According to a report by Savills Vietnam, apartments priced between VND 3-5 billion in Ho Chi Minh City will become increasingly rare in the next two years, with new supply mainly focusing on the VND 5-10 billion per unit segment. Meanwhile, in Binh Duong and Dong Nai, apartments priced below VND 2 billion, which used to be abundant in these areas, will also become extinct in the future.

Looking ahead, Savills experts predict that supply will continue to be scarce and prices will remain high due to limited land resources and increasing construction and management costs. This has caused concern among many people, especially young couples, who fear that their opportunities to own a home will become even more limited in the future.

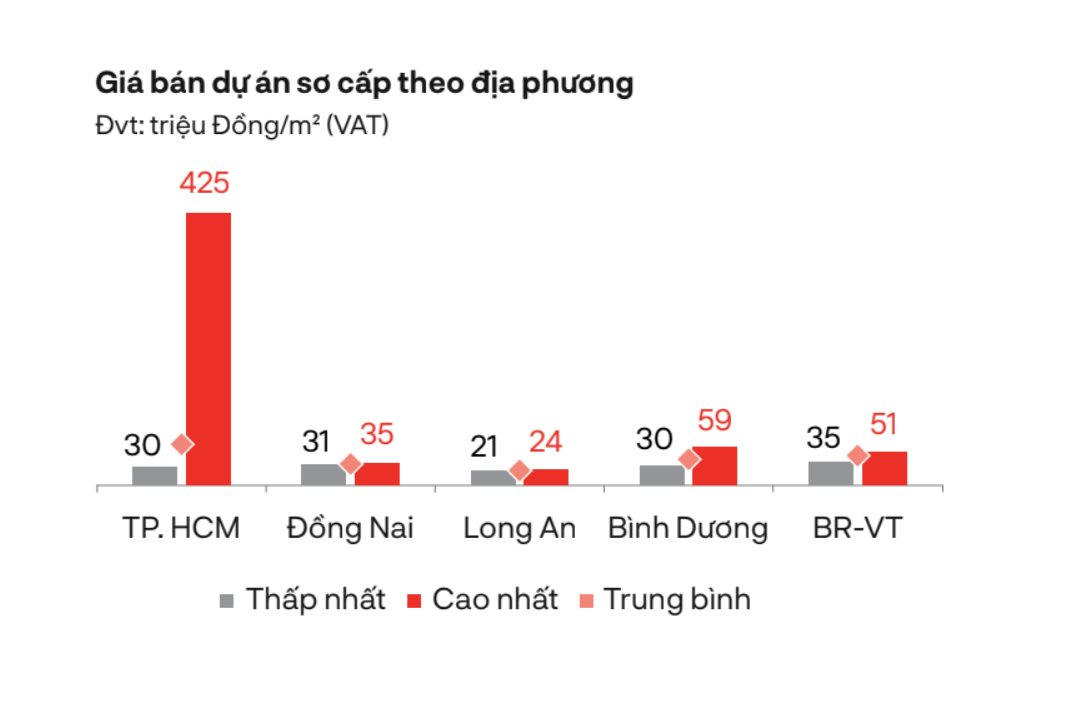

Soft-priced apartment supply in areas neighboring Ho Chi Minh City will become increasingly invisible. Source: DKRA Group

In Binh Duong, where there is the highest number of new supply in the Southern market at this stage, it is not easy to find apartments priced below VND 2 billion per unit. The price threshold for apartments in the area of Di An and Thuan An has mostly reached VND 38-45 million per square meter. An apartment suitable for a young family now costs around VND 2.3 to nearly VND 3 billion per unit. Without proper financial solutions, young people with modest initial savings will find it very difficult to own a home.

Recently, in Binh Duong, the Phu Dong SkyOne apartment project by Phu Dong Group was introduced to the market with prices ranging from VND 1.4 to VND 1.8 billion per unit (accounting for 75% of the total units in the project), attracting much attention. This is a rare price range in the local apartment market. Moreover, the developer also supports young homebuyers with a financial solution that allows them to pay only VND 7.5 million per month, with a relaxed payment schedule until the handover of the apartment. Thus, a couple with a combined income of VND 20-23 million per month can easily own a home near Ho Chi Minh City.

In addition, if customers have limited finances, they can still buy a home thanks to the policy of paying only 20% upfront, with the developer supporting 100% of the interest for 24 months. Specifically, for a VND 1.5 billion apartment, customers only need to pay VND 300 million upfront and take out a bank loan for the remaining amount, without any additional costs until the handover of the apartment. After two years, when the developer hands over the apartment, customers will have saved up a certain amount of money to repay the bank. Or, if they don’t need to move in immediately, they can choose to rent out the apartment for VND 8-10 million per month to cover the loan payments, thus owning a high-end home and escaping the rental lifestyle.

Nowadays, witnessing the annual increase in apartment prices, many young people have boldly taken out bank loans to buy homes. After working and saving for several years, many have planned to buy a home with installment payments and additional bank loans.

“Waiting for housing prices to drop is very difficult, and there aren’t many options available. So, my husband and I decided to take out a bank loan, taking advantage of the low-interest rates and the developer’s extended payment schedule,” said Ms. Kh, an office worker in Thu Duc City, Ho Chi Minh City, sharing her recent decision to buy a home.

Research by PropertyGuru shows that the age group of 22-39 years old is the main driving force behind the demand for home purchases in this phase. In terms of the proportion of people planning to buy real estate in the near future, those under 39 years old account for 64%.

However, finding a suitable dwelling that fits both financial capabilities and quality of life expectations also poses challenges for young people, especially as soft-priced apartments are becoming increasingly elusive, and it is difficult to find new supply in the market.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)