The Vietnamese real estate market witnessed a decline in 2023, with prices dropping across all segments. While the secondary downward trend has eased, transaction prices remain lower than the market rates at the beginning of 2022.

As of 2024, the price reduction across various real estate segments, compared to the peak prices in early 2022, can be summarized as follows:

– Intra-city townhouses: A decrease of 5% to 15%, as per bank valuations.

– Condominiums priced between 40 and 55 million VND per square meter in populous areas with convenient access to workplaces: A reduction of 10% to 15%. For instance, a condominium purchased for 2.8 billion VND would now sell for 2.5 billion VND.

– Condominiums priced above 55 million VND per square meter or located in sparsely populated areas with limited accessibility: A decrease of 15% to 25%. For context, a condominium initially bought for 2.3 billion VND would now have to be sold for 1.8 billion VND.

– Townhouses in real estate projects: Prices have reverted to the levels set by developers in 2019-2020, and in some cases with legal complications, secondary market prices are even lower than the original developer prices from four years ago.

– Suburban land plots within a 20-kilometer radius of the city center: A reduction of 15% to 30%. For example, a plot of land purchased for 19 billion VND would now transact at 13 billion VND; another bought for 4.8 billion VND would sell for less than 3 billion VND.

– Land plots in distant provincial areas: A decrease of 20% to 40%. For instance, a land plot marketed at 1.3 billion VND in late 2021 would now struggle to fetch 800 million VND; a plot advertised for 1.5 billion VND in early 2022 would now be hard-pressed to find a buyer willing to pay more than 1 billion VND.

– Large land plots in distant provincial areas: A reduction of 25% to 50%.

– Leisure and resort real estate: Prices have dropped below the levels set by developers in 2019-2020.

According to Mr. Le Quoc Kien, a veteran real estate investor from Ho Chi Minh City, 2024 will be a year of both contention and market observation, as investors navigate the real estate landscape and monitor economic indicators.

Opportunities: The legal framework for the real estate market is gradually being refined, with relevant laws being passed. This paves the way for resolving legal issues and increasing the supply of new projects.

The primary market offers an array of discounts, promotions, and flexible payment plans from developers.

The secondary market presents a wealth of options with attractive prices for prospective homeowners.

Challenges:

Investor confidence: While bank deposits have increased, savings account interest rates have decreased. However, in the past few months, investors have opted for a defensive strategy due to a lack of trust in the market’s recovery.

Economic headwinds: The economy is facing challenges, and most individuals have experienced a decrease in income, leading to reduced savings and tighter budgets. There is a prevailing tendency to prioritize cash retention rather than investing or starting new ventures. Typically, real estate buyers rely on a combination of savings and leverage, but their budgets for property purchases have diminished significantly.

Mr. Kien illustrates this point with an example: For a prospective buyer intending to purchase a 4-billion-VND house, the plan might involve using 2 billion VND in savings and taking out a 2-billion-VND loan. With the loan, the buyer would need to pay the bank 28 million VND monthly, requiring a minimum income of 50 million VND to cover family expenses of 22 million VND. However, due to economic hardships, if the buyer’s income decreases to 35 million VND, they would only have 13 million VND left for the bank after essential expenses. Their savings would be further depleted, leaving only 1.5 billion VND. Consequently, their maximum budget for a house purchase would be limited to 1.5 billion VND in savings and a 900-million-VND loan, totaling 2.4 billion VND. Moreover, when faced with reduced income, buyers are likely to retain at least 30% of their savings as a safety net, further reducing their purchasing power.

Developer challenges: Developers are grappling with the dual burden of continuing project development and addressing past issues, such as legal complications, customer deposits, outstanding debts, and maturing bonds.

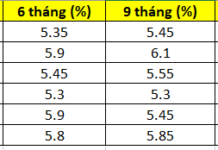

Lending environment: While lending rates have decreased, credit assessments have become more stringent, with a keen focus on collateral valuation, loan purpose, repayment capacity, and borrower credit history.