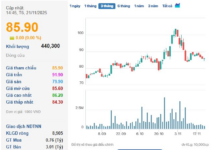

Inertia from the previous week’s session continued, with strong momentum driving capital inflows into small-cap penny stocks after successful profit-taking in large-cap stocks. The index managed to maintain its upward trajectory, despite showing signs of weakness towards the end of the trading day.

The VN-Index closed with a gain of 4.47 points, reaching the 1,277-point level. The market breadth was positive, with 264 advancing stocks versus 174 declining ones, and green dominated the small-cap sector. Several industries posted solid gains, including Building Materials (up 1.13%), Insurance (3.89%), Consumer Discretionary (1.37%), and Rubber (0.83%). Large-cap sectors maintained their upward trend, with Banks rising by 0.53%, Real Estate by 0.42%, and Securities by 0.21%.

The top stocks contributing to the market’s gains included BCM, adding 1.04 points; VPB, contributing 0.77 points; and HPG, with 0.57 points. On the flip side, FPT and VHM shaved off 0.46 and 0.42 points, respectively. Turnover rose to VND 31,000 billion, with a significant portion flowing into small-cap stocks.

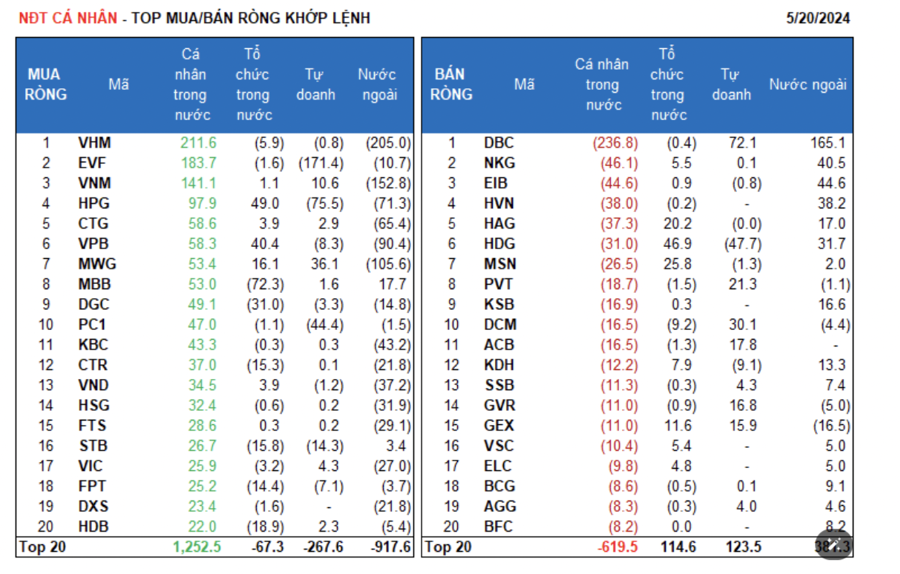

Foreign investors recorded a net sell position, matching the previous session’s net selling value of VND 1,016.7 billion. Specifically, in matched orders, they net sold VND 853.2 billion.

The sectors that witnessed net buying by foreign investors in matched orders were Travel & Leisure and Automobiles & Components. The top stocks purchased by foreign investors in matched orders were DBC, EIB, FUEVFVND, NKG, HVN, HDG, MBB, HAG, KSB, and KDH.

On the selling side, foreign investors offloaded Real Estate stocks in matched orders. The top stocks sold by foreign investors in matched orders were VHM, VNM, MWG, VPB, HPG, KBC, VHC, VND, and CMG.

Individual investors net bought VND 807.5 billion, of which VND 979.4 billion was in matched orders. In terms of matched orders, they net bought 14 out of 18 sectors, mainly focusing on the Real Estate industry. The top stocks purchased by individual investors included VHM, EVF, VNM, HPG, CTG, VPB, MWG, MBB, DGC, and PC1.

On the selling side, in matched orders, individual investors offloaded 4 out of 18 sectors, primarily in the Food & Beverage and Travel & Leisure industries. The top stocks sold by individual investors included DBC, NKG, EIB, HVN, HAG, HDG, PVT, KSB, and DCM.

Proprietary trading accounted for a net buy position of VND 165.9 billion, while in matched orders, they net sold VND 76.9 billion.

In terms of matched orders, proprietary trading bought 9 out of 18 sectors, with the highest net buying observed in the Food & Beverage and Industrial Goods & Services sectors. The top stocks purchased by proprietary trading in today’s session were DBC, TCB, MWG, CMG, DCM, PVT, ACB, SSI, GVR, and GEX. On the selling side, they offloaded Financial Services stocks, with the top sold stocks being EVF, HPG, HDG, PC1, FUEVFVND, STB, VIB, POW, BMI, and KDH.

Domestic institutional investors net sold VND 151.8 billion, and in matched orders, they net sold VND 49.3 billion.

Breaking down the matched orders, domestic institutions sold 13 out of 18 sectors, with the largest net selling observed in the Banking sector. The top sold stocks by domestic institutions were MBB, DGC, HDB, STB, CTR, HAH, GMD, VCB, VIB, and FPT. On the buying side, they focused on the Food & Beverage sector, with the top purchased stocks being HPG, HDG, VPB, MSN, HAG, VHC, MWG, BID, GEX, and KDH.

Today’s negotiated trading value reached VND 4,618.4 billion, a significant increase of 57.8% compared to the previous week’s session, contributing 14.9% to the total trading value.

Noteworthy negotiated trades occurred in VPB, with over 66 million units (equivalent to VND 1.3 trillion) changing hands among three investor groups: Individuals, Domestic Institutions, and Proprietary Trading.

Additionally, there were negotiated trades between Domestic Institutions in SHB and between Foreign Institutions in FPT. Individual investors continued to engage in negotiated trades in the Banking sector, including LPB, SHB, HDB, VIB, SSB, and TCB.

The capital allocation ratio increased in Banking, Steel, Construction, Chemicals, and Oil Equipment & Services, while it decreased in Real Estate, Securities, Agricultural & Marine Farming, Food, Retail, Plastics, Rubber & Fibers, Software, and Aviation.

Focusing on matched orders, the trading value ratio continued to rise in the mid-cap VNMID and small-cap VNSML sectors, while it decreased in the large-cap VN30 sector.