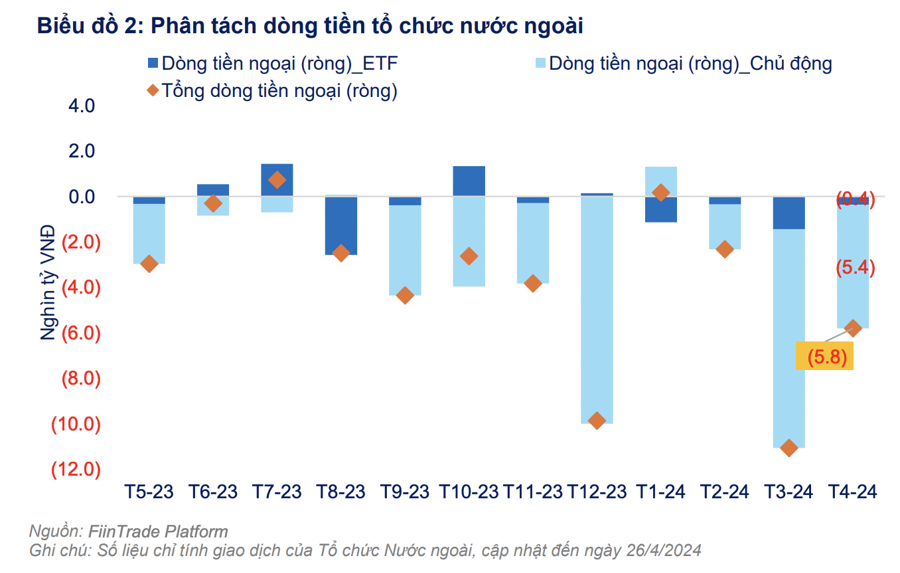

In April 2024, foreign institutions maintained net selling, mainly from the Active group: The total net selling value of foreign institutions was VND 5.8 trillion, the third consecutive month of net outflows. Specifically, the Active group accounted for 87% of the net selling value in the month, and the rest came from ETFs.

Cumulative for 4T2024, foreign institutions net sold equivalent to 76% of the whole year of 2023: The total net selling value of foreign institutions exceeded VND 19 trillion, equivalent to 76% of the total net selling value in 2023. Of this, the Active group net sold VND 15.7 trillion, and ETFs accounted for the rest (VND 3.3 trillion).

TAIWAN AND SOUTH KOREA’S CAPITAL INFLOWS INTO VIETNAM

Considering the past year, the net selling of the Active group has continuously increased. Meanwhile, ETF money flows were less volatile but started to show a net selling trend. In the 12-month cumulative period, the Active group net sold a total of VND 41 trillion.

The Active group net bought Retail while net selling Real Estate and Financial Services: In April 2024, the Active group net bought the Retail sector (MWG) and net sold Real Estate (VHM, VIC) and Financial Services (VCI, VND, and SSI).

Meanwhile, the ETF group focused on net selling Banking: The ETF group net sold the Banking sector, focusing on stocks that had reached the foreign ownership limit in the VNDiamond basket, such as TCB, MBB, and ACB.

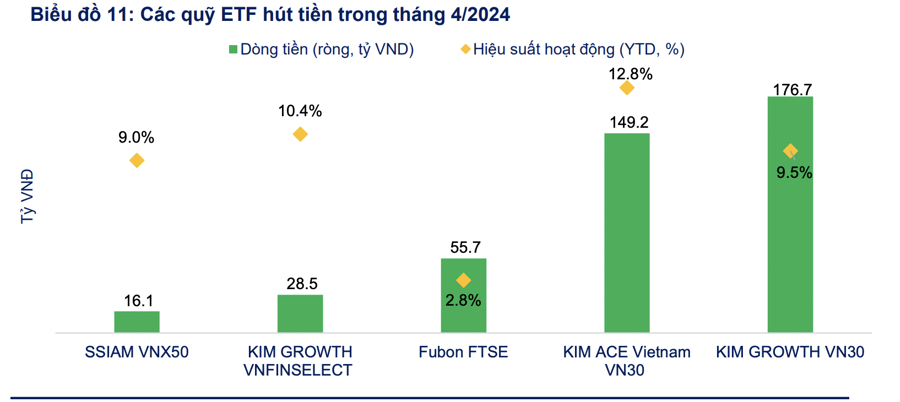

Foreign ETF funds recorded outflows of more than VND 365 billion in April 2024. This was the fourth consecutive month of outflows for this group, with a cumulative value since the beginning of 2024 of more than VND 3.3 trillion, compared to an inflow of VND 4.1 trillion in 2023.

