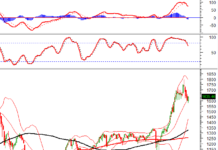

Hanoi’s apartment market has witnessed a surge in demand since Q2 2023, according to data from PropertyGuru Vietnam. The peak was reached in August 2023, followed by a gradual decline. However, from December 2023, apartment searches picked up again, and by March 2024, they had almost reached the August 2023 peak.

Interestingly, in April 2024, the interest in Hanoi apartments took an unexpected turn, with a 23% drop compared to the previous month.

Despite the cooling-off period, asking prices for Hanoi apartments show no signs of slowing down. In April, the affordable apartment segment (below VND 30 million/sq m) saw a 12% price increase compared to the previous month. Mid-range apartments (VND 30-50 million/sq m) also experienced a 5% hike, while high-end apartments (above VND 50 million/sq m) climbed by 3%.

Is now a good time to buy an apartment in Hanoi? (Illustration: Cong Hieu)

Given the current situation, many are wondering if it is wise to invest in an apartment in Hanoi at this time.

Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, advises consumers to be clear about their intentions. If the purpose is for owner-occupation, it is advisable to purchase when your financial situation allows, as this will address immediate practical needs for housing and establishing a home.

“Waiting for a significant drop in apartment prices is highly unlikely, given the limited supply. With the upcoming amendments to the Law on Real Estate Business coming into force, the number of developers able to meet the requirements to launch projects will further decrease. Meanwhile, the demand for home ownership remains ever-present, especially in large cities,” said Mr. Quoc Anh.

However, for those considering purchasing for investment purposes, Mr. Quoc Anh recommends proceeding with caution. If the investment horizon is short-term, it may not be the best time to commit as prices and market interest are still volatile, which could pose challenges when quick liquidity is needed.

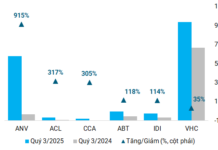

On the other hand, for long-term investments or investments aimed at generating rental income, apartments can still be a viable option. This is supported by the fact that investment profit growth in apartments (price appreciation plus rental yield) during 2015-2023 reached an impressive 97%, outperforming other investment avenues such as stocks, gold, savings, and foreign currency. This information is based on historical price data and big data analysis by PropertyGuru Vietnam.