The VN-Index closed the 20th trading week of 2024 at 1,273.11 points, a gain of 28.41 points or 2.28% from the previous week, with slightly improved liquidity.

The average trading value of the session (across all three exchanges) during week 20 was 23,021 billion VND. For matched orders alone, the average trading value was 20,363 billion VND, up 8.5% from week 19 and 5.8% from the 5-week average.

In terms of industry, the average trading value of the session increased in Banking, Securities, Construction, Agriculture & Fisheries, Retail, Textiles, Water Transport, and Paper. On the other hand, Real Estate, Chemicals, Oil Equipment & Services, and Information Technology saw slight decreases. All of these industries experienced positive price movements.

Foreign investors sold a net amount of 2,149.23 billion VND, and for matched orders alone, they sold a net amount of 2,318.6 billion VND.

The main sectors that foreign investors bought on a net basis were Retail and Basic Resources. The top stocks bought by foreign investors on a net basis were MWG, NVL, NLG, HPG, DBC, HVN, DCM, HSG, NKG, and VNM.

On the selling side, foreign investors focused on the Banking sector. The top stocks sold by foreign investors on a net basis were VHM, CTG, VPB, KBC, BID, CMG, MBB, PVD, and VRE.

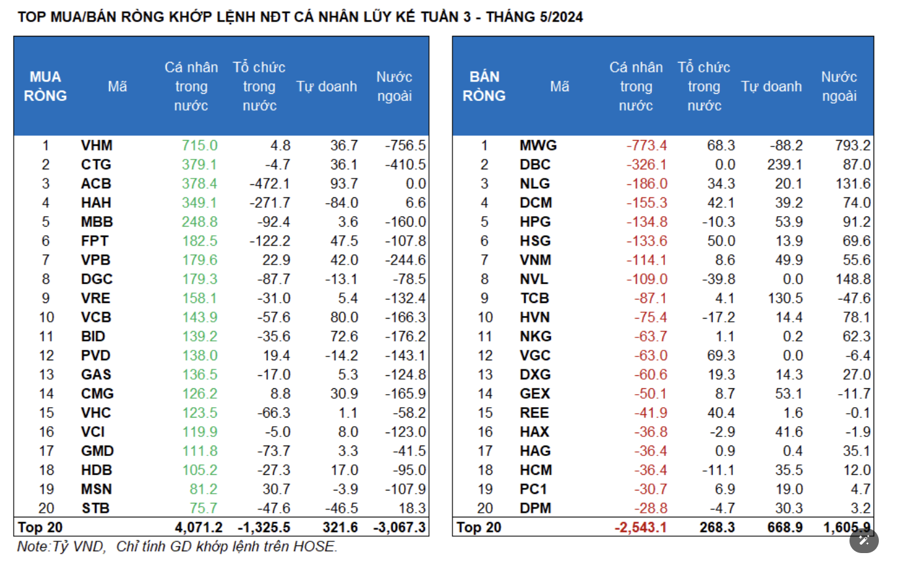

Individual investors bought a net amount of 2,428.26 billion VND, including 2,213 billion VND in matched orders. For matched orders, they were net buyers in 13 out of 18 industries, mainly in Banking. Their top purchases included VHM, CTG, ACB, HAH, MBB, FPT, VPB, DGC, VRE, and VCB.

On the selling side, they sold on a net basis in 5 out of 18 industries, mainly in the Retail and Basic Resources sectors. Their top sells included MWG, DBC, NLG, DCM, HPG, HSG, NVL, TCB, and HVN.

Domestic institutional investors sold a net amount of 1,381.69 billion VND, and for matched orders, they sold a net amount of 1,164.2 billion VND. Domestic institutions sold on a net basis in 10 out of 18 industries, with the largest value in the Banking sector. Their top sells included ACB, HAH, FPT, MBB, DGC, GMD, VCG, VIB, VHC, and VCB.

In terms of net buying, the focus was on the Real Estate sector. Their top purchases included KBC, VGC, MWG, HSG, SHB, DCM, REE, VJC, NLG, and MSN.

Proprietary trading bought a net amount of 1,102.66 billion VND, and for matched orders, they bought a net amount of 1,269.8 billion VND. Proprietary trading was net buyers in 12 out of 18 industries, with the strongest sectors being Banking, Food & Beverage. Their top buys on a net basis included DBC, TCB, ACB, VCB, BID, E1VFVN30, HPG, GEX, VNM, and FPT.

The top-selling sector was Retail. The top stocks sold on a net basis included MWG, HAH, STB, FRT, PVD, CTR, DGC, FUEVFVND, PVT, and BAF.

Looking at the weekly chart, the money flow distribution to the 10-week bottom was in Real Estate, Securities, and Construction Materials; increasing from the bottom in Banking and Electrical Equipment; decreasing from the peak in Steel, Food, Chemicals, Airlines, and Oil Production; and maintaining an upward trend in Agriculture & Fisheries, Textiles, and Water Transport.

Money Flow Strength: The small-cap group, VNSML, became more attractive to money flow, while the money flow distribution decreased in the large-cap group, VN30, and the mid-cap group, VNMID.

In the 20th week of 2024, the focus remained on the mid-cap group, VNMID, with a distribution ratio of 43.6% (down from 44.2% in week 19), but there was a significant increase in the small-cap group, VNSML, reaching 11.4% – the highest level in 30 weeks (since the end of October 2023).

In contrast, the money flow distribution into the large-cap group, VN30, decreased for the third consecutive week, reaching 40.8% in week 20.

In terms of money flow size, the average trading value of the session slightly increased in the VN30 and VNMID groups, up 113 billion VND (+1.4%) and 37 billion VND (+0.4%), respectively. Meanwhile, the VNSML group saw a significant increase of 490 billion VND, or 27.3%.

In terms of price movements, the VNMID group had the best performance (+4.03%), followed by VNSML (+2.7%) and VN30 (+2.56%).