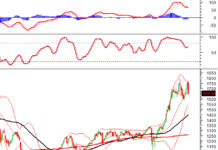

The market witnessed a fierce tug-of-war session, with the index dipping and recovering to close at 1,273 points, a gain of 4.3 points, surpassing investors’ expectations.

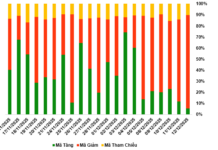

The breadth improved towards the end of the session, with 234 gainers and 176 losers. The agriculture, forestry, and fisheries sector stood out, with several stocks surging to their daily limit-up, including HAG, HNG, BAF, and DAB, surging by 6.37%. Meanwhile, the food and beverage sector saw unexpected gains, with MSN rising by 4.28% and SAB by 1.04%. The securities sector also impressed, climbing by 1.51% as VND jumped 4.04% after receiving approval for a capital increase. The banking sector edged up 0.96% with the Land Law, while the seafood sector rose 1.18%, and the construction materials sector gained 0.43%. Oil and gas followed a similar trajectory.

April’s stock market no longer lacks supportive news as an abundance of positive news has pushed the index up steadily. Meanwhile, the banking sector declined slightly by 0.16%. The top stocks driving the market included MSN, contributing 1.13 points; GVR, adding 0.78 points; and LPB and VHM. On the flip side, VCB was the biggest culprit for the market’s tug-of-war, erasing 1.11 points.

The total matched trading volume on the three exchanges reached VND26,200 billion, with foreign investors net selling VND869.7 billion. Specifically, they net sold VND842.8 billion in matched trading.

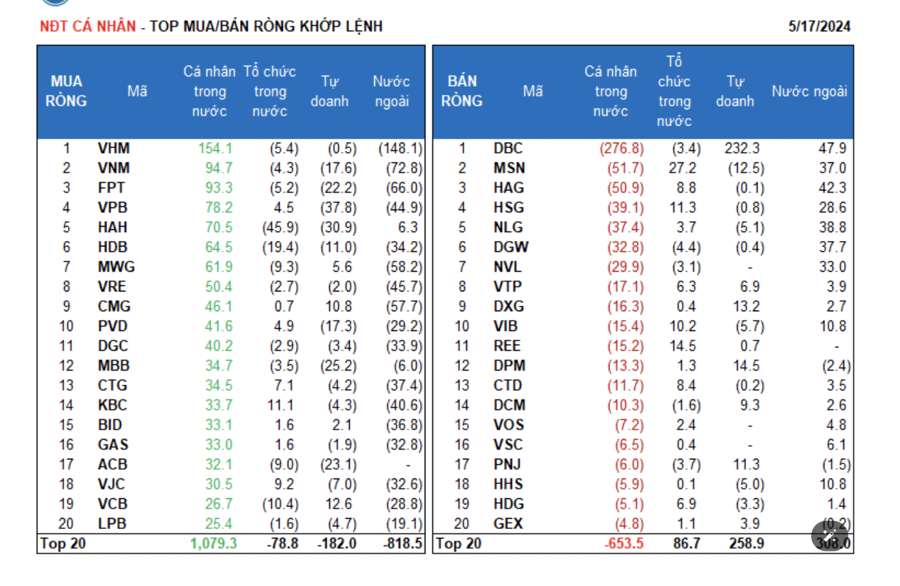

Foreign investors’ main net buying on the matched trading was in the food and beverage and automobile and components sectors. The top net bought stocks by foreign investors on the matched trading included DBC, HAG, NLG, DGW, MSN, NVL, HSG, STB, FUEVFVND, and HHS.

On the sell side, foreign investors net sold on the matched trading in the banking sector. The top net sold stocks by foreign investors on the matched trading were VHM, VNM, FPT, MWG, CMG, VPB, KBC, CTG, and BID.

Individual investors net bought VND1,115.6 billion, of which VND900.2 billion was net bought on the matched trading. In terms of matched trading, they net bought 13 out of 18 sectors, mainly in the banking sector. The top net bought stocks by individual investors included VHM, VNM, FPT, VPB, HAH, HDB, MWG, VRE, CMG, and PVD.

On the sell side, they net sold on the matched trading in 5 out of 18 sectors, mainly in the food and beverage and basic resources sectors. The top net sold stocks included DBC, MSN, HAG, HSG, NLG, DGW, VTP, DXG, and VIB.

Proprietary trading net sold VND87.2 billion, of which VND23.5 billion was net sold on the matched trading. In terms of matched trading, proprietary trading net bought 6 out of 18 sectors. The top net bought sectors were food and beverage and chemicals. The top net bought stocks by proprietary trading today included DBC, DPM, DXG, VCB, HVN, PNJ, CMG, DCM, E1VFVN30, and PLX. The top net sold sector was banking. The top net sold stocks included VPB, HAH, STB, MBB, SSI, FUEVFVND, ACB, FPT, PVT, and VNM.

Domestic institutional investors net sold VND233.4 billion, of which VND33.8 billion was net sold on the matched trading.

In terms of matched trading, domestic institutions net sold 10 out of 18 sectors, with the largest value in the industrial goods and services sector. The top net sold stocks included HAH, GMD, HDB, NAB, VHC, FUEVFVND, VCB, MWG, ACB, and STB. The top net bought sector was basic resources. The top net bought stocks included MSN, HPG, REE, PVT, SSI, HSG, KBC, VIB, SHB, and VJC.

Today’s matched trading volume reached VND2,925.9 billion, up 38.8% from the previous session, contributing 11.1% of the total trading value.

Most of today’s matched trading volume continued to come from individual investors, focusing on the banking sector (LPB, VPB, SHB), the VN30 group (MWG, VHM), and the VNMID group (REE, AGG).

Additionally, there was a notable matched trading transaction in HDB, with 9 million shares (equivalent to VND207 billion) sold by domestic institutions to individual investors.

Money flow allocation increased in real estate, securities, agricultural & marine products, food, warehousing, logistics & maintenance, and plastics, rubber & fibers sectors. Meanwhile, it decreased in banking, retail, chemicals, oil & gas, and software sectors.

In terms of matched trading volume, the mid-cap VNMID and small-cap VNSML groups saw an increase in trading value allocation, while the large-cap VN30 group witnessed a decrease.