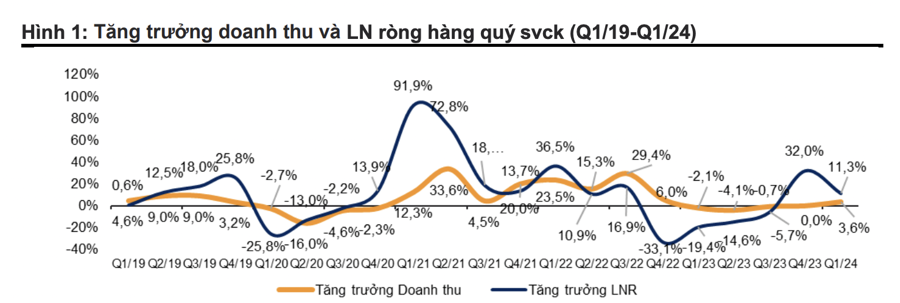

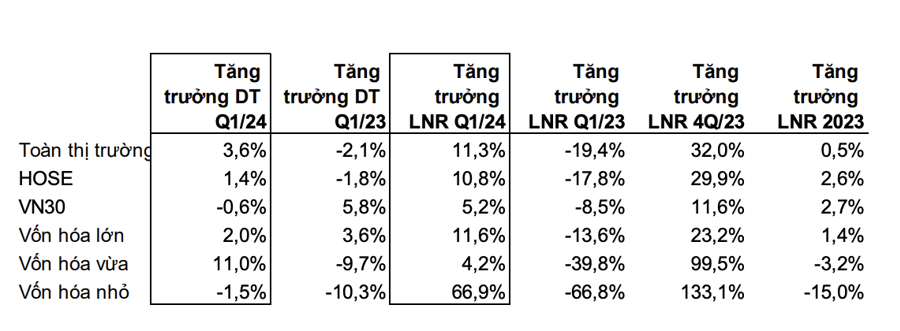

The Q1/24 financial results showcase promising profit prospects for the year. VnDirect estimates a 11.3% year-on-year increase in net profits for listed companies across the three exchanges (HOSE, HNX, UPCOM), driven by both a more pronounced economic recovery and a low base effect from Q1/2023.

The upward profit trend in the following quarters will serve as a catalyst to support the stock market against any potential sell-offs in the future.

The Aviation industry witnessed astonishing profit growth, with a 1957% surge compared to the same period last year. This remarkable performance was attributed to the strong recovery in international passenger traffic, which reached 4.6 million, a 72% increase year-on-year, and even surpassed pre-pandemic levels by 3.2%. Meanwhile, domestic passenger traffic also improved, reaching 30 million, a 9.1% increase year-on-year.

However, the industry’s profits were largely driven by HVN, and HVN’s profits were boosted by the recognition of VND 3.63 trillion in other income from debt write-offs as per settlement agreements.

The Steel and Securities industries maintained their growth trajectory. Steel companies’ net profits in Q1/24 continued the robust upward trend, surging 532% year-on-year due to improved consumption volumes and stable upward trends in steel prices, along with effective management of raw material costs, resulting in higher gross profit margins.

Securities firms’ profits rose 152.7% year-on-year, driven by a 40% increase in their investment portfolios, a 34% rise in margin lending, and a 237% jump in brokerage profits compared to the same period last year.

While the Real Estate industry reported a 29.2% decline in profits year-on-year, the actual figures seem better than the statistics suggest. The revenue drop in the real estate sector is mainly due to the first quarter not being a period for recognizing revenue and profits for some large real estate enterprises.

All market cap groups witnessed healthy profit growth in Q1/24, led by small-cap stocks with a 66.9% jump in net profits year-on-year.

