On May 17, Joint Stock Company Cang Doan Xa held its 2024 Annual General Meeting. The company’s focus for the year ahead will be on two core areas: port operations and asphalt road construction, in line with the government’s large-scale investment in infrastructure.

2023 Revenue Quadruples

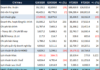

Despite a challenging business landscape in 2023, Cang Doan Xa achieved impressive results. The company’s revenue for the year reached nearly VND 411 billion, almost four times higher than the previous year. The newly established asphalt business, which began operations in Q3 2023, contributed significantly to this success, bringing in nearly VND 289 billion, or over 70% of the total revenue. The core business of port services also performed well, generating VND 122 billion, an increase from 2022. DXP, as the company is known, handled over 1.2 million tons of cargo through its ports and produced more than 24,300 tons of asphalt.

After expenses, DXP’s pre-tax profit was VND 67.9 billion, a 51% increase from 2022, surpassing the targets set by the AGM.

Given these outstanding results, the AGM approved a dividend payout ratio of 15%, including a 5% cash dividend and a 10% stock dividend. The company will distribute nearly VND 30 billion in cash dividends and issue approximately 6 million new shares as stock dividends.

As of the end of 2023, DXP’s cash balance (including cash, cash equivalents, and short-term deposits) stood at VND 480 billion, accounting for half of the company’s total assets. The company also experienced a positive cash flow from operating activities of nearly VND 148 billion, eight times higher than the previous year. DXP is one of the rare debt-free companies on the stock exchange, with a strong cash position to invest in and expand its business operations.

Annual General Meeting of Cang Doan Xa

2024 Growth Plan: Aiming for a Fivefold Increase in Asphalt Business Profit

Speaking to shareholders at the AGM, the company’s management acknowledged both opportunities and challenges for DXP in the coming year.

In the port business, according to the city’s plans, a portion of the Hoang Dieu Port area will be used for the construction of the Nguyen Trai Bridge, eventually leading to the cessation of port operations. This presents a significant opportunity for DXP to increase its cargo volume and revenue in 2024.

Additionally, DXP has established a strong reputation in the automobile and steel industries, earning the trust of major bulk cargo agents. This provides a solid foundation for increasing the volume of bulk cargo handled by the port. The company’s ability to handle cargo outside the anchorage area has also improved, further enhancing its potential for growth.

According to the Vietnam Logistics Business Association (VLA), port businesses in Vietnam have significant growth potential due to new-generation FTAs and government policies promoting the development of the port and logistics industries. The government has also increased the floor price for port services, which is expected to boost revenue from cargo handling fees. Currently, these fees are only one-third of what shipping lines charge shippers, the lowest in Southeast Asia.

DXP’s port services revenue is expected to continue its upward trajectory due to regional advantages. The port system in HP benefits not only from the surge in foreign investment projects in the province but also from those in other northern provinces, including emerging industrial hubs like Bac Giang, Bac Ninh, Quang Ninh, and Hai Duong. As a result, the growth rate of cargo volume in the Hai Phong port system is projected to significantly outperform the industry average.

However, as shared by DXP’s management, the highly competitive nature of the port business and the logistics industry as a whole presents new challenges for smaller ports like DXP.

In the asphalt business, DXP stands to benefit from the government’s focus on infrastructure development, particularly road and airport projects. Recognizing the growth potential in this sector, the company has set ambitious targets for 2024, aiming for a production volume of 56,700 tons and a profit of VND 21.7 billion, five times higher than in 2023.

The AGM overwhelmingly approved the 2024 business plan, which includes a revenue target of VND 804 billion and a pre-tax profit goal of VND 75 billion. These targets represent increases of 87% and 7%, respectively, compared to the 2023 results.

Capital Increase to Seize New Opportunities

Given that DXP’s core business is closely linked to the dynamic Vietnamese economy, the company recognizes the importance of being agile in capturing and implementing new business opportunities and projects.

To enhance its financial strength, increase its capital scale, and improve its competitiveness and bidding capacity, DXP’s shareholders approved a plan to issue 21.5 million new shares to existing shareholders at a ratio of 307:100. This means that for every 307 shares held, shareholders will have the right to purchase 100 new shares at a price of VND 10,000 per share.