The shift from commercial ground-floor spaces in Ho Chi Minh City’s central districts, such as District 1 and District 3, continues to unfold. While the rate of space return has decreased compared to early 2023, the relocation of various retail sectors has quietly boosted the demand for shophouses in some completed apartment projects.

In August 2023, it was observed that the occupancy rate of shophouses in the East and West of Ho Chi Minh City was quite low. However, as of now, these same projects have recorded an occupancy rate of 80-90%. The “For Rent” signs have been taken down, replaced by the bustling activities of retail stores, restaurants, cafes, spas, clinics, and offices.

Shophouses in Ho Chi Minh City, August 2023. Photo: Ha Vy

The same location now has a much-improved occupancy rate. The vibrant activities of retail stores, restaurants, cafes, spas, clinics, and offices indicate a renewed interest in shophouses. Photo: Ha Vy

Following the market fluctuations from mid-2022 to the end of 2023, the shophouse segment in the Southern market was also impacted. Amid the wave of space returns in the central area since the beginning of 2023, leasing and business activities became subdued. Even shophouses in bustling streets of districts like Binh Thanh and Go Vap faced a significant number of returns. Shophouses in the ground floors of older apartment projects also struggled to find tenants.

Since the Lunar New Year, with signs of economic recovery, business activities have picked up. Consequently, many small businesses that previously rented commercial spaces in the central area have now relocated to nearby residential areas and apartment complexes, benefiting from more flexible rental rates and spaces.

According to experts, this shift from expensive central locations to shophouses is happening in Ho Chi Minh City, but only for specific low-end sectors. Photo: Ha Vy

Along with the sector shift, many investors have started eyeing the shophouse segment in completed apartment projects in Ho Chi Minh City. Investors can immediately lease or operate businesses in these spaces, which is considered an advantage for attracting investment capital, especially given the city’s current scarcity of completed apartment projects.

Nonetheless, investors’ criteria and preferences are now more selective. They favor shophouses in completed residential areas with a reasonably high occupancy rate, convenient trading locations, and potential for urban development. Additionally, they seek rental incentives from developers.

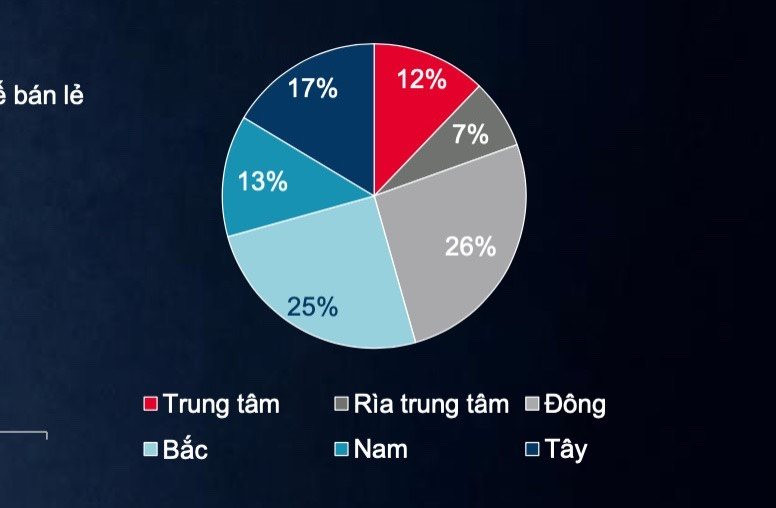

Retail supply allocation illustrates the dwindling land bank in the city center and the clear trend of business sectors moving towards the city’s periphery. Image source: Cushman & Wakefield

In the past, shophouses were only suitable for long-term investors with substantial capital. Now, opportunities are evenly distributed among buyers with limited funds. To stimulate demand in this segment, some developers are actively offering supportive policies for investors.

For instance, recently in the administrative center of Binh Chanh, the Westgate complex by An Gia introduced a rental guarantee policy with total benefits of approximately VND 1.5 billion and a 36-month contract, attracting attention. This is considered an instant profit, generating passive income for investors and increasing the project’s liquidity.

Buyers of shophouses in this project only need to have VND 3.9 billion in ready capital to receive the property for leasing or business operations. The remaining amount will be supported by the developer over 24 months. Even customers with limited funds can now consider investing in shophouses with this policy.

Specifically, customers only need to pay 30% (VND 3.9 billion) upfront for a Westgate shophouse and can expect a profit of approximately VND 1 billion thanks to the 2-year rental guarantee. At the beginning of the third year, they pay the remaining 65% of the shophouse value. At this point, investors can opt for bank loans and use the 12-month rental guarantee to cover the interest payments regularly each month. In the fourth year, they can either start their business operations or transfer the real estate for investment purposes if the expected rate of return is met.

Currently, investments in shophouses in Ho Chi Minh City are not as frenzied as they once were. Instead of riding the wave of speculation, most investors now adopt a long-term perspective, aiming for safe profit margins. This approach aligns with the practical situation of the real estate market in this new phase.

Commenting on the shift from expensive central locations to completed apartment complexes, Do Thi Xuan Trang, Head of Retail Services at Avison Young Vietnam, stated that high rental rates and limited land availability in Ho Chi Minh City’s center, coupled with urban expansion, are driving domestic and foreign retail corporations and brands to explore emerging areas.

For instance, the East side is experiencing rapid growth due to high urbanization and improving infrastructure connectivity, while the West side offers potential with its abundant land bank. Developers will choose areas with clean land funds, good connectivity, and new residential and urban areas capable of attracting residents.

Shophouses in Ho Chi Minh City are attracting investors’ attention.

In addition to the sector shift, tenants in the commercial ground floors of inner-city apartment projects in Ho Chi Minh City will seek to expand their number of outlets and capture market share in the peripheral areas. Hence, they will turn to nearby locations for reasonable rental rates and a variety of spaces and options.

Ms. Trang further analyzed that the demand for retail spaces would follow residential demand. As real estate developments expand outward, new residential and urban areas emerge, driving the growth of commercial real estate such as supermarkets, shophouses, and apartment complexes to serve these communities. Moreover, new leases allow brands to reach new customers, seize opportunities, and capture market share in emerging areas with potential.

“Whether in the inner or outer city, retail spaces will experience rental rate increases over time. Rent also rises to match the most recent business activity in that location. However, with good revenue and a stable customer base, tenants will accept rental rate increases to maintain their premises,” emphasized Ms. Xuan Trang.

Nevertheless, according to industry experts, the time when shophouse investments solely relied on their exclusivity within urban projects to drive prices through scarcity has passed. Instead, we should view this product in relation to the surrounding community to recognize its potential for generating regular cash flow. Shophouses are an investment channel like any other segment. If you want to invest in shophouses for business purposes, this product is a suitable choice. Investors can develop their businesses, lease, or exploit these spaces.