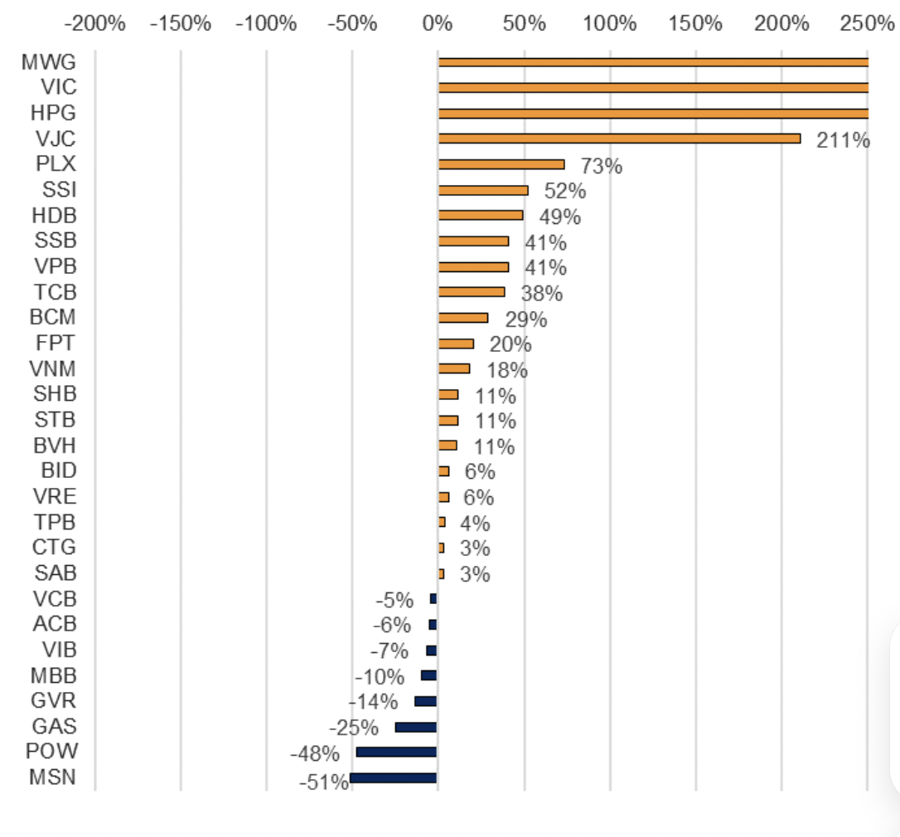

MWG, VIC, HPG, and VJC were the top contributors. The combined net profits of the VN30 stocks in Q1/24 rose 5.2% year-on-year but dipped 3.8% compared to the previous quarter. During this period, 21 companies in the VN30 index reported profit growth, led by MWG (+4143%), VIC (+644%), HPG (+622%), and VJC (+211%).

MWG’s robust profit growth reflects a recovery in consumer spending, and BHX’s pre-tax profits continued to improve, narrowing its net loss from VND 354 billion in Q1/23 to just VND 105 billion in Q1/24. HPG’s net profits in Q1/24 soared 622% year-on-year due to 1) efficient management of raw material costs and stable steel price increases, contributing to improved gross profit margins, and 2) continued growth in sales volume. VJC’s profits were driven by significant growth in international passenger traffic in 1Q/24.

Gross profit margins edged slightly higher during the period. The estimated gross profit margin for the overall market in Q1/24 increased by 1.4 percentage points to 15.6%. This improvement was driven by the Aviation industry (+12.8 percentage points), Industrial & Transport (+6.6 percentage points), Automotive & Components (+4.2 percentage points), and Construction & Materials (+3.8 percentage points).

Interest expenses declined to 5.7% in Q1/24, a decrease compared to Q4/23 (-0.5 percentage points quarter-on-quarter), indicating that the State Bank’s interest rate cuts have been effective in lowering the borrowing environment for loans. However, interest rates are unlikely to decrease further as commercial banks are currently raising rates to meet the increasing credit demands of businesses expanding production and benefiting from the economic recovery. The debt-to-equity ratio rose to 74.4% in Q1/24, an increase of 10.6 percentage points compared to the previous quarter.