The VNSmallcap was the only capitalization-weighted index on the HoSE to close at today’s high. Pressure on many stocks pushed all other indices to their intraday lows. Despite the market’s gains, breadth remained positive, but sellers’ price suppression was evident.

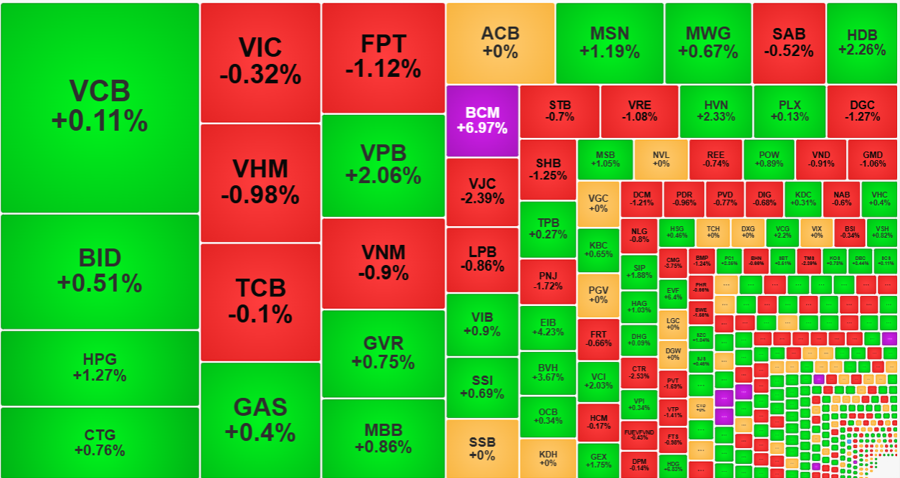

The VN-Index ended the session with a modest gain of 0.35%, or 4.47 points, lower than the morning session and the intraday low. VN30-Index followed suit, rising insignificantly by 0.18%, while Midcap rose by 0.25%. Meanwhile, VNSmallcap outperformed with a gain of 1.08%.

The small-cap basket also witnessed the most significant improvement in liquidity, with a 27.4% increase compared to the previous session, while mid-cap and VN30 baskets saw increases of 15.6% and 11.6%, respectively. Of course, in absolute terms, the small-cap group pales in comparison to the others. Nonetheless, today’s trading value of 2,627 billion VND was the highest for penny stocks in the past nine weeks.

The small-cap group also contributed five stocks that hit the daily limit-up, out of a total of eight, namely MIG, NHA, HCD, BIC, and QCG. Additionally, 60 other stocks in this group rose by more than 1%, while the HoSE floor had 113 similar stocks. In terms of liquidity, the penny group also contributed several stocks with very positive trading volumes, such as HAH, which rose by 2.09% with a liquidity of 263.2 billion VND; IJC, which increased by 4.14% with 161.8 billion VND; TCM, up by 6.11% with 152.8 billion VND; VSC, rising by 4.43% with 150.6 billion VND; and BAF, gaining 1.81% with 150 billion VND… DPG, KSB, TV2, VOS, LCG, ELC, and others also saw significant price increases with high liquidity.

In reality, it is quite rare for penny stocks to achieve trading volumes in the hundreds of billions of VND, and even volumes of 30-50 billion VND per session are uncommon. Nonetheless, this group is highly favored by individual investors due to their small liquidity, which makes price increases more feasible, and their highly speculative nature. On the other hand, blue-chip stocks are currently exhibiting signs of stagnation, lacking a true leading sector, and having already experienced early price increases, leaving behind opportunities that are now riskier.

The VN30 basket performed poorly in the afternoon session, with liquidity even decreasing by 8.3% compared to the morning. The breadth also worsened, with 18 stocks advancing and 10 declining. Statistics show that only 6 out of 30 stocks in the basket rose in the afternoon session, while 16 stocks fell.

Most of the VN-Index’s pillar stocks were among those that declined. VPB was a rare exception among the Top 10, posting a notable gain. This stock ended the morning session up 1.03%, then rose another 1.02% in the afternoon, closing 2.06% above the reference price. While BCM remained the pillar that pushed the index up the most, its ceiling price had already been reached in the morning. VPB climbed to second place. HPG also saw a slight improvement, rising by 0.47% in the afternoon and closing 1.27% above the reference price. MSN inched up by 0.53%, ending the day with a total gain of 1.19%. Six stocks in the VN30 basket rose by more than 1% during this session.

In a somewhat surprising turn of events, liquidity did not increase but instead decreased in the afternoon. Specifically, the two exchanges matched an additional 11,806 billion VND, a decrease of 12.5% compared to the morning session. One reason for this was a reduction in capital inflows into blue-chip stocks. Despite the positive trading in the penny group, it could not make up for the decline in the larger stocks. With high liquidity in the morning session and gradually weakening prices, liquidity decreased in the afternoon, indicating a weakening of capital inflows after enthusiastic buying. The total matched order value on the HoSE and HNX exchanges in this session reached 25,294 billion VND, still up 13% from the previous session. This was also the fourth session in which liquidity exceeded 20,000 billion VND.

There are indications that foreign investor selling pressure has been increasing in the last two weeks. Statistics from the HoSE since the beginning of May show that the total value of capital withdrawn by this group amounts to 6,426 billion VND, including 5,748 billion VND in net selling of stocks. This group has been offloading blue-chip stocks at a time when these stocks have performed well, with the VN30-Index even surpassing its March 2024 peak.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)