Tax Department of Quang Tri Province Temporarily Suspends Overseas Travel for Legal Representatives of Delinquent Companies

On May 16th, Mr. Nguyen Ngoc Tu, Director of the Quang Tri Province Tax Department, announced that they have issued notifications to the Department of Exit and Entry Management under the Ministry of Public Security regarding the temporary suspension of overseas travel for several legal representatives of companies within their jurisdiction.

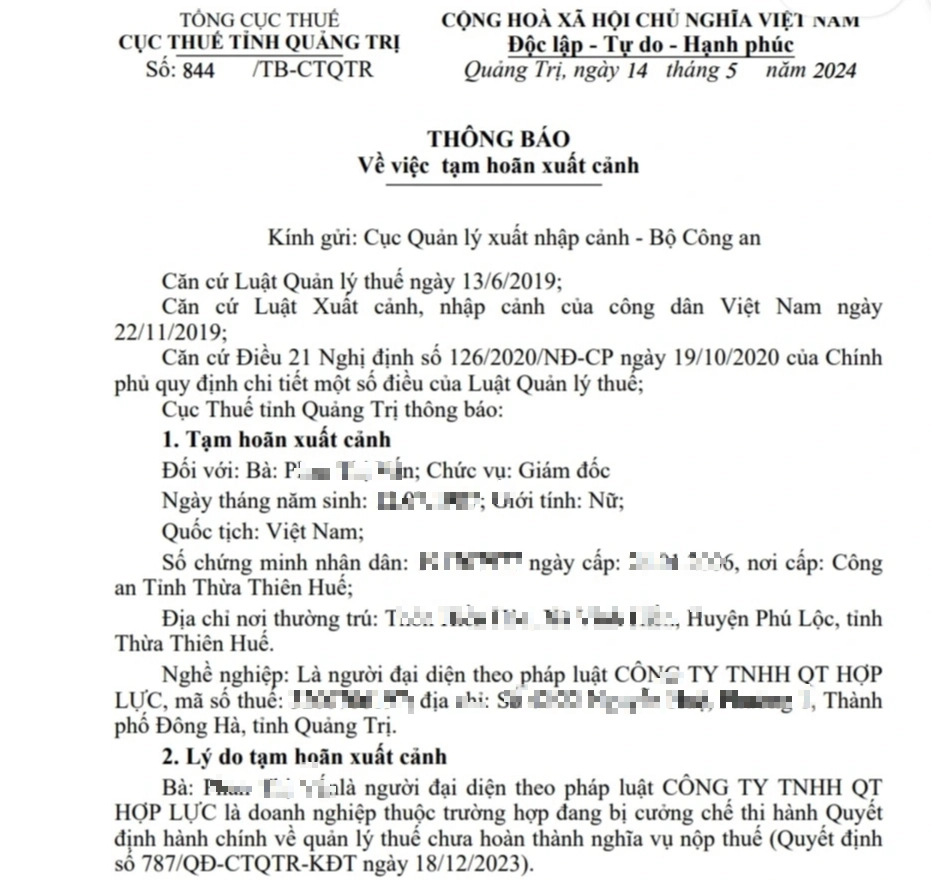

Specifically, on May 14th, the Tax Department of Quang Tri Province issued five notifications for the temporary suspension of overseas travel for five legal representatives of five companies who had failed to fulfill their tax obligations.

The five individuals affected by this suspension are: Ms. P.T.V, Director of QT HL Co., Ltd.; Mr. L.V.D, Director of TT Investment and Construction Joint Stock Company; Mr. N.D.T, Director of MT Co., Ltd.; Ms. D.T.H, Director of TT Real Estate One-Member Limited Liability Company; and Mr. P.C.C, Director of DPMT Petroleum One-Member Co., Ltd.

The reason for these temporary suspensions, as stated by the Tax Department, is the failure of these companies to comply with administrative decisions regarding tax management and their outstanding tax liabilities.

According to Mr. Nguyen Ngoc Tu, since the beginning of 2024, the Tax Department has issued similar notifications for over 200 individuals representing delinquent companies. Approximately 50 of these companies have since fulfilled their tax obligations. The Tax Department will lift the temporary suspension of overseas travel for these individuals once they have complied with their tax liabilities as required by law.