The outflows were mainly from the Xtrackers FTSE Vietnam ETF (-VND 408 billion) and the iShares MSCI Frontier and Select ETF (-VND 201 billion).

More positive signals were seen in some foreign funds such as Fubon FTSE Vietnam ETF (+VND 55.7 billion), KIM Growth (+VND 176 billion), and KIM Kindex (+VND 149 billion).

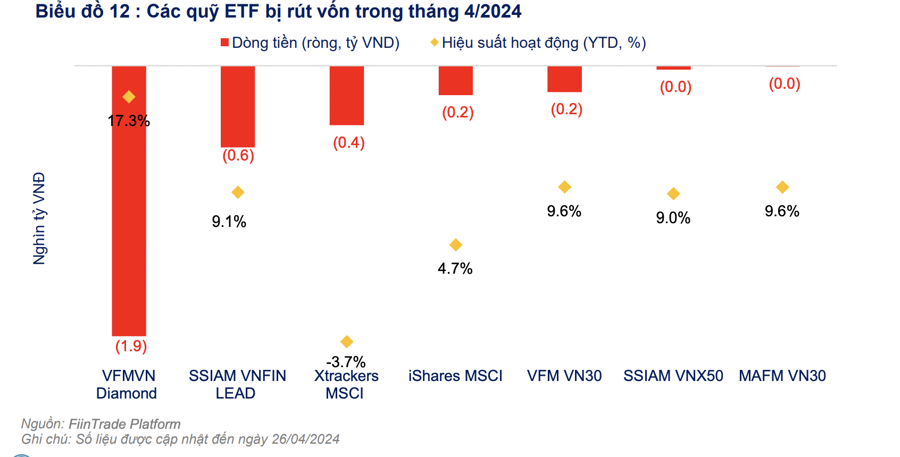

Domestic ETFs continued to witness strong outflows: In April 2024, the outflows from domestic ETFs were VND 2.4 trillion, a decrease compared to the outflows in March 2024. However, it is worth noting that this was the ninth consecutive month of outflows for this group. Cumulative for the first four months of 2024, the total outflows from domestic ETFs were VND 7.9 trillion (equivalent to 1.37 times the outflows in 2023).

Most of the outflows were recorded in 2 DC-owned funds, VFMVN Diamond ETF (-VND 1.8 trillion) and VFM VN30 ETF (-VND 181 billion). In addition, the SSIAM VNFIN LEAD ETF also experienced outflows of more than VND 559 billion.

Capital inflows into ETFs in April 2024 mainly came from South Korea (KIM GROWTH VN30, KIM ACE Vietnam VN30) and Taiwan (Fubon FTSE Vietnam ETF). The portfolios of these funds mainly focused on Steel (HPG), Information Technology (FPT), and Food and Beverage (VNM, MSN).

In contrast, capital outflows were seen from Europe (Xtrackers FTSE Vietnam Swap UCITS ETF), the US (iShares MSCI Frontier and Select EM ETF), and Asia (DCVFMVN DIAMOND ETF and SSIAM VNFIN LEAD ETF).

The scale of net selling in the Active foreign group decreased but remained high: In April 2024, the net selling value of the Active foreign group was VND 5.4 trillion, 43.4% lower than the net selling value in March 2024. However, considering the past year, the net selling value in April 2024 was still relatively high. Cumulative for the first four months of 2024, the Active group net sold VND 15.7 trillion, equivalent to 38% of the total net selling value in 2023 (VND 41.3 trillion).

The foreign active fund VEIL recorded outflows of more than VND 116 billion, while the PYN Elite fund continued to see inflows for the second consecutive month, with more than VND 75 billion in April 2